Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Consider a one-year forward contract established at rate of $105. The contract is four months into its life. The spot price is $108,

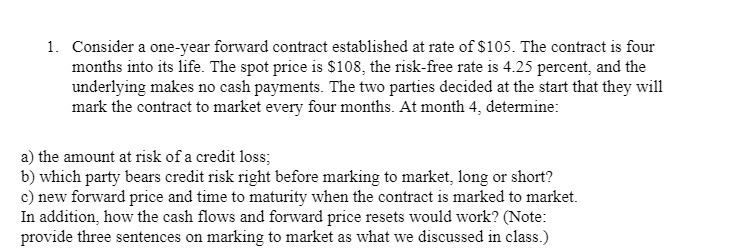

1. Consider a one-year forward contract established at rate of $105. The contract is four months into its life. The spot price is $108, the risk-free rate is 4.25 percent, and the underlying makes no cash payments. The two parties decided at the start that they will mark the contract to market every four months. At month 4, determine: a) the amount at risk of a credit loss; b) which party bears credit risk right before marking to market, long or short? c) new forward price and time to maturity when the contract is marked to market. In addition, how the cash flows and forward price resets would work? (Note: provide three sentences on marking to market as what we discussed in class.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To determine the amount at risk of a credit loss we need to calculate the difference between the f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started