Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Compute the Cost of Equity for XYZ Inc. 2. Compute the WEIGHTED AVERAGE after-tax cost of debt (short term and long term combined) for

1. Compute the Cost of Equity for XYZ Inc.

2. Compute the WEIGHTED AVERAGE after-tax cost of debt (short term and long term combined) for XYZ Inc.

3. Compute the Weights for Short Term Debt, Long Term Debt and Equity.

4. Compute the Weighted Average Cost of Capital

5. Calculate the Free Cash Flow for the next three years

6. Use the Free Cash Flow Method to compute the value of XYZ Inc. (assume there are no non-operating assets).

7. Based on the Free Cash Flow Valuation, compute the Value of XYZs equity and the estimated price per share.

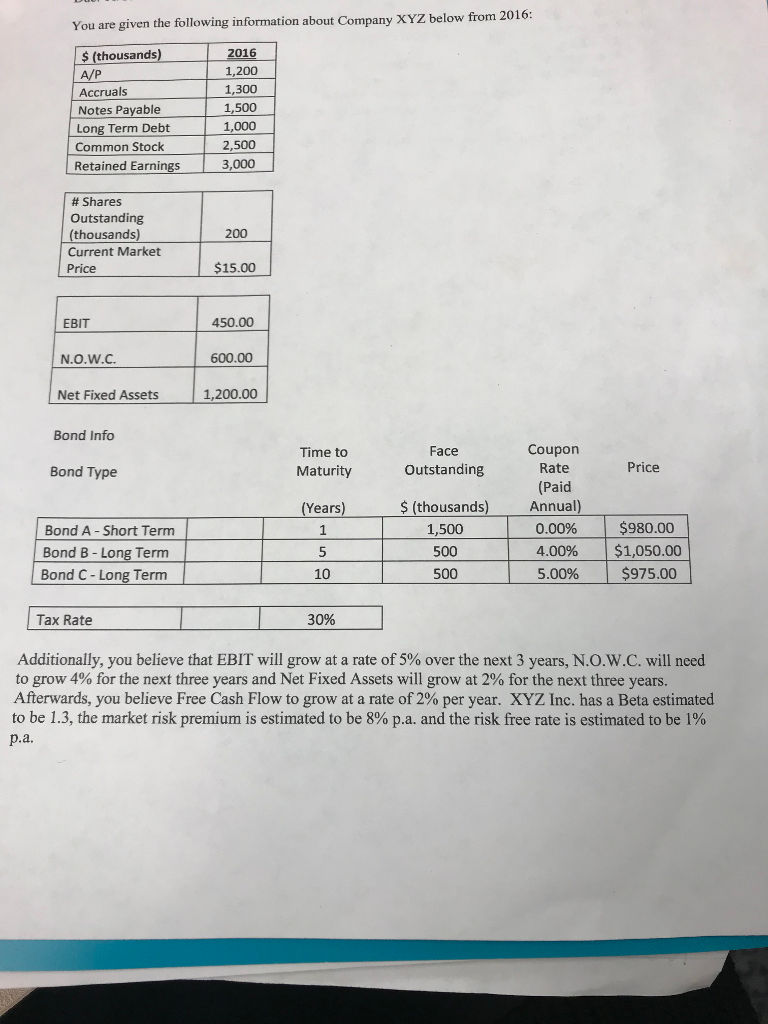

You are given the following information about Company XYZ below from 2016: $(thousands) A/P Accruals Notes Payable Long Term Debt Common Stock 2016 1,200 1,300 1,500 1,000 2,500 Retained Earnings 3,000 # Shares Outstanding (thousands) Current Market Price 200 $15.00 EBIT 450.00 N.O.W.C 600.00 Net Fixed Assets 1,200.00 Bond Info Coupon Rate (Paid Annual) Time to Maturity Face Outstanding Price Bond Type (Years) Bond A Short Term Bond B- Long Term Bond C-Long Term S (thousands) 1,500 500 500 0.00% 4.00% 5.00% | $980.00 | $1,050.00 | $975.00 5 10 Tax Rate 30% Additionally, you believe that EBIT will grow at a rate of 5% over the next 3 years, N.Ow.c. will need to grow 4% for the next three years and Net Fixed Assets will grow at 2% for the next three years Afterwards, you believe Free Cash Flow to grow at a rate of 2% per year. XYZ Inc. has a Beta estimated to be 1.3, the market risk premium is estimated to be 8% p.a. and the risk free rate is estimated to be 1% p.a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started