Answered step by step

Verified Expert Solution

Question

1 Approved Answer

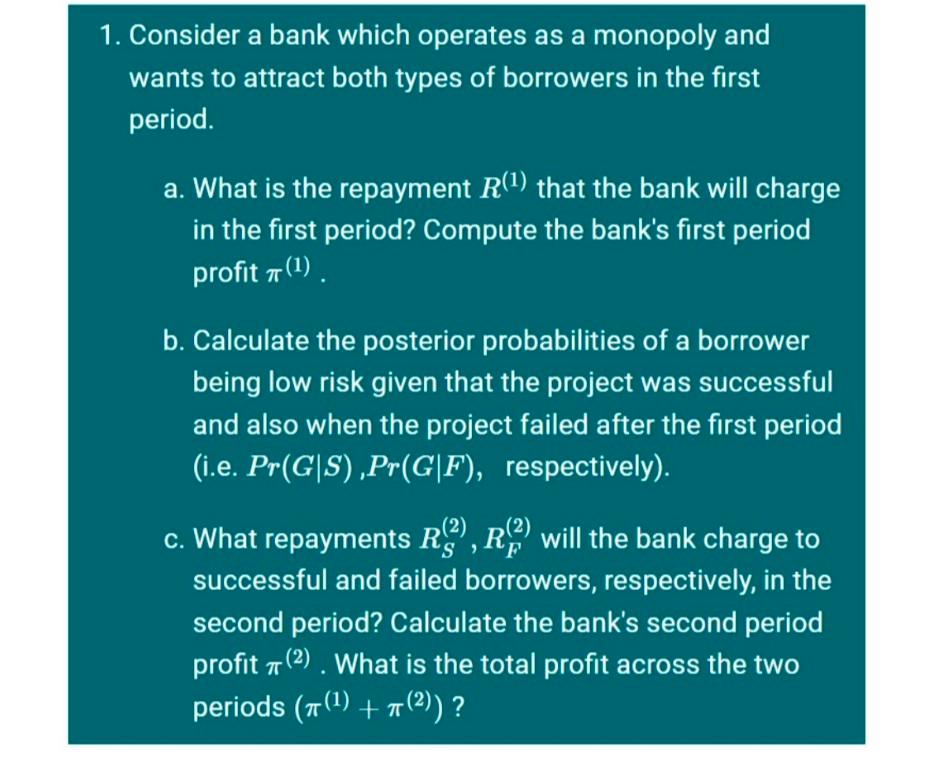

1. Consider a bank which operates as a monopoly and wants to attract both types of borrowers in the first period. a. What is the

1. Consider a bank which operates as a monopoly and wants to attract both types of borrowers in the first period. a. What is the repayment R(1) that the bank will charge in the first period? Compute the bank's first period profit 7 (1) ) b. Calculate the posterior probabilities of a borrower being low risk given that the project was successful and also when the project failed after the first period (i.e. Pr(G|S),Pr(G|F), respectively). (2) (2) c. What repayments RS", R will the bank charge to successful and failed borrowers, respectively, in the second period? Calculate the bank's second period profit 7 (2). What is the total profit across the two periods (5 (1) +7 (2)) ? 1. Consider a bank which operates as a monopoly and wants to attract both types of borrowers in the first period. a. What is the repayment R(1) that the bank will charge in the first period? Compute the bank's first period profit 7 (1) ) b. Calculate the posterior probabilities of a borrower being low risk given that the project was successful and also when the project failed after the first period (i.e. Pr(G|S),Pr(G|F), respectively). (2) (2) c. What repayments RS", R will the bank charge to successful and failed borrowers, respectively, in the second period? Calculate the bank's second period profit 7 (2). What is the total profit across the two periods (5 (1) +7 (2))

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started