1. Conduct a DuPont decomposition of Lucent's ROE by quarter. What factors contributed to the differences in Lucent's performance between those quarters?

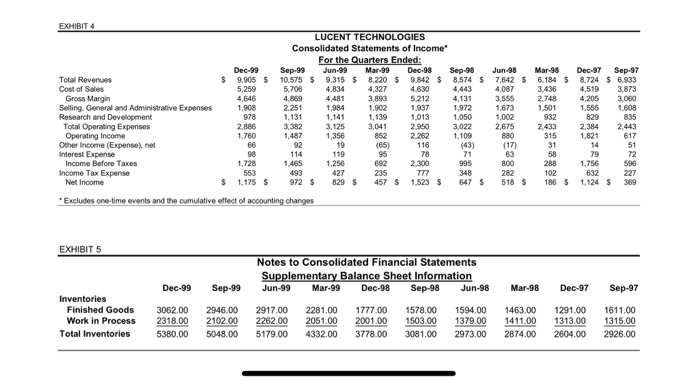

(Calculate the change in Sales, Accounts Recievable, Inventory and Gross Margin by (same) quarter.

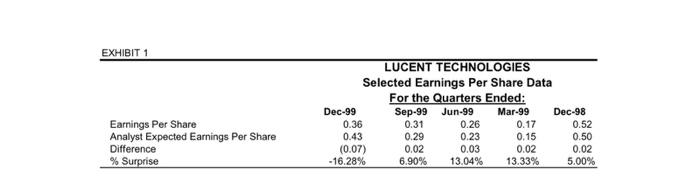

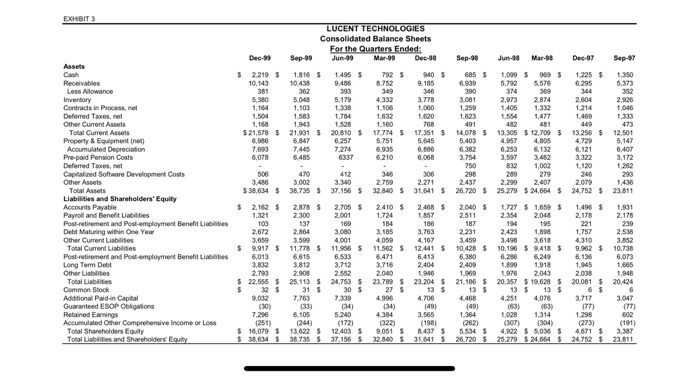

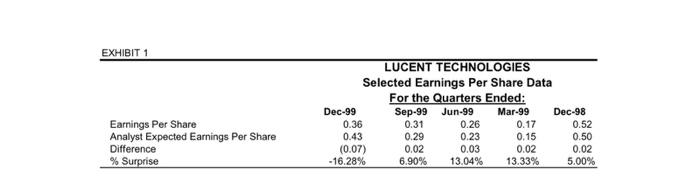

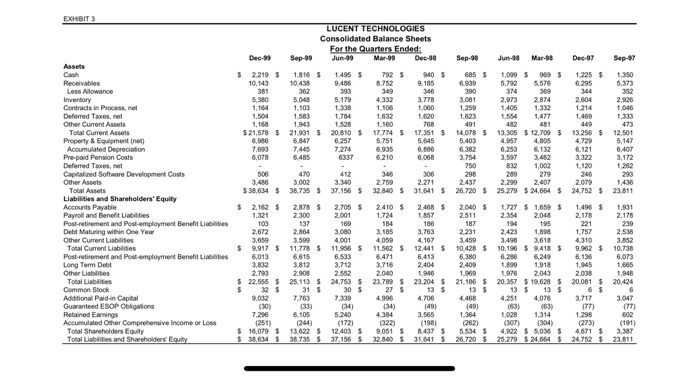

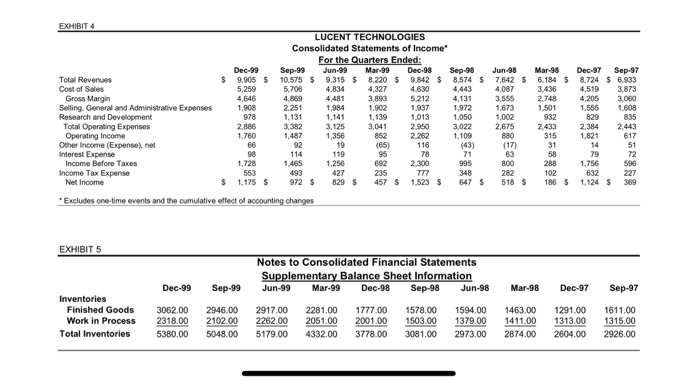

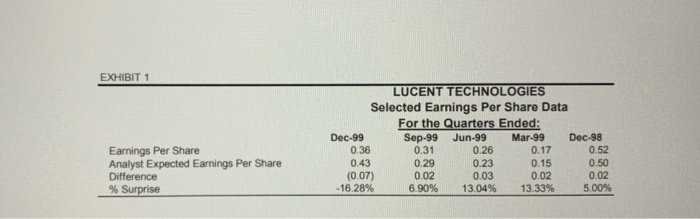

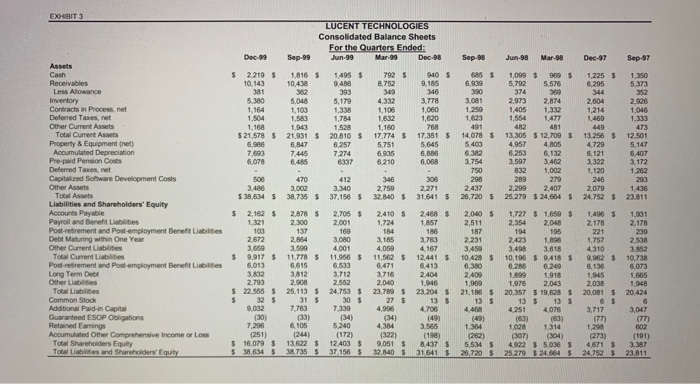

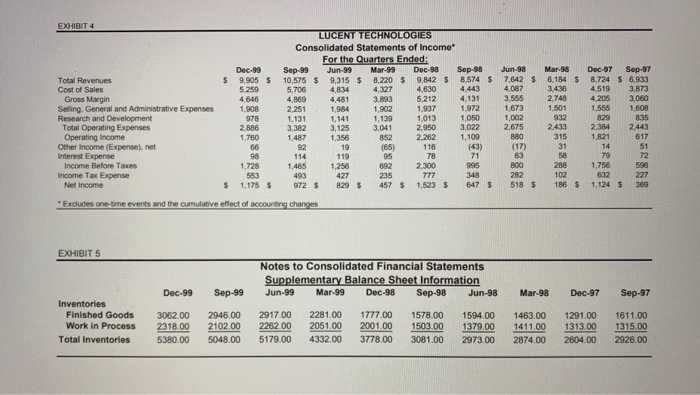

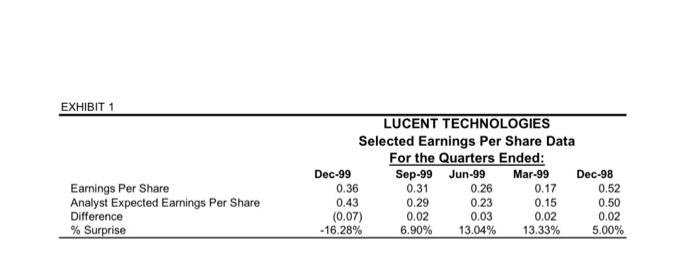

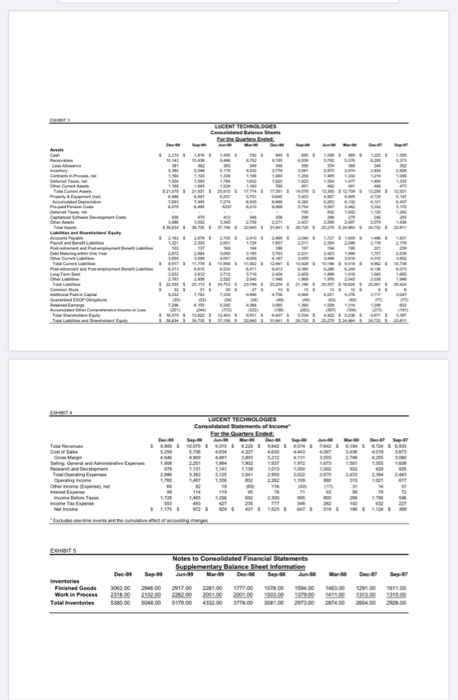

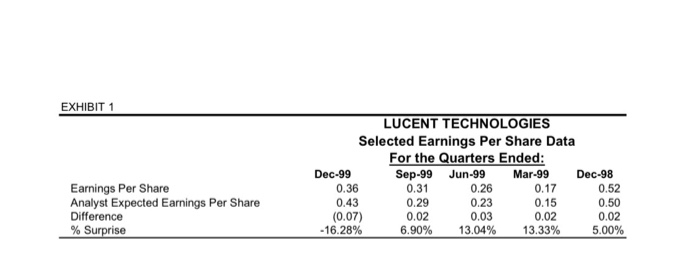

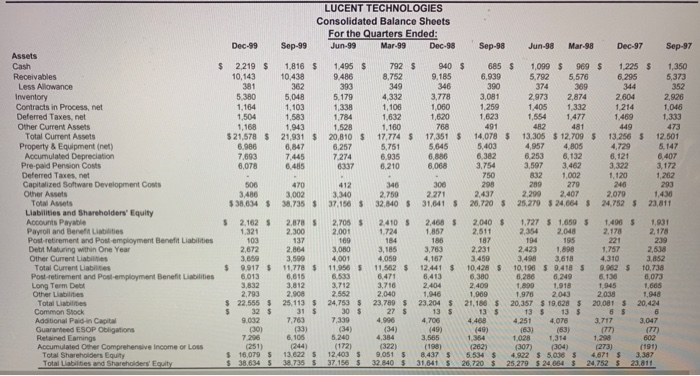

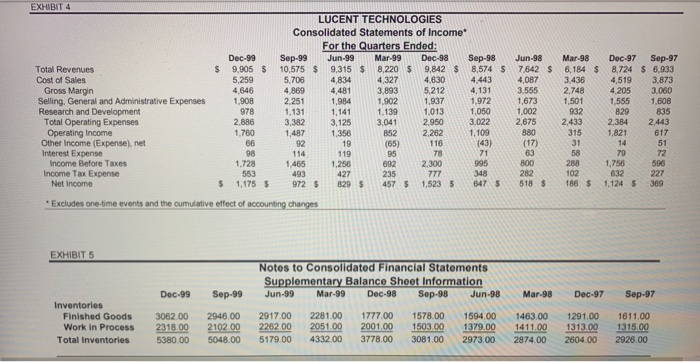

EXHIBIT 1 LUCENT TECHNOLOGIES Selected Earnings Per Share Data For the Quarters Ended: Dec-99 Sep-99 Jun-99 Mar-99 Dec-98 0.36 0.31 0.26 0.17 0.52 0.43 0.29 0.23 0.15 0.50 (0.07) 0.02 0.03 0.02 0.02 - 16.28% 6.90% 13.04% 13.33% 5.00% Earnings Per Share Analyst Expected Earnings Per Share Difference % Surprise EXHIBITS LUCENT TECHNOLOGIES Consolidated Balance Sheets For the Quarters Ended: Jun-99 Dec- Sep-99 Jun-8 Mars Dec-97 Sep-97 $ 2.219 $ 1.816 $ 792 $ 1,099 $ 969 $ 1 225 $ 14955 9.486 405 9.185 1,350 5.373 $21,578 $ 1.943 21,931 $ 20.810 $ 1.100 17.774 $ 5.751 14.078 $ 13,305 $ 12,709 $ 13 256 $ 12.501 17 351 $ 5.645 7.445 6485 6.121 31322 6.070 6.060 3.436 $38.634 $ 38.735 $ 37,156 $ 32 840 $ 31,541 5 26.720 $ 2.299 2.407 25 279 $ 24,654 $ 24.752 $ 23.811 Cash Receivables Less Allowance Inventory Contracts in Process Deferred Taxos, met Other Current Assets Total Current Assets Property & Equipment (net) Acoumulated Depreciation Pre-pad Pension Costs Deferred Taxes, Capitalized Software Development Costs Other Assets Total Assets Liabilities and Shareholders' Equity Accounts Payable Payroll and Benefit abilities Post-retirement and Post-employment Benefit Liabilities Debt Maturing within One Year Other Current Liables Total Current Liabilities Post-retirement and Post-employment Benefit Listes Long Term Debt Other Liabilities Total Liabilities Common Stock Additional Paid-in Capital Guaranteed ESOP Obligations Retained Earnings Accumulated Other Comprehensive Income or Loss Total Shareholders Equity Total Liabilities and Shareholders Equity $ $ S 2.705 $ 2410 $ 2.468 $ $ 2.162 1.321 $ 2.878 2.300 2000$ 2.511 1.727 2,354 1.659 2,048 2.178 2.178 2,672 $ 11.778 LOU42. 10.190 9 1412 9,917 $ 6,013 3.832 6.135 1945 2909 25.113 S 22.555 $ $ 24.753 5 7,296 1 298 6.105 1264 13,622 S 28.735 S $ $ 1,028 1,314 (307) (304) 4,822 $500 $ 25.279 $ 24,664 $ 16.079 $ 2.64 $ (172) 12.403 $ 37.156 $ (322) 9.051 S 32 10 $ 8.437 $ 31,641 $ 5.534 $ 26.720 $ 4.671 $ 24.752 $ 3.387 23.811 EXHIBIT 4 Dec-99 9.905 $ $ $ $ $ 5.259 LUCENT TECHNOLOGIES Consolidated Statements of Income For the Quarters Ended: Sep-99 Jun-99 Mar-99 Dec 08 Sep 28 Jun-08 10.575 $ 9.315 $ 8.220 $ 9.842 $ 8.574 $ 7.642 5.706 4.327 4.630 4.443 4,087 4.989 4,481 3,893 5212 4,131 3.555 2.251 1.984 1,902 1937 1.972 1673 1,131 1.141 1.139 1.013 1.050 1.002 3,125 3,0412 95030222,675 1,487 1,356 2.262 1,109 (43) (17) Sep-97 6.933 .873 4.834 Dec-97 8,724 4.519 4,205 1.555 3 Mar98 6.184 3.436 2.748 1501 9 32 2.433 4,646 1,908 1.608 829 835 2.886 Total Revenues Cost of Sales Gross Margin Selling General and Administrative Expenses Research and Development Total Operating Expenses Operating Income Other Income (Expense). net Interest Expense Income Before Taxes Income Tax Expense Net Income 2.443 2,384 1.821 1.780 (65) 116 1.756 598 1.728 553 1,175 1.465 493 972 1,256 427 829 692 295 2 300 777 1.523 995 348 647 800 282 518 288 102 $ $ $ $ 457 $ $ $ 632 1,124 S 186 $ $ 389 *Excludes one-time events and the cumulative effect of accounting changes EXHIBIT 5 Notes to Consolidated Financial Statements Supplementary Balance Sheet Information Jun-99 Mar-99 Dec-98 Sep-98 Jun-98 Dec-99 Sep-99 Mar-98 Dec-97 Sep-97 Inventories Finished Goods Work in Process Total Inventories 3062.00 2318,00 5380.00 2946.00 2102.00 5048,00 2917.00 2262.00 5179.00 2281.00 2051.00 4332.00 1777.00 2001.00 3778.00 1578.00 1503.00 3081.00 1594.00 1379.00 2973.00 1463.00 1411.00 2874.00 1291.00 1313.00 2604.00 1611.00 1315.00 2926.00 EXHIBIT 1 LUCENT TECHNOLOGIES Selected Earnings Per Share Data For the Quarters Ended: Dec-99 Sep-99 Jun-99 Mar-99 Dec-98 0.36 0.31 0.26 0.17 0.52 0.43 0.29 0.23 0.15 0.50 (0.07) 0.02 0.03 0.02 0.02 - 16.28% 6.90% 13.04% 13.33% 5.00% Earnings Per Share Analyst Expected Earnings Per Share Difference % Surprise EXOBIT 3 LUCENT TECHNOLOGIES Consolidated Balance Sheets For the Quarters Ended: Deco Dec-99 Sep-99 Sep-98 Jun-98 Mar-98 Sep-97 $ $ $ $ Cash Receivables 2219 $ 10,143 1.816 10 438 1,099 5,792 1.225 $ 1,350 6.939 5575 5.380 5.048 2.004 2.920 3.778 1.060 3.081 1.250 2.973 1,405 2.874 1,332 Contracts in Process net 1,469 1.333 Other Current Assets 1943 482 13,305 $ 12,709 $ $ 21,578 $ 20.810 $ 17,774 $ $ 21,931 $ 6 847 7.445 17,351 $ 5,645 6.896 14,078 5.403 6.382 3.754 13 256 $ 4,729 6.121 6.253 3.597 12501 5.147 6.407 3.172 1 262 6.078 290 $ 38,534 $ 38,735 $ 37,156 $ 32,840 $ 2271 31 641 $ 2,437 26,720 $ 25 279 $ 24,654 $ 24,752 $ 1,436 23.811 71595 1.321 1 857 2,511 2,354 2,048 2178 2 178 2.572 Progetyou mentine Accumulated Depreciation Pre-paid Pension Cases Deferred Textes, net Capitalized Software Development Costs Other Assets Total Assets Liabilities and Shareholders' Equity Accounts Payable Payroll and Benefit Labies Post-retirement and Post employment Benefit Liabilities Debt Maturing within One Year Other Current Liabilities Total Current Liabilities Post-retirement and Post-employment Benefit Liabilities Long Term Det Other Liabilities Total abilities Common Stock Additional Paid in Capital Guaranteed ESOP Obligations Retained Earnings Accumulated Other Comprehensive Income of Loss Total Shareholders Equity Total bites and Shareholders' Equity 3 .852 1073 $ $ $ 59 10.428 11.900 $ 11,562 $ $ 9.917 5 013 32 11.778 6.515 2012 2,409 4, 167 12.441 S 6413 2.404 1946 23.204 $ 13 S 4.706 3,498 3,618 4310 10,195 $ 9.418 $ 6200 6.249 1.99 1,918 1,945 1.975 2043 22039 20,357 $ 19,628 $ 20,081 13 $ 1356 $ 22.555 S 25.113 $ 24.753 S 30 $ 23,780 $ 27 $ 21,106 $ 13 $ 4.469 $ $ 20,424 9,032 3,047 7.763 331 6.105 2441 13,622 38 735 $ $ 2511 16,079 38,634 $ $ 5 $ (172) 12 403 37,156 $ $ (322) 9051 $ 32,840 S 3.565 (190) 437 31 641 $ 1,364 (202) 5.534 26,720 (307) 4.922 25 279 $ $ 1314 (304) $5.036 $ $ 24. 64 $ (273) 4671 $ 24.752 $ (191) 3.387 23,811 EXHIBIT 4 $ $ $ J un-98 7,642 4,087 $ Mar 18 6.184 3.436 S Dec-99 9,905 5.259 4.646 1.908 978 2.886 1.750 Sep-97 6.983 3.873 3.060 LUCENT TECHNOLOGIES Consolidated Statements of Income For the Quarters Ended: Sep 99 Jun-99 Mar-99 Dec-98 10.575 $ 9.315 $ 8.220 $ 9.842 $ 5.706 4,834 4.327 4,630 4.869 4,481 3.893 5.212 2.251 1.984 1.902 1.937 1,131 1.141 1,139 1.013 3.382 3,125 3,041 2.950 1.487 1.356 2.262 92 114 119 1,465 1 256 692 2,300 493 235 972 $ 829 $ 457 $ 1,523 $ Sep-98 8.574 4.443 4.131 1,972 1,050 3.022 1,109 (43) 2.749 1.501 Dec-97 8.724 5 4,519 4 205 1555 829 2 384 1.821 Total Revenues Cost of Sales Gross Margin Selling. General and Administrative Expenses Research and Development Total Operating Expenses Operating Income Other Income (Expensel.net Interest Expense Income Before Taxes Income Tax Expense Net Income 1 608 1.673 1.002 2.675 932 2.443 315 (65) 116 995 200 1,728 563 777 348 288 102 186 1.758 632 1,124 282 518 $ 1,175 $ 647 $ $ $ $ 369 - Excludes one-time events and the cumulative effect of accounting changes EXHIBIT 5 Notes to Consolidated Financial Statements Supplementary Balance Sheet Information Jun-99 Mar-99 D ec-98 Sep-98 Jun-98 Dec-99 Sep-99 Mar-98 Dec-97 Sep-97 Inventories Finished Goods Work in Process Total Inventories 3062.00 2318.00 5380.00 2946.00 2102.00 5048.00 2917.00 2262.00 5179.00 2281.00 2051.00 4332.00 1777.00 2001.00 3778.00 1578.00 1503.00 3081.00 1594.00 1379.00 2973.00 1463.00 1411.00 2874.00 1291.00 1313.00 2604.00 1611.00 1315.00 2926.00 EXHIBIT 1 LUCENT TECHNOLOGIES Selected Earnings Per Share Data For the Quarters Ended: Dec-99 Sep-99 Jun-99 Mar-99 Dec-98 0.36 0.310 .26 0.17 0.43 0.29 0.23 0.15 0.50 (0.07) 0.02 0.03 0.02 0.02 -16.28% 6.90% 13.04% 13.33% 5.00% 0.52 Earnings Per Share Analyst Expected Earnings Per Share Difference % Surprise 23 2512 Notes to conted Financia Supplea Balance Sheet m ents EXHIBIT 1 LUCENT TECHNOLOGIES Selected Earnings Per Share Data For the Quarters Ended: Dec-99 Sep-99 Jun-99 Mar-99 Dec-98 0.36 0.310 .26 0.17 0.43 0.29 0.23 0.15 0.50 (0.07) 0.02 0.03 0.02 0.02 -16.28% 6.90% 13.04% 13.33% 5.00% 0.52 Earnings Per Share Analyst Expected Earnings Per Share Difference % Surprise LUCENT TECHNOLOGIES Consolidated Balance Sheets For the Quarters Ended: Jun-99 Mar-99 Dec.98 Dec-99 Sep-99 Sep-98 Jun-98 Mar-98 Dec-97 Sep-97 $ $ $ $ $ 685 $ $ $ $ 2.219 10,143 1,816 10.438 1.495 9486 1.099 5.792 374 969 5,576 369 1.225 6.295 1,350 5.373 2.973 2874 5.179 1.338 5.048 1.103 2.926 3,081 1.259 1.623 792 S 940 8.7529 .185 349 346 4.332 3.778 1.106 1.050 1.632 1.620 1,160 17.774 $ 17,351 5.751 5,645 6.935 6.886 6.210 6,068 5.380 1.164 1.504 1,168 $ 21,578 69 2.604 1214 1.469 1.332 1,477 1,046 1.333 1.583 1.405 1,554 482 13,305 1.943 $ $ 1.528 20,810 6.257 $ $ $ $ 12,709 $ $ 12.501 21,931 6.847 7.445 6.485 14,078 5.403 6.382 3.754 4957 13,256 4,729 0.121 3.322 6,078 6.253 3.597 832 289 2.299 25.270 500 6.132 3.462 1.002 279 2.407 5 24.064 1.120 6.407 3.172 1262 293 1.430 23.811 300 246 3,486 $38.634 470 3.002 38,735 3.340 37.156 2.750 32.140 S 2 271 31.641 S 2,437 2.079 $ $ $ 2720 S $ 24.752 $ Assets Cash Receivables Less Allowance Inventory Contracts in Process, net Deferred Taxes, net Other Current Assets Total Current Assets Property & Equipment (net) Accumulated Depreciation Pre-paid Pension Costs Deferred Taxes, net Capitalized Software Development Costs Other Assets Total Assets Liabilities and Shareholders' Equity Accounts Payable Payroll and Benet Liabilities Post-retirement and Post-employment Benefit Liabilities Debt Maturing within One Year Other Current Liabilities Total Current Liabilities Post-retirement and Post-employment Benefit Liabilities Long Term Debt Other Liabilities Total Liabilities Common Stock Additional Paid in Capital Guaranteed ESOP Obligations Retained Earnings Accumulated Other Comprehensive Income or LOSS Total Shareholders Equity Total Liabilities and Shareholders' Equity $ $ 2.706 $ $ 2.468 $ $ 2.8785 2.300 2.410 1.724 1.931 2178 2.864 2.162 1.321 103 2.872 3.69 9917 6,013 3.832 2.793 22,556 2040 2.511 187 2.231 3.459 10,428 6380 2.409 1.909 21,186 $ 1,727 $ 1.659 $ 1.490 5 2.34 2.048 2178 194 195 221 2.423 1,898 1,757 3.498 3.618 4 310 10.198 $ 9.418 $ 9.962 $ 6,288 62496 ,138 1945 1.978 2043 2.038 20,357 $ 19.028 $ 20,081 $ $ $ 11.956 3,185 4,059 11,582 6,471 3.710 $ 3.783 4.167 12.441 6,413 2404 $ 11,778 6,615 3.812 $ $ 2.538 3852 10.738 6,073 1.065 $ $ 25.113 24,753 $ 23,780 $ 23,204 $ $ 20,424 9.032 7339 4706 4.251 (63) 4,078 (63) 3.717 77 (49) 3,047 7 7 4,996 (34) 4.384 (322) ,051 $ 32 840 $ 5.240 (172) 12.403 5 37,156 (273) (251) 16,079 38.634 $ $ 9 $ $ 13,622 38 735 $ $ (198) 8,437 7 $ 5 31,641 5 (262) 5.534 5.534 26.720 (307) 304) 4.922 $ 50385 25 279 S 24.664 S $ $ $ (191) 3.387 23.811 $ 24,752 S EXHIBIT 4 $ $ $ $ $ Dec-99 9,905 5,259 4.646 1.90B 978 2.886 1.760 66 LUCENT TECHNOLOGIES Consolidated Statements of Income* For the Quarters Ended: Sep-99 Jun-99 Mar-99 Dec-98 Sep-98 10,575 $ 9,315 $ 8,220 $ 9,842 $ 8,574 5.708 4,834 4.327 4.630 4.443 4.869 4,481 3,893 5,212 4.131 2251 1.984 1.902 1.937 1.972 1.131 1,141 1.139 1,050 3.382 3.125 3.041 2.950 3,022 1.487 1.356 852 2,262 1,109 (43) Total Revenues Cost of Sales Gross Margin Selling. General and Administrative Expenses Research and Development Total Operating Expenses Operating Income Other Income (Expense), net Interest Expense Income Before Taxes Income Tax Expense Net Income Jun-98 7.642 4,087 3555 1.673 1.002 2.675 880 (17) Mar-98 6,184 3436 2.748 1.501 932 2.433 315 Dec-97 8,724 4,519 4, 205 1.555 829 2384 1.821 14 Sep-97 $ 6.933 3.873 3.060 1.600 835 2443 1.013 617 (65) 116 51 83 79 1,465 995 800 1.728 553 1.175 2.300 777 1,523 $ 288 102 235 348 1.756 632 1.124 $ $ 282 518 972 $ 829 $ 647 $ 457 $ 227 369 $ 186 $ $ Excludes one-time events and the cumulative effect of accounting changes EXHIBIT 5 Notos to Consolidated Financial Statements Supplementary Balance Sheet Information Jun-99 Mar-99 Dec-98 Sep-98 Jun-98 Dec-99 Sep-99 Mar-98 Dec-97 Sep-97 Inventories Finished Goods Work in Process Total Inventories 3 062.00 2318.00 5380.00 2946.00 2102.00 5048.00 2017.00 2262.00 5179.00 2281.00 2051.00 4332.00 1777.00 2001,00 3778.00 1578.00 1503.00 3081.00 1594.00 1379.00 2973.00 1463.00 1411.00 2874.00 1291.00 1313.00 2604.00 1611.00 1315.00 2926.00 EXHIBIT 1 LUCENT TECHNOLOGIES Selected Earnings Per Share Data For the Quarters Ended: Dec-99 Sep-99 Jun-99 Mar-99 Dec-98 0.36 0.31 0.26 0.17 0.52 0.43 0.29 0.23 0.15 0.50 (0.07) 0.02 0.03 0.02 0.02 - 16.28% 6.90% 13.04% 13.33% 5.00% Earnings Per Share Analyst Expected Earnings Per Share Difference % Surprise EXHIBITS LUCENT TECHNOLOGIES Consolidated Balance Sheets For the Quarters Ended: Jun-99 Dec- Sep-99 Jun-8 Mars Dec-97 Sep-97 $ 2.219 $ 1.816 $ 792 $ 1,099 $ 969 $ 1 225 $ 14955 9.486 405 9.185 1,350 5.373 $21,578 $ 1.943 21,931 $ 20.810 $ 1.100 17.774 $ 5.751 14.078 $ 13,305 $ 12,709 $ 13 256 $ 12.501 17 351 $ 5.645 7.445 6485 6.121 31322 6.070 6.060 3.436 $38.634 $ 38.735 $ 37,156 $ 32 840 $ 31,541 5 26.720 $ 2.299 2.407 25 279 $ 24,654 $ 24.752 $ 23.811 Cash Receivables Less Allowance Inventory Contracts in Process Deferred Taxos, met Other Current Assets Total Current Assets Property & Equipment (net) Acoumulated Depreciation Pre-pad Pension Costs Deferred Taxes, Capitalized Software Development Costs Other Assets Total Assets Liabilities and Shareholders' Equity Accounts Payable Payroll and Benefit abilities Post-retirement and Post-employment Benefit Liabilities Debt Maturing within One Year Other Current Liables Total Current Liabilities Post-retirement and Post-employment Benefit Listes Long Term Debt Other Liabilities Total Liabilities Common Stock Additional Paid-in Capital Guaranteed ESOP Obligations Retained Earnings Accumulated Other Comprehensive Income or Loss Total Shareholders Equity Total Liabilities and Shareholders Equity $ $ S 2.705 $ 2410 $ 2.468 $ $ 2.162 1.321 $ 2.878 2.300 2000$ 2.511 1.727 2,354 1.659 2,048 2.178 2.178 2,672 $ 11.778 LOU42. 10.190 9 1412 9,917 $ 6,013 3.832 6.135 1945 2909 25.113 S 22.555 $ $ 24.753 5 7,296 1 298 6.105 1264 13,622 S 28.735 S $ $ 1,028 1,314 (307) (304) 4,822 $500 $ 25.279 $ 24,664 $ 16.079 $ 2.64 $ (172) 12.403 $ 37.156 $ (322) 9.051 S 32 10 $ 8.437 $ 31,641 $ 5.534 $ 26.720 $ 4.671 $ 24.752 $ 3.387 23.811 EXHIBIT 4 Dec-99 9.905 $ $ $ $ $ 5.259 LUCENT TECHNOLOGIES Consolidated Statements of Income For the Quarters Ended: Sep-99 Jun-99 Mar-99 Dec 08 Sep 28 Jun-08 10.575 $ 9.315 $ 8.220 $ 9.842 $ 8.574 $ 7.642 5.706 4.327 4.630 4.443 4,087 4.989 4,481 3,893 5212 4,131 3.555 2.251 1.984 1,902 1937 1.972 1673 1,131 1.141 1.139 1.013 1.050 1.002 3,125 3,0412 95030222,675 1,487 1,356 2.262 1,109 (43) (17) Sep-97 6.933 .873 4.834 Dec-97 8,724 4.519 4,205 1.555 3 Mar98 6.184 3.436 2.748 1501 9 32 2.433 4,646 1,908 1.608 829 835 2.886 Total Revenues Cost of Sales Gross Margin Selling General and Administrative Expenses Research and Development Total Operating Expenses Operating Income Other Income (Expense). net Interest Expense Income Before Taxes Income Tax Expense Net Income 2.443 2,384 1.821 1.780 (65) 116 1.756 598 1.728 553 1,175 1.465 493 972 1,256 427 829 692 295 2 300 777 1.523 995 348 647 800 282 518 288 102 $ $ $ $ 457 $ $ $ 632 1,124 S 186 $ $ 389 *Excludes one-time events and the cumulative effect of accounting changes EXHIBIT 5 Notes to Consolidated Financial Statements Supplementary Balance Sheet Information Jun-99 Mar-99 Dec-98 Sep-98 Jun-98 Dec-99 Sep-99 Mar-98 Dec-97 Sep-97 Inventories Finished Goods Work in Process Total Inventories 3062.00 2318,00 5380.00 2946.00 2102.00 5048,00 2917.00 2262.00 5179.00 2281.00 2051.00 4332.00 1777.00 2001.00 3778.00 1578.00 1503.00 3081.00 1594.00 1379.00 2973.00 1463.00 1411.00 2874.00 1291.00 1313.00 2604.00 1611.00 1315.00 2926.00 EXHIBIT 1 LUCENT TECHNOLOGIES Selected Earnings Per Share Data For the Quarters Ended: Dec-99 Sep-99 Jun-99 Mar-99 Dec-98 0.36 0.31 0.26 0.17 0.52 0.43 0.29 0.23 0.15 0.50 (0.07) 0.02 0.03 0.02 0.02 - 16.28% 6.90% 13.04% 13.33% 5.00% Earnings Per Share Analyst Expected Earnings Per Share Difference % Surprise EXOBIT 3 LUCENT TECHNOLOGIES Consolidated Balance Sheets For the Quarters Ended: Deco Dec-99 Sep-99 Sep-98 Jun-98 Mar-98 Sep-97 $ $ $ $ Cash Receivables 2219 $ 10,143 1.816 10 438 1,099 5,792 1.225 $ 1,350 6.939 5575 5.380 5.048 2.004 2.920 3.778 1.060 3.081 1.250 2.973 1,405 2.874 1,332 Contracts in Process net 1,469 1.333 Other Current Assets 1943 482 13,305 $ 12,709 $ $ 21,578 $ 20.810 $ 17,774 $ $ 21,931 $ 6 847 7.445 17,351 $ 5,645 6.896 14,078 5.403 6.382 3.754 13 256 $ 4,729 6.121 6.253 3.597 12501 5.147 6.407 3.172 1 262 6.078 290 $ 38,534 $ 38,735 $ 37,156 $ 32,840 $ 2271 31 641 $ 2,437 26,720 $ 25 279 $ 24,654 $ 24,752 $ 1,436 23.811 71595 1.321 1 857 2,511 2,354 2,048 2178 2 178 2.572 Progetyou mentine Accumulated Depreciation Pre-paid Pension Cases Deferred Textes, net Capitalized Software Development Costs Other Assets Total Assets Liabilities and Shareholders' Equity Accounts Payable Payroll and Benefit Labies Post-retirement and Post employment Benefit Liabilities Debt Maturing within One Year Other Current Liabilities Total Current Liabilities Post-retirement and Post-employment Benefit Liabilities Long Term Det Other Liabilities Total abilities Common Stock Additional Paid in Capital Guaranteed ESOP Obligations Retained Earnings Accumulated Other Comprehensive Income of Loss Total Shareholders Equity Total bites and Shareholders' Equity 3 .852 1073 $ $ $ 59 10.428 11.900 $ 11,562 $ $ 9.917 5 013 32 11.778 6.515 2012 2,409 4, 167 12.441 S 6413 2.404 1946 23.204 $ 13 S 4.706 3,498 3,618 4310 10,195 $ 9.418 $ 6200 6.249 1.99 1,918 1,945 1.975 2043 22039 20,357 $ 19,628 $ 20,081 13 $ 1356 $ 22.555 S 25.113 $ 24.753 S 30 $ 23,780 $ 27 $ 21,106 $ 13 $ 4.469 $ $ 20,424 9,032 3,047 7.763 331 6.105 2441 13,622 38 735 $ $ 2511 16,079 38,634 $ $ 5 $ (172) 12 403 37,156 $ $ (322) 9051 $ 32,840 S 3.565 (190) 437 31 641 $ 1,364 (202) 5.534 26,720 (307) 4.922 25 279 $ $ 1314 (304) $5.036 $ $ 24. 64 $ (273) 4671 $ 24.752 $ (191) 3.387 23,811 EXHIBIT 4 $ $ $ J un-98 7,642 4,087 $ Mar 18 6.184 3.436 S Dec-99 9,905 5.259 4.646 1.908 978 2.886 1.750 Sep-97 6.983 3.873 3.060 LUCENT TECHNOLOGIES Consolidated Statements of Income For the Quarters Ended: Sep 99 Jun-99 Mar-99 Dec-98 10.575 $ 9.315 $ 8.220 $ 9.842 $ 5.706 4,834 4.327 4,630 4.869 4,481 3.893 5.212 2.251 1.984 1.902 1.937 1,131 1.141 1,139 1.013 3.382 3,125 3,041 2.950 1.487 1.356 2.262 92 114 119 1,465 1 256 692 2,300 493 235 972 $ 829 $ 457 $ 1,523 $ Sep-98 8.574 4.443 4.131 1,972 1,050 3.022 1,109 (43) 2.749 1.501 Dec-97 8.724 5 4,519 4 205 1555 829 2 384 1.821 Total Revenues Cost of Sales Gross Margin Selling. General and Administrative Expenses Research and Development Total Operating Expenses Operating Income Other Income (Expensel.net Interest Expense Income Before Taxes Income Tax Expense Net Income 1 608 1.673 1.002 2.675 932 2.443 315 (65) 116 995 200 1,728 563 777 348 288 102 186 1.758 632 1,124 282 518 $ 1,175 $ 647 $ $ $ $ 369 - Excludes one-time events and the cumulative effect of accounting changes EXHIBIT 5 Notes to Consolidated Financial Statements Supplementary Balance Sheet Information Jun-99 Mar-99 D ec-98 Sep-98 Jun-98 Dec-99 Sep-99 Mar-98 Dec-97 Sep-97 Inventories Finished Goods Work in Process Total Inventories 3062.00 2318.00 5380.00 2946.00 2102.00 5048.00 2917.00 2262.00 5179.00 2281.00 2051.00 4332.00 1777.00 2001.00 3778.00 1578.00 1503.00 3081.00 1594.00 1379.00 2973.00 1463.00 1411.00 2874.00 1291.00 1313.00 2604.00 1611.00 1315.00 2926.00 EXHIBIT 1 LUCENT TECHNOLOGIES Selected Earnings Per Share Data For the Quarters Ended: Dec-99 Sep-99 Jun-99 Mar-99 Dec-98 0.36 0.310 .26 0.17 0.43 0.29 0.23 0.15 0.50 (0.07) 0.02 0.03 0.02 0.02 -16.28% 6.90% 13.04% 13.33% 5.00% 0.52 Earnings Per Share Analyst Expected Earnings Per Share Difference % Surprise 23 2512 Notes to conted Financia Supplea Balance Sheet m ents EXHIBIT 1 LUCENT TECHNOLOGIES Selected Earnings Per Share Data For the Quarters Ended: Dec-99 Sep-99 Jun-99 Mar-99 Dec-98 0.36 0.310 .26 0.17 0.43 0.29 0.23 0.15 0.50 (0.07) 0.02 0.03 0.02 0.02 -16.28% 6.90% 13.04% 13.33% 5.00% 0.52 Earnings Per Share Analyst Expected Earnings Per Share Difference % Surprise LUCENT TECHNOLOGIES Consolidated Balance Sheets For the Quarters Ended: Jun-99 Mar-99 Dec.98 Dec-99 Sep-99 Sep-98 Jun-98 Mar-98 Dec-97 Sep-97 $ $ $ $ $ 685 $ $ $ $ 2.219 10,143 1,816 10.438 1.495 9486 1.099 5.792 374 969 5,576 369 1.225 6.295 1,350 5.373 2.973 2874 5.179 1.338 5.048 1.103 2.926 3,081 1.259 1.623 792 S 940 8.7529 .185 349 346 4.332 3.778 1.106 1.050 1.632 1.620 1,160 17.774 $ 17,351 5.751 5,645 6.935 6.886 6.210 6,068 5.380 1.164 1.504 1,168 $ 21,578 69 2.604 1214 1.469 1.332 1,477 1,046 1.333 1.583 1.405 1,554 482 13,305 1.943 $ $ 1.528 20,810 6.257 $ $ $ $ 12,709 $ $ 12.501 21,931 6.847 7.445 6.485 14,078 5.403 6.382 3.754 4957 13,256 4,729 0.121 3.322 6,078 6.253 3.597 832 289 2.299 25.270 500 6.132 3.462 1.002 279 2.407 5 24.064 1.120 6.407 3.172 1262 293 1.430 23.811 300 246 3,486 $38.634 470 3.002 38,735 3.340 37.156 2.750 32.140 S 2 271 31.641 S 2,437 2.079 $ $ $ 2720 S $ 24.752 $ Assets Cash Receivables Less Allowance Inventory Contracts in Process, net Deferred Taxes, net Other Current Assets Total Current Assets Property & Equipment (net) Accumulated Depreciation Pre-paid Pension Costs Deferred Taxes, net Capitalized Software Development Costs Other Assets Total Assets Liabilities and Shareholders' Equity Accounts Payable Payroll and Benet Liabilities Post-retirement and Post-employment Benefit Liabilities Debt Maturing within One Year Other Current Liabilities Total Current Liabilities Post-retirement and Post-employment Benefit Liabilities Long Term Debt Other Liabilities Total Liabilities Common Stock Additional Paid in Capital Guaranteed ESOP Obligations Retained Earnings Accumulated Other Comprehensive Income or LOSS Total Shareholders Equity Total Liabilities and Shareholders' Equity $ $ 2.706 $ $ 2.468 $ $ 2.8785 2.300 2.410 1.724 1.931 2178 2.864 2.162 1.321 103 2.872 3.69 9917 6,013 3.832 2.793 22,556 2040 2.511 187 2.231 3.459 10,428 6380 2.409 1.909 21,186 $ 1,727 $ 1.659 $ 1.490 5 2.34 2.048 2178 194 195 221 2.423 1,898 1,757 3.498 3.618 4 310 10.198 $ 9.418 $ 9.962 $ 6,288 62496 ,138 1945 1.978 2043 2.038 20,357 $ 19.028 $ 20,081 $ $ $ 11.956 3,185 4,059 11,582 6,471 3.710 $ 3.783 4.167 12.441 6,413 2404 $ 11,778 6,615 3.812 $ $ 2.538 3852 10.738 6,073 1.065 $ $ 25.113 24,753 $ 23,780 $ 23,204 $ $ 20,424 9.032 7339 4706 4.251 (63) 4,078 (63) 3.717 77 (49) 3,047 7 7 4,996 (34) 4.384 (322) ,051 $ 32 840 $ 5.240 (172) 12.403 5 37,156 (273) (251) 16,079 38.634 $ $ 9 $ $ 13,622 38 735 $ $ (198) 8,437 7 $ 5 31,641 5 (262) 5.534 5.534 26.720 (307) 304) 4.922 $ 50385 25 279 S 24.664 S $ $ $ (191) 3.387 23.811 $ 24,752 S EXHIBIT 4 $ $ $ $ $ Dec-99 9,905 5,259 4.646 1.90B 978 2.886 1.760 66 LUCENT TECHNOLOGIES Consolidated Statements of Income* For the Quarters Ended: Sep-99 Jun-99 Mar-99 Dec-98 Sep-98 10,575 $ 9,315 $ 8,220 $ 9,842 $ 8,574 5.708 4,834 4.327 4.630 4.443 4.869 4,481 3,893 5,212 4.131 2251 1.984 1.902 1.937 1.972 1.131 1,141 1.139 1,050 3.382 3.125 3.041 2.950 3,022 1.487 1.356 852 2,262 1,109 (43) Total Revenues Cost of Sales Gross Margin Selling. General and Administrative Expenses Research and Development Total Operating Expenses Operating Income Other Income (Expense), net Interest Expense Income Before Taxes Income Tax Expense Net Income Jun-98 7.642 4,087 3555 1.673 1.002 2.675 880 (17) Mar-98 6,184 3436 2.748 1.501 932 2.433 315 Dec-97 8,724 4,519 4, 205 1.555 829 2384 1.821 14 Sep-97 $ 6.933 3.873 3.060 1.600 835 2443 1.013 617 (65) 116 51 83 79 1,465 995 800 1.728 553 1.175 2.300 777 1,523 $ 288 102 235 348 1.756 632 1.124 $ $ 282 518 972 $ 829 $ 647 $ 457 $ 227 369 $ 186 $ $ Excludes one-time events and the cumulative effect of accounting changes EXHIBIT 5 Notos to Consolidated Financial Statements Supplementary Balance Sheet Information Jun-99 Mar-99 Dec-98 Sep-98 Jun-98 Dec-99 Sep-99 Mar-98 Dec-97 Sep-97 Inventories Finished Goods Work in Process Total Inventories 3 062.00 2318.00 5380.00 2946.00 2102.00 5048.00 2017.00 2262.00 5179.00 2281.00 2051.00 4332.00 1777.00 2001,00 3778.00 1578.00 1503.00 3081.00 1594.00 1379.00 2973.00 1463.00 1411.00 2874.00 1291.00 1313.00 2604.00 1611.00 1315.00 2926.00