Answered step by step

Verified Expert Solution

Question

1 Approved Answer

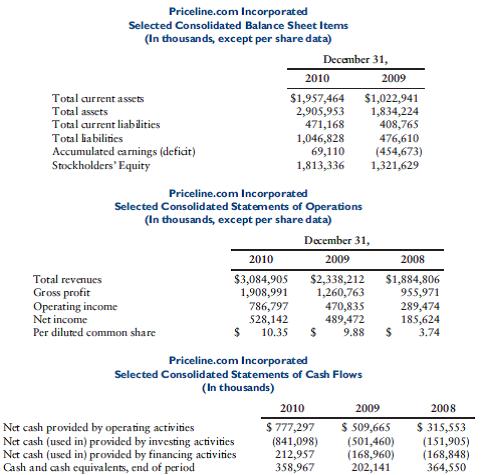

The data in this case come from the financial reports of Priceline.com.* Required a. 1. Compute the current ratio for 2010 and 2009. Comment. 2.

The data in this case come from the financial reports of Priceline.com.*

Required

a. 1. Compute the current ratio for 2010 and 2009. Comment.

2. Compute the debt ratio for 2010 and 2009. Comment.

3. Total revenues – Prepare a horizontal common-size – use 2008 as the base. Comment.

4. Gross profit – Prepare a horizontal common-size – use 2008 as the base. Comment.

5. Net income – Prepare a horizontal common-size – use 2008 as the base. Comment.

6. Per diluted common share – Prepare a horizontal common-size – use 2008 as the base. Comment.

7. Net cash provided by operating activities – Prepare a horizontal common-size – use 2008 as the base. Comment.

b. Give an overall comment.

Priceline.com Incorporated Selected Consolidated Balance Sheet Items (In thousands, except per share data) Decamber 31, 2010 2009 Total aurrent assets Total assets $1,957,464 $1,022,941 2,905,953 471,168 1,046,828 69,110 1,813,336 1,834,224 408,765 476,610 (454,673) Total aurrent liabilities Total iabilities Accumulated earnings (deficit) Stockholders' Equity 1,321,629 Priceline.com Incorporated Selected Consolidated Statements of Operations (In thousands, except per share data) December 31, 2010 2009 2008 $3,084,905 1,908,991 786,797 528,142 10.35 $2,338,212 1,260,763 470,835 489,472 9.88 $1,884,806 955,971 289,474 Total revenues Gross profit Operating income Net income 185,624 3.74 Per diluted common share Priceline.com Incorporated Selected Consolidated Statements of Cash Flows (In thousands) 2010 2009 2008 Net cash provided by operating activities Net cash (used in) provided by investing activities Net cash (used in) provided by financing activities Cash and cash equivalents, end of period $ 777,297 (841,098) 212,957 358,967 $ 509,665 (501,460) (168,960) 202,141 $ 315,553 (151,905) (168,848) 364,550

Step by Step Solution

★★★★★

3.34 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 of 10 A 1 Computation of current ratio Current assets are the assets which can be converted ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started