Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1- Consider a 4-year forward contract to buy a 5-year bond providing 9% annual coupon paid semiannually on a principal of $1,000. The first

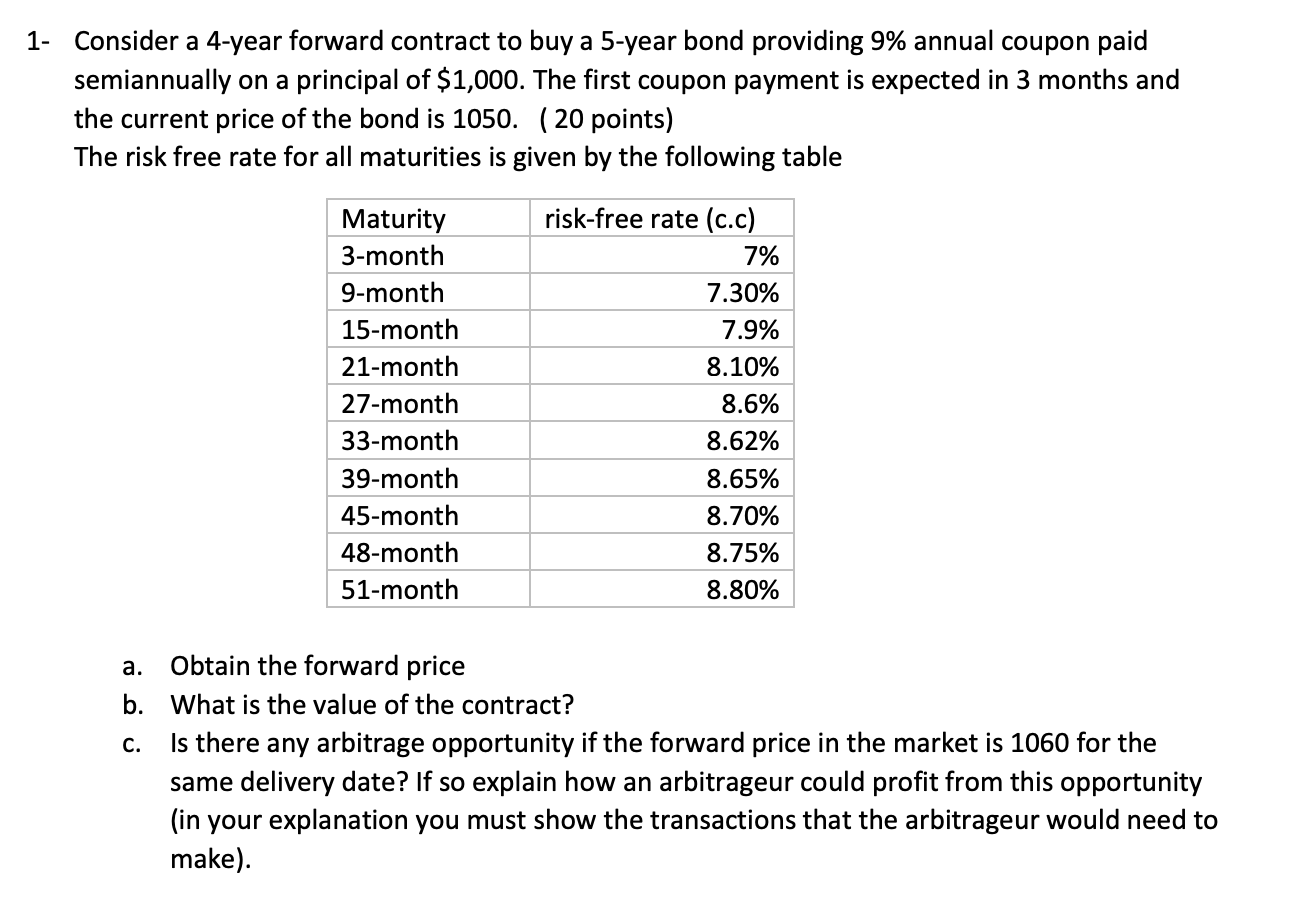

1- Consider a 4-year forward contract to buy a 5-year bond providing 9% annual coupon paid semiannually on a principal of $1,000. The first coupon payment is expected in 3 months and the current price of the bond is 1050. (20 points) The risk free rate for all maturities is given by the following table Maturity risk-free rate (c.c) 3-month 7% 9-month 7.30% 15-month 7.9% 21-month 8.10% 27-month 8.6% 33-month 8.62% 39-month 8.65% 45-month 8.70% 48-month 8.75% 51-month 8.80% a. Obtain the forward price b. What is the value of the contract? C. Is there any arbitrage opportunity if the forward price in the market is 1060 for the same delivery date? If so explain how an arbitrageur could profit from this opportunity (in your explanation you must show the transactions that the arbitrageur would need to make).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Obtain the forward price To calculate the forward price we need to find the present value of the bonds cash flows using the riskfree rates The bond ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started