1) Compute inventory turnover for Boeing and McDonald's

2) Using the ratios you computed in question 1, Boeing and McDonald's are very different companies in very different industries. Do their inventory turnover rates differ? What factors might impact the similarities/differences in their inventory turnover rates?

3) Compute Return on Equity (ROE) for the following companies: Home Depot, Walmart, and Verizon

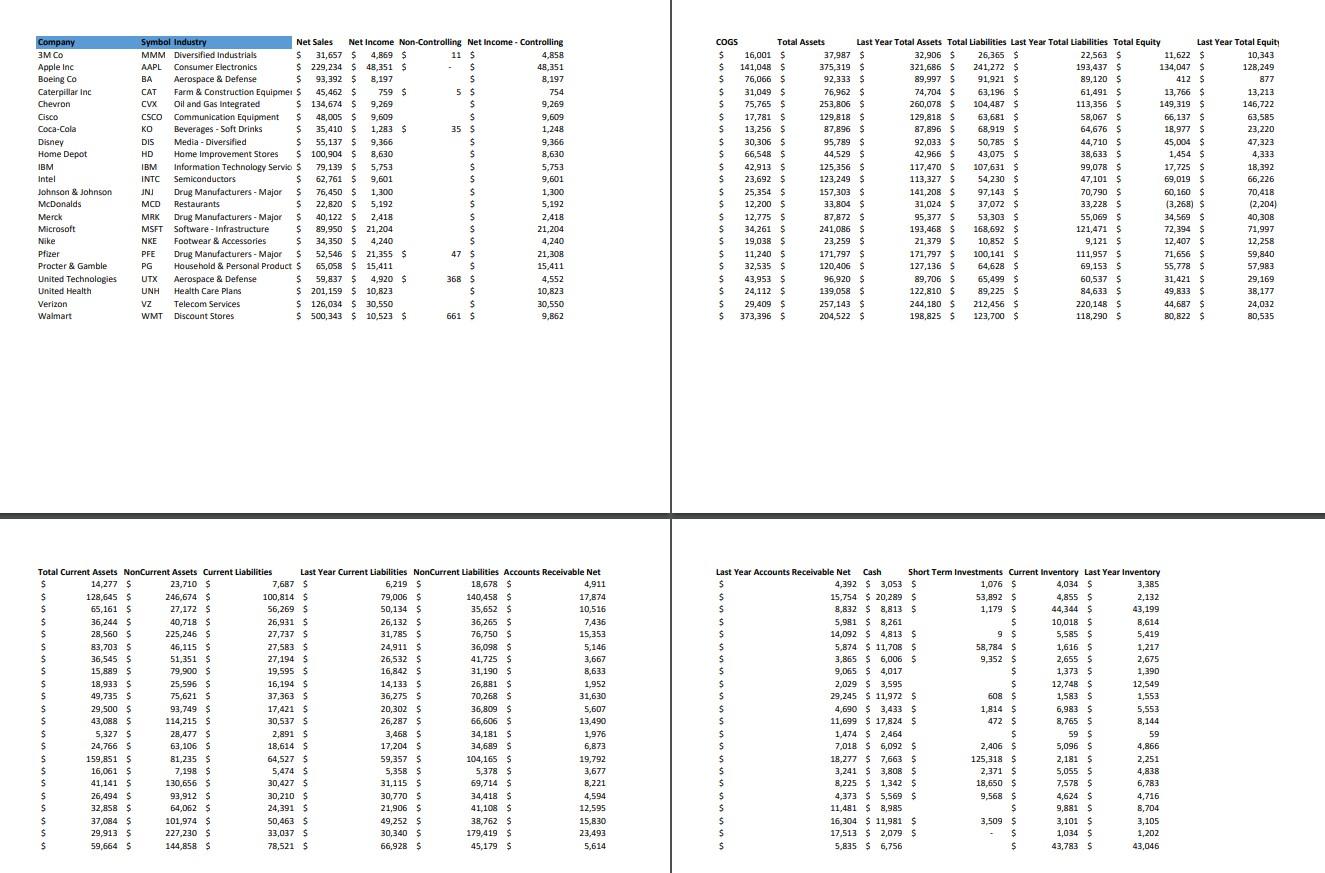

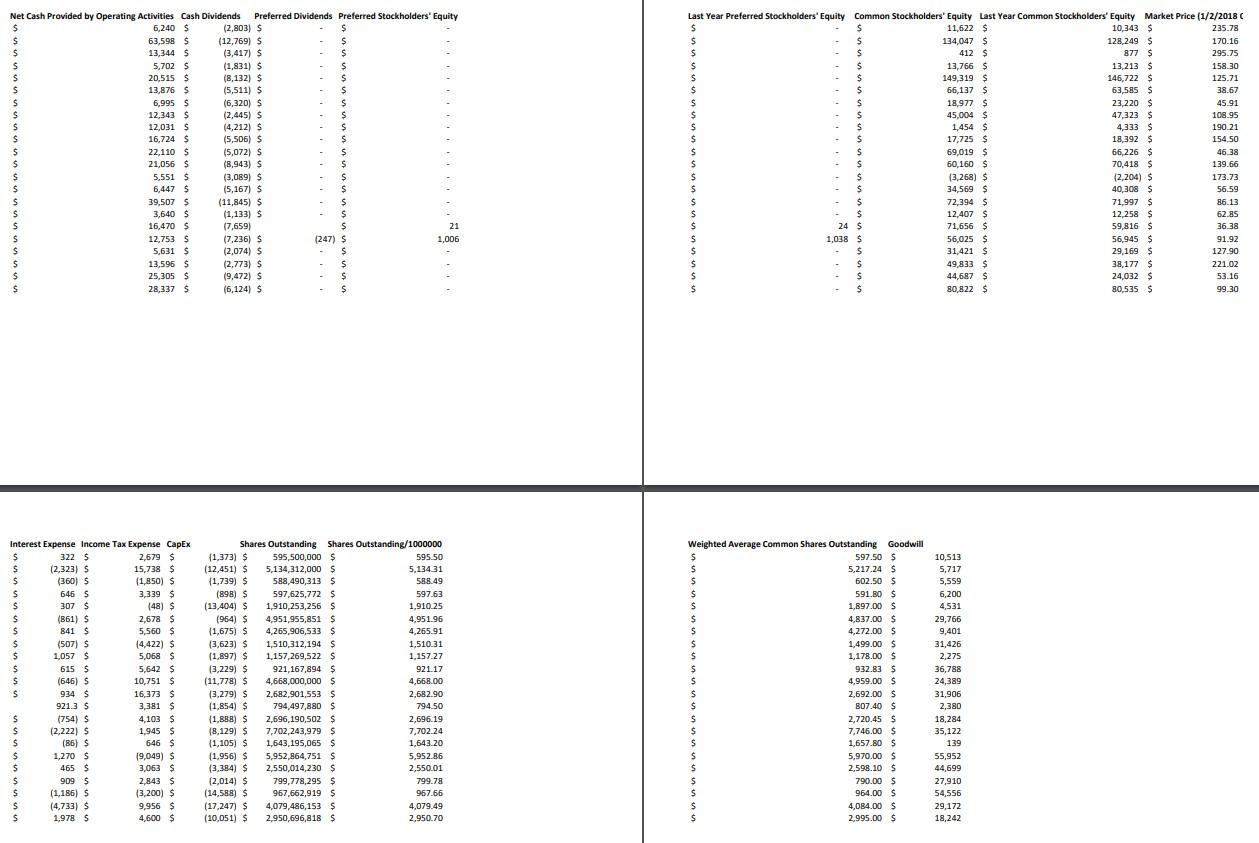

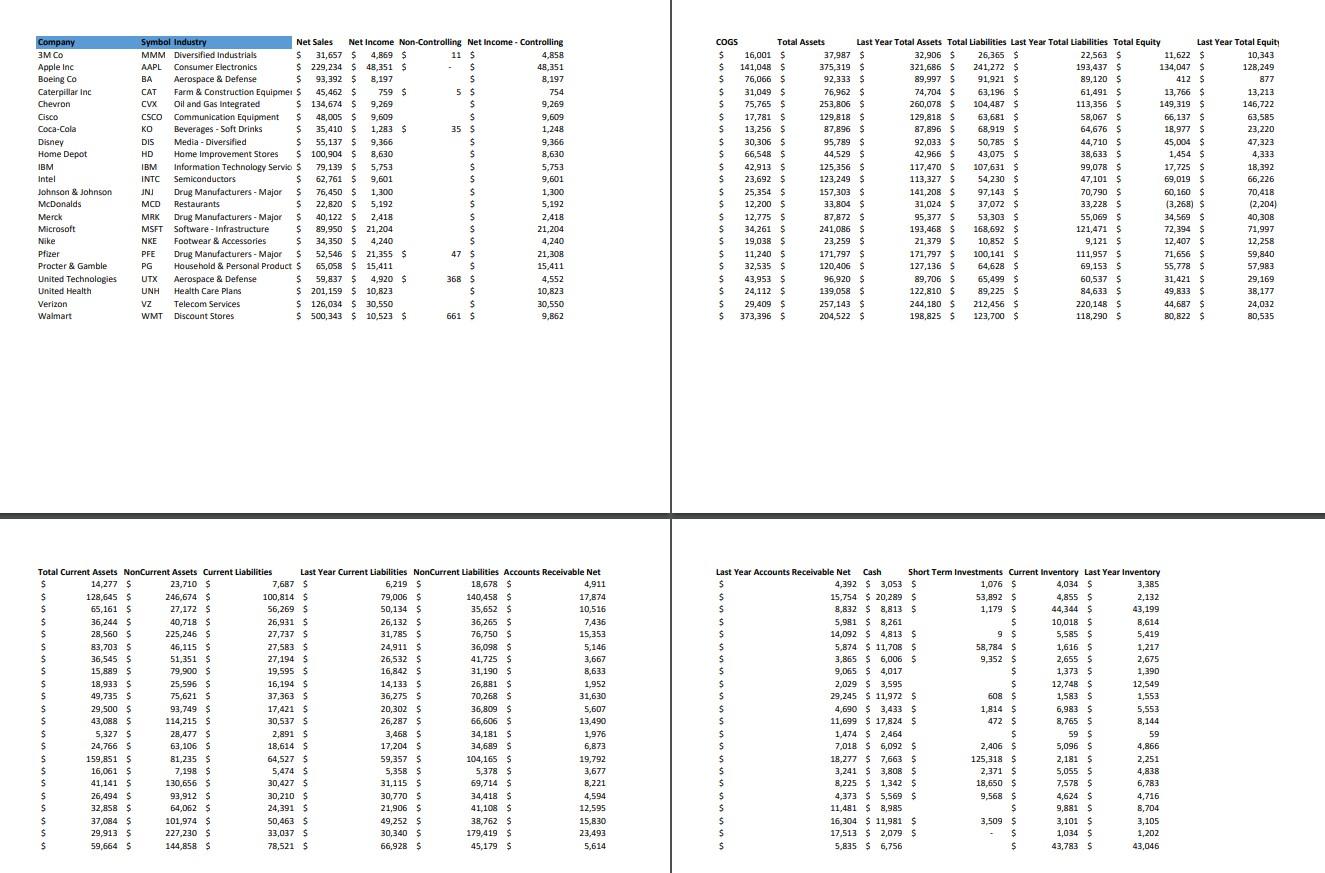

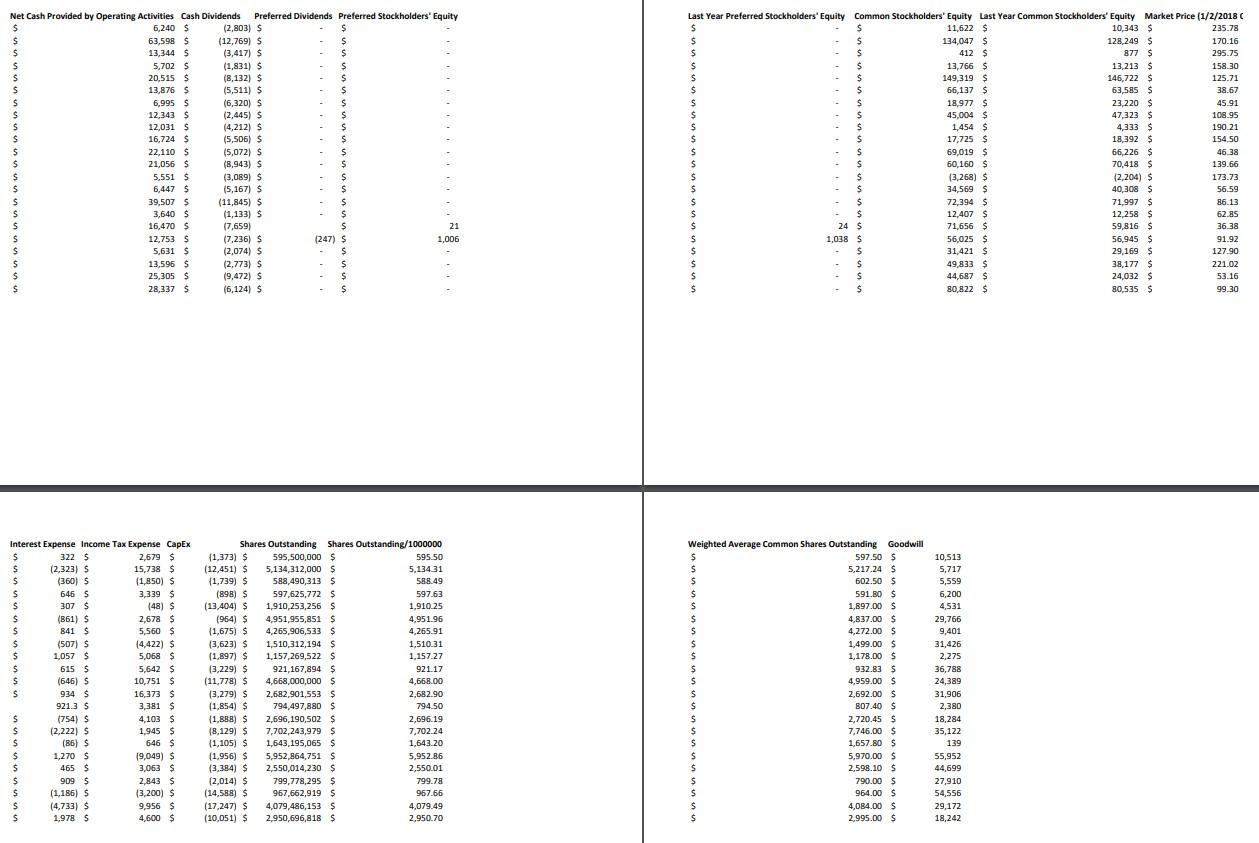

Company Apple Inc Boeing Co Caterpillar Inc Chevron Cisco Coca-Cola Disney Home Depot IBM Intel Johnson & Johnson McDonalds Merck Microsoft Nike Pfizer Procter & Gamble United Technologies United Health Verizon Walmart Symbol Industry Net Sales Net Income Non-Controlling Net Income - Controlling MMM Diversified Industriais $ 31,657 $4,869 $ 11 $ 4,858 AAPL Consumer Electronics $ 229,234 $ 48,351 $ $ 48,351 BA Aerospace & Defense 5 93,3925 8,197 $ 8,197 CAT Farm & Construction Equipmet $ 45,462 $ 759 $ 5 $ 754 CVX Oil and Gas Integrated $ 134,674 $ 9,269 $ 9,269 CSCO Communication Equipment $ 48,005 $ 9,609 $ 9,609 KO Beverages - Soft Drinks $ 35,410 $ 1,283 $ 35 $ 1,248 DIS Media - Diversified $ 55,137 $ 9.366 $ 9,366 HD Home Improvement Stores $ 100,904 $ 8,630 $ 8,630 IBM Information Technology Servio $ 79,139 $ 5,753 5,753 INTC Semiconductors $ 62,761 $ 9,601 $ 9,601 JNJ Drug Manufacturers - Major $ 76,450 $ 1,300 1,300 MCD Restaurants $ 22,820 $ 5,192 $ 5,192 MRK Drug Manufacturers - Major - $ S 40,122 5 2,418 $ 2,418 MSFT Software - Infrastructure $ 89,950 $ 21,204 $ 21,204 NKE Footwear & Accessories $ 34,350 $ 4,240 4,240 PFE Drug Manufacturers - Major $ 52,546 $ 21,355 $ 47 $ 21,308 PG Household & Personal Products 65,058 $ 15,411 $ 15,411 UTX Aerospace & Defense $ 59,837 $ 4,920 $ 368 $ 4,552 UNH Health Care Plans $ 201,159 $ 10,823 $ 10,823 Vz Telecom Services $ 126,034 $ 30,550 $ 30,550 WMT Discount Stores $ 500,343 $ 10,523 $ 661 $ 9,862 COGS Total Assets Last Year Total Assets Total Liabilities Last Year Total Liabilities Total Equity Last Year Total Equity $ 16,001 $ 37,987 $ 32,906 $ 26,365 $ 22,563 $ 11,622 $ 10,343 $ 141,048 $ 375,319 $ 321,686 $ 241,272 $ 193,437 $ 134,047 $ 128,249 $ 76,066 $ 92,333 $ 89,997 5 91,921 $ 89,120 $ 412 $ 877 $ 31,049 $ 76,962 $ 74,704 $ 63,196 $ 61,491 $ 13,766 $ 13,213 $ 75,765 $ 253,806 $ 260,078 $ 104,487 $ 113,356 S 149,319 $ 146,722 $ 17,781 $ 129,818 $ 129,818 5 63,681 $ 58,067 $ 66,137 S 63,585 $ 13,256 $ 87,896 $ 87,896 S 68,919 $ 64,676 S 18,977 $ 23,220 $ 30,3065 95,789 $ 92,033 $ 50,785 $ 44,7105 45,004 $ 47,323 $ 66,548 $ 44,529 $ 42,966 $ 43,075 S 38,633 $ 1,454 $ 4,333 $ 42,913 $ 125,356 $ 117,470 $ 107,631 S 99,078 $ 17,725 $ 18,392 $ 23,692 $ 123,249 $ 113,327 S 54 230$ 47,101 $ 69,019 $ 66,226 $ 25,354 $ 157 303 $ 141,208 S 97,143S 70,790 $ 60,160 $ 70,418 $ 12,200 $ 33,804 $ 31,024 $ 37,072 $ 33,228 $ (3,268) $ (2,204) $ 12,775 $ 87,872 S 95,377 $ 53,303 S 55,069 $ 34,569 $ 40,308 $ 34,261 $ 241,086 $ 193,468 $ 168,692 $ 121,471 $ S 72,394 $ 71,997 $ 19,038 $ 23,259 $ 21,3795 10,852 S 9,121 $ 12,407 $ 12,258 $ 11,240 $ 171,797 $ 171,797 $ 100,141 $ 111,9575 71,656 $ 59,840 $ 32,535 $ 120,406 $ 127,136 $ 64,628 $ 69,153 $ 55,778 $ 57,983 $ 43,953s 96,920 $ 89,706 $ 65,499 $ 60,537 S 31,421 $ 29,169 $ 24,112 $ 139,058 $ 122,810 $ 89,225 $ 84,633 S 49,833 $ 38,177 $ 29,409 $ 257,143 $ 244,180 $ 212,456 $ 220,148 $ 44,687 $ 24,032 $ 373,396 $ 204,522 $ 198,8255 123,700 118,290 $ 80,822 $ 80,535 Total Current Assets NonCurrent Assets Current Liabilities Last Year Current Liabilities NonCurrent Liabilities Accounts Receivable Net $ 14,277 $ 23,710 $ 7,687 $ 6,219 $ 18,678 $ 4,911 $ 128,645 $ 246,674 $ 100,814 $ 79,006 $ 140,458 $ 17,874 $ 65,161 $ 27,172 $ 56,269S 50,134 $ 35,652 $ 10,516 $ 36,244 S 40,718 $ 26,931 S 26,132 $ 36,265 $ 7,436 $ 28,560 $ 225,246 $ 27,737 5 31,785 $ 76,750 $ 15,353 $ 83,703 5 46,115$ 27,583 $ 24,911 $ 36,098 $ 5,146 $ 36,545$ 51,351 $ 27,194 $ 26,532 $ 41,725 $ 3,667 $ 15,889 $ 79,900 $ 19,595 $ 16,842 $ 31,190 $ 8,633 $ 18,933 $ 25,596 $ 16,194 $ 14,133 $ 26,881 $ 1,952 $ 49,735 $ 75,621 $ 37,363 S 36,275 $ $ 70,268 $ 31,630 $ 29,500 $ 93,749 $ 17,421 $ 20,302 $ 36,809 $ 5,607 $ 43,088 $ 114,215 $ 30,537 S 26,287 $ 66,606 $ 13,490 $ 5327 $ 28,477 $ 2,891 $ 3,468 $ 34,181 $ 1,976 $ 24,766 $ 63,106 $ 18,614 $ 17,204 $ 34,689 $ 6,873 $ 159,851 $ 81,235 S 64,527 S 59,357 $ 104,165 $ 19,792 $ 16,061 $ 7,198 $ 5,474 $ 5,358 $ 5,378 $ 3,677 $ 41,141 $ 130,656 $ 30,427 $ 31,115 $ 69,714 $ 8,221 $ 26,494 $ 93,912 $ 30,210 $ 30,770 5 34,418 $ 4,594 $ 32.858 $ 64,062 $ 24,391 S 21,906 $ 41,108 $ 12,595 $ 37,084 $ 101,974 $ 50,463 $ 49,252 $ 38,762 $ 15,830 $ 29,913 $ 227,230 $ 33,037 $ 30,340 $ 179,419 $ 23,493 $ 59,664 $ 144,858 $ 78,521 $ 66,928 $ 45,179 $ 5,614 Last Year Accounts Receivable Net Cash Short Term Investments Current Inventory Last Year Inventory $ 4,392 $ 3,053 5 1,076 $ 4,034 5 3,385 15,754 $ 20,289 $ 53,892 $ 4,855 $ 2,132 8,832 $ 8,813 $ 1,179 $ 44,344 5 43,199 5,981 $ 8,261 $ 10,018 $ 8,614 14,092 $ 4,813 $ 9 $ 5,585 $ 5,419 5,874 $ 11,708 $ 58,784 $ 1,616 5 1,217 3,865 $ 6,006 $ 9,352 $ 2,655 $ 2,675 9,065 $ 4,017 $ 1,373 $ 1,390 2,029 $ 3,595 $ 12,748 5 12,549 29,245 $ 11,972 $ 608 S 1,583 $ 1,553 4,690 $ 3,433 $ 1,814 $ 6,983 $ 5,553 11,699 $ 17,824 $ 472 $ 8,765 8,144 1,474 $ 2,464 $ 59 $ 59 7,018 $ 6,092 $ 2,406 $ 5,096 $ 4,866 18,277 $ 7,663 $ 125,318 $ 2,181 $ 2.251 3,241 $ 3,808 $ 2,371 $ 5,055 5 4,838 8,225 $ 1,342 $ 18,650 $ 7,578 $ 6,783 4,373 $ 5,569 $ 9,568 $ 4,624 $ 4,716 11,481 $ 8,985 $ 9,881 $ 8,704 16,304 $ 11,981 $ 3,509 $ 3,101 S 3,105 17,513 $ 2,079 $ $ 1,034 $ 1,202 5,835 $ 6,756 $ 43,783 $ 43,046 Net Cash Provided by Operating Activities Cash Dividends Preferred Dividends Preferred Stockholders' Equity 6,240 $ (2,803) $ 63,598 $ (12,769) $ 13,344 $ (3,417) $ 5,702 $ (1,831) s $ 20,515 $ (8,132) $ 13,876 $ (5,511) S 6,995 $ (6,320) S s 12,343 $ (2,445) $ $ 12,031 $ (4,212) 5 $ 16,724 $ (5,506) $ s 22,110 $ (5,072) $ 5 21,056 $ (8,943) S $ 5,551 $ (3,089) 5 $ 6,447 $ (5,167) S s 39,507 5 (11,845) $ 3,640 $ (1,133) $ $ 16,470 $ (7,659) 21 12,753 (7,236) $ (247) $ 1,006 5,631 $ (2,074) $ $ 13,595 $ (2,773) S $ 25,305 $ (9,472) $ $ 28,337 $ (6,124) $ $ Last Year Preferred Stockholders' Equity Common Stockholders' Equity Last Year Common Stockholders' Equity Market Price (1/2/2018 $ $ 11,622 $ 10,343 $ 235.78 $ 134,047 $ 128,249 $ 170.16 $ 412 $ 877 $ 295.75 $ 13,7665 13,213 $ 158.30 $ $ 149,319 $ 146,722 $ 125.71 66,137 $ 63,585 $ 38.67 $ 18,977 $ 23,220 $ 45.91 45,004 $ 47,323 $ 108.95 1,454 $ 4,333 $ 190 21 $ 17,725$ 18,392 $ 154.50 69,019 $ 66,2265 46.38 60,160 $ 70,418 $ 139.66 (3,268) $ (2,204) S 173.73 $ 34,569 $ 40,308 $ 56.59 $ 72,394 $ 71,997 $ 86.13 $ $ 12,407 $ 12,258 S 62.85 $ 24 $ 71,656 $ 59,816 $ 36.38 1,038 $ 56,025 $ 56,945 $ 91.92 $ 31,421 $ 29,169 $ 127.90 $ 49,833 $ 38,177 221.02 $ 44.6875 24,032 53.16 80,822 $ 80,535 $ 99.30 Interest Expense Income Tax Expense Capex $ 322 $ 2,679 $ $ (2,323) S 15,738 $ $ (360) $ (1,850) $ $ 646 5 3,339 $ $ 307 $ (48) $ S (861) $ 2,678 $ $ 841 S 5,560 $ $ (507) $ (4,422) $ $ 1,057 S 5,068 $ 615 $ 5,642 $ (646) $ 10,751 $ 934 $ 16,373 $ 9213 S 3,381 $ $ (754) S 4,103 $ 12,222) $ 1,945 $ (86) $ 646 $ 1,270 $ 19,049) $ 465 $ 3,063 $ 909 $ 2,843 $ $ (1,186) $ (3,200) $ (4.733) $ 9,956 $ $ 1,978 $ 4,600 $ Shares Outstanding Shares Outstanding/1000000 (1,373) $ 595,500,000 $ 595.50 (12,451) $ 5,134,312,000 $ 5,134 31 (1,739) $ 588,490,313 $ 588.49 (898) $ 597,625,772 5 597.63 (13,404) $ 1,910,253,256 $ 1,910.25 (964) S 4,951,955,851 $ 4,951.96 (1,675) $ 4,265,906,533 $ 4,265.91 (3,623) $ 1,510,312,194 $ 1,510.31 (1,897) $ 1,157,269,522 $ 1.157.27 (3,229) $ 921,167,894 $ 921.17 (11,778) $ 4.668.000.000 $ 4,668.00 (3,279) S 2,682,901,553 $ 2,682.90 (1,854) S 794,497,880 $ 794.50 () 1,888) $ 2,696,190,502 $ 2,696.19 18,129) S 7,702,243,979 $ 7,702.24 (1,105) $ 1,643,195,065 $ 1,643.20 (1,956) $ 5,952,864,751 $ 5,952.86 (3,384) $ 2,550,014,230 $ 2,550.01 (2,014) $ 799,778,295 $ 799.78 (14,588) $ 967,662,919 $ 967.66 (17,247) S 4,079,486,153 $ 4,079.49 (10,051) $ 2,950,696,818 $ 2,950.70 Weighted Average Common Shares Outstanding Goodwill $ 597.50 $ $ 5,217.24 $ $ 602.50 $ $ 591.80 $ 1,897.00 $ $ 4,837.00 $ 4,272.00 S 1,499.00 $ 1,178.00 $ 932.83 $ 4,959.00 $ 2,692.00 S 807.40 $ 2,720.45 $ 7.746.00 $ 1,657.80 $ 5,970.00 $ $ 2,598.10 $ 790.00 $ $ 964.00 $ 4,084.00 $ 2,995.00 $ 10,513 5,717 5,559 6,200 4,531 29,766 9,401 31,426 2,275 36,788 24,389 31,906 2,380 18,284 35,122 139 55,952 44,699 27,910 54,556 29,172 18,242