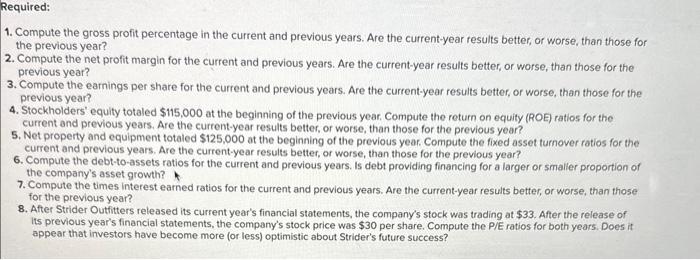

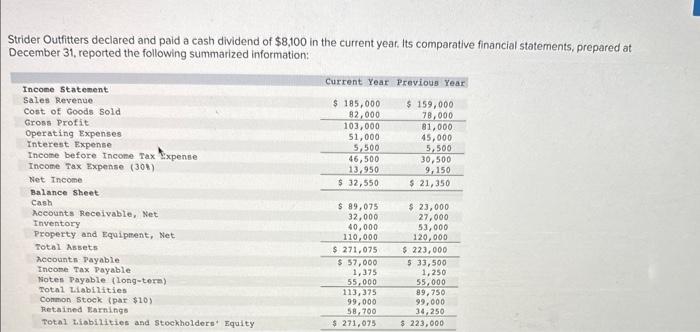

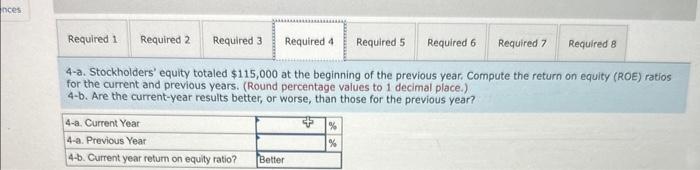

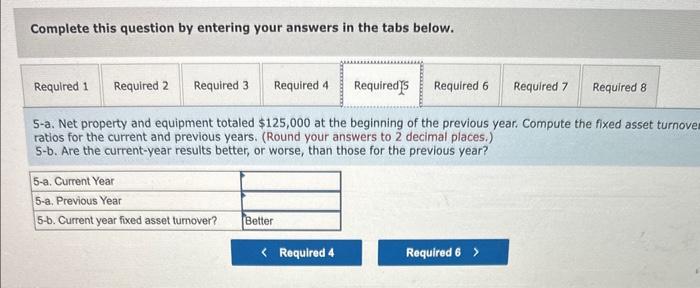

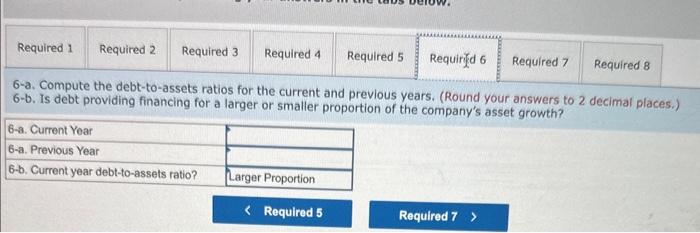

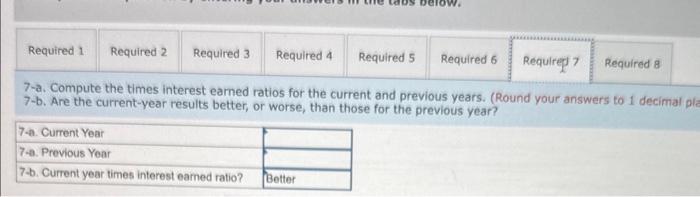

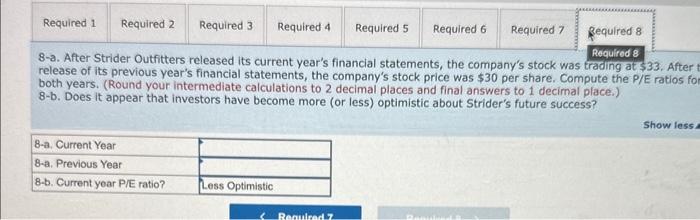

1. Compute the gross profit percentage in the current and previous years. Are the current-year results better, or worse, than those for the previous year? 2. Compute the net profit margin for the current and previous years. Are the current-year results better, or worse, than those for the previous year? 3. Compute the earnings per share for the current and previous years. Are the current-year results better, or worse, than those for the previous year? 4. Stockholders' equity totaled $115,000 at the beginning of the previous year. Compute the roturn on equity (ROE) ratios for the current and previous years. Are the current-year results better, or worse, than those for the previous year? 5. Net property and equipment totaled $125,000 at the beginning of the previous year. Compute the fixed asset turnover ratios for the current and previous years. Are the current-year results better, or worse, than those for the previous year? 6. Compute the debt-to-assets ratios for the current and previous years. Is debt providing financing for a larger or smaller proportion of the company's asset growth? 7. Compute the times interest eamed ratios for the current and previous years. Are the current-year results better, or worse, than those for the previous year? 8. After Strider Outfitters released its current year's financial statements, the company's stock was trading at $33. After the release of Its previous year's financial statements, the company's stock price was $30 per share. Compute the P/E ratios for both years. Does it appear that investors have become more (or less) optimistic about Strider's future success? Strider Outfitters declared and paid a cash dividend of $8,100 in the current year. Its comparative financial statements, prepared at December 31, reported the following summarized information: 4-a. Stockholders' equity totaled $115,000 at the beginning of the previous year. Compute the return on equity (ROE) ratios for the current and previous years. (Round percentage values to 1 decimal place.) 4-b. Are the current-year results better, or worse, than those for the previous year? Complete this question by entering your answers in the tabs below. 5-a. Net property and equipment totaled $125,000 at the beginning of the previous year. Compute the fixed asset turnove ratios for the current and previous years. (Round your answers to 2 decimal places.) 5-b. Are the current-year results better, or worse, than those for the previous year? 6-a. Compute the debt-to-assets ratios for the current and previous years. (Round your answers to 2 decimal places.) 6-b. Is debt providing financing for a larger or smaller proportion of the company's asset growth? 7-a. Compute the times interest eamed ratios for the current and previous years. (Round your answers to 1 decimal p 7-b. Are the current-year results better, or worse, than those for the previous year? 8-a. After Strider Outfitters released its current year's financial statements, the company's stock was trading at $33. After release of its previous year's financial statements, the company's stock price was $30 per share. Compute the P/E ratios fo both years. (Round your intermediate calculations to 2 decimal places and final answers to 1 decimal place.) 8-b. Does it appear that investors have become more (or less) optimistic about Strider's future success