Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Consider a market in which the Capital Asset Pricing Model (CAPM) holds. There are two assets with the following attributes.: Rate of return

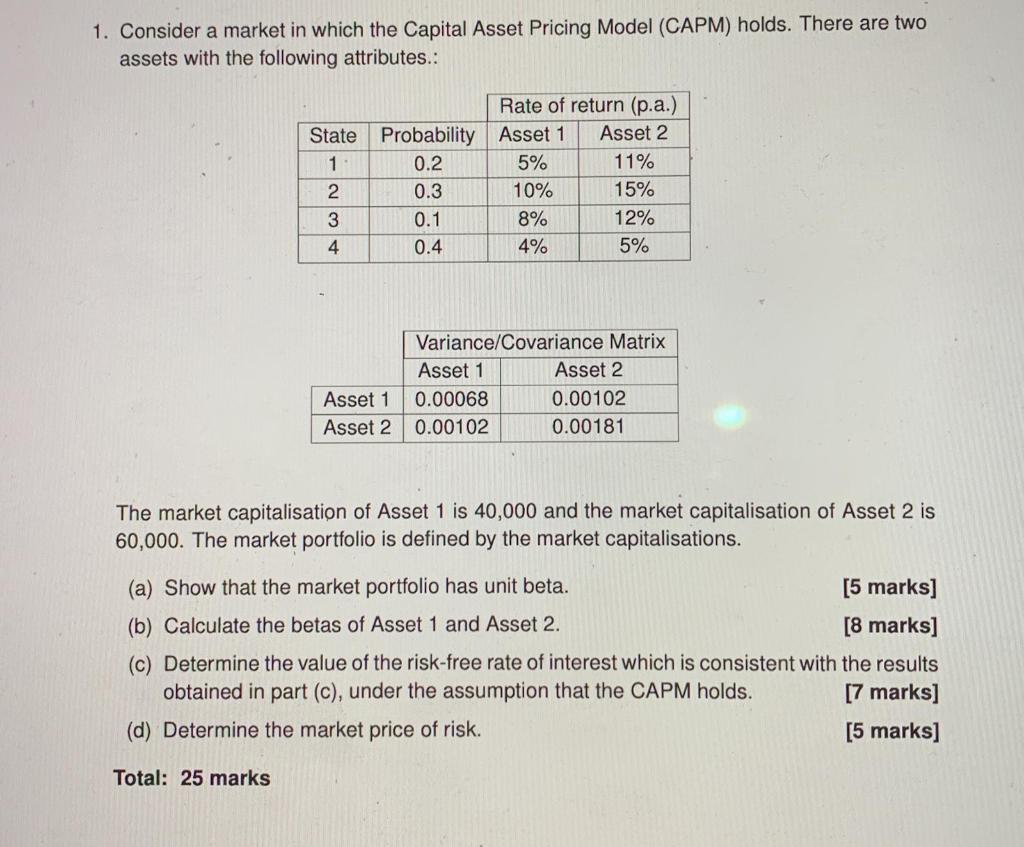

1. Consider a market in which the Capital Asset Pricing Model (CAPM) holds. There are two assets with the following attributes.: Rate of return (p.a.) State Probability Asset 1. Asset 2 1 0.2 5% 11% 2 0.3 10% 15% 3 0.1 8% 12% 4 0.4 4% 5% Variance/Covariance Matrix Asset 1 Asset 2 Asset 1 0.00068 0.00102 Asset 2 0.00102 0.00181 The market capitalisation of Asset 1 is 40,000 and the market capitalisation of Asset 2 is 60,000. The market portfolio is defined by the market capitalisations. (a) Show that the market portfolio has unit beta. (b) Calculate the betas of Asset 1 and Asset 2. [5 marks] [8 marks] (c) Determine the value of the risk-free rate of interest which is consistent with the results obtained in part (c), under the assumption that the CAPM holds. (d) Determine the market price of risk. [7 marks] [5 marks] Total: 25 marks

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Answer Part a Market Portfolio Beta Market Portfolio Beta m 1 In a market where CAPM holds the beta of the market portfolio m is always equal to 1 Thi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started