Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Consider a portfolio optimization problem without short selling for n=3 risky securities with correlations, 12=0.10,13=0.20, and 23=0.25. Following Markowitz's critical line method, the problem

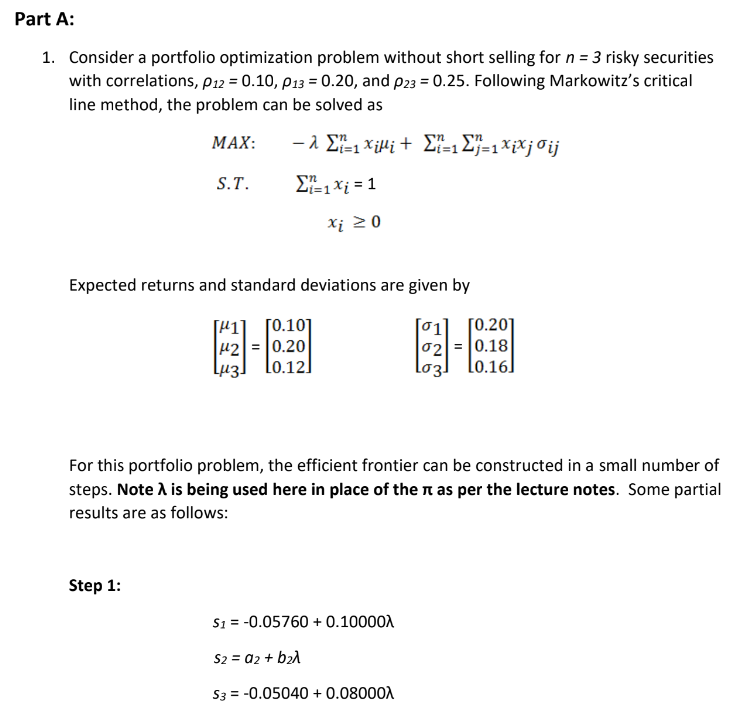

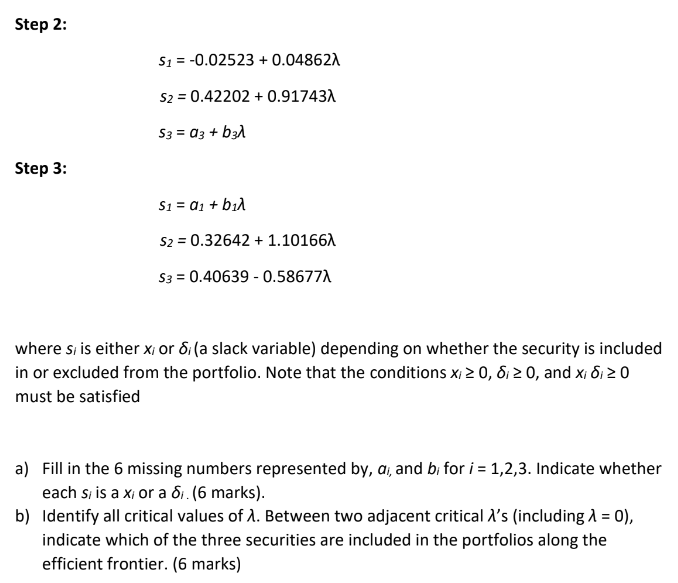

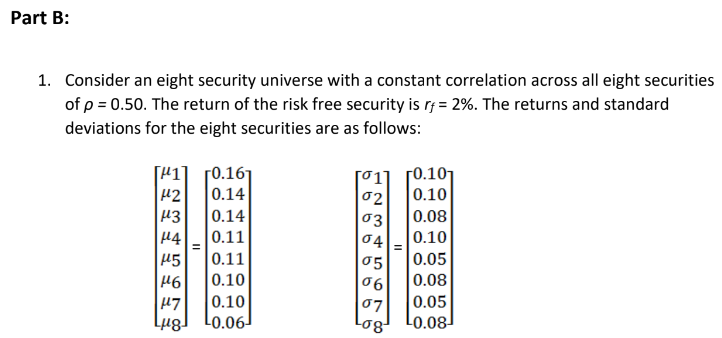

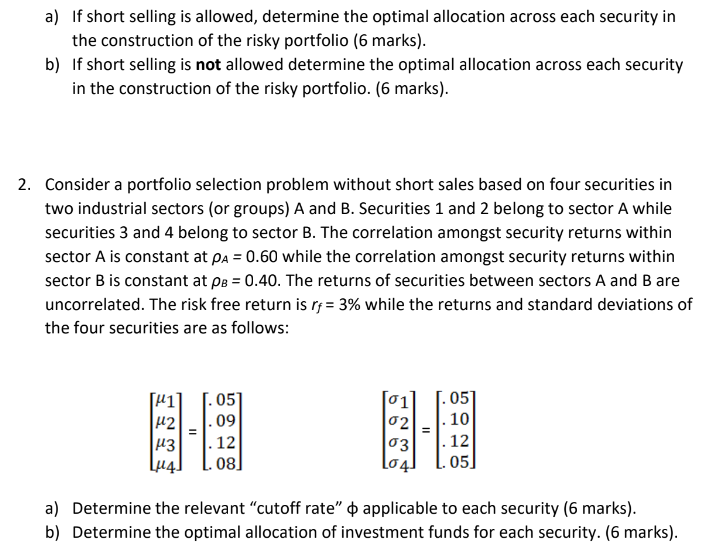

1. Consider a portfolio optimization problem without short selling for n=3 risky securities with correlations, 12=0.10,13=0.20, and 23=0.25. Following Markowitz's critical line method, the problem can be solved as MAX:S.T.i=1nxii+i=1nj=1nxixjiji=1nxi=1xi0 Expected returns and standard deviations are given by 123=0.100.200.12123=0.200.180.16 For this portfolio problem, the efficient frontier can be constructed in a small number of steps. Note is being used here in place of the as per the lecture notes. Some partial results are as follows: Step 1: s1=0.05760+0.10000s2=a2+b2s3=0.05040+0.08000 Step 2: s1=0.02523+0.04862s2=0.42202+0.91743s3=a3+b3 Step 3: s1=a1+b1s2=0.32642+1.10166s3=0.406390.58677 where si is either xi or i (a slack variable) depending on whether the security is included in or excluded from the portfolio. Note that the conditions xi0,i0, and xii0 must be satisfied a) Fill in the 6 missing numbers represented by, ai, and bi for i=1,2,3. Indicate whether each si is a xi or a i. (6 marks). b) Identify all critical values of . Between two adjacent critical 's (including =0 ), indicate which of the three securities are included in the portfolios along the efficient frontier. (6 marks) 1. Consider an eight security universe with a constant correlation across all eight securities of =0.50. The return of the risk free security is rf=2%. The returns and standard deviations for the eight securities are as follows: 12345678=0.160.140.140.110.110.100.100.0612345678=0.100.100.080.100.050.080.050.08 a) If short selling is allowed, determine the optimal allocation across each security in the construction of the risky portfolio ( 6 marks). b) If short selling is not allowed determine the optimal allocation across each security in the construction of the risky portfolio. (6 marks). Consider a portfolio selection problem without short sales based on four securities in two industrial sectors (or groups) A and B. Securities 1 and 2 belong to sector A while securities 3 and 4 belong to sector B. The correlation amongst security returns within sector A is constant at A=0.60 while the correlation amongst security returns within sector B is constant at B=0.40. The returns of securities between sectors A and B are uncorrelated. The risk free return is rf=3% while the returns and standard deviations of the four securities are as follows: 1234=.05.09.12081234=.05101205 a) Determine the relevant "cutoff rate" applicable to each security (6 marks). b) Determine the optimal allocation of investment funds for each security. (6 marks)

1. Consider a portfolio optimization problem without short selling for n=3 risky securities with correlations, 12=0.10,13=0.20, and 23=0.25. Following Markowitz's critical line method, the problem can be solved as MAX:S.T.i=1nxii+i=1nj=1nxixjiji=1nxi=1xi0 Expected returns and standard deviations are given by 123=0.100.200.12123=0.200.180.16 For this portfolio problem, the efficient frontier can be constructed in a small number of steps. Note is being used here in place of the as per the lecture notes. Some partial results are as follows: Step 1: s1=0.05760+0.10000s2=a2+b2s3=0.05040+0.08000 Step 2: s1=0.02523+0.04862s2=0.42202+0.91743s3=a3+b3 Step 3: s1=a1+b1s2=0.32642+1.10166s3=0.406390.58677 where si is either xi or i (a slack variable) depending on whether the security is included in or excluded from the portfolio. Note that the conditions xi0,i0, and xii0 must be satisfied a) Fill in the 6 missing numbers represented by, ai, and bi for i=1,2,3. Indicate whether each si is a xi or a i. (6 marks). b) Identify all critical values of . Between two adjacent critical 's (including =0 ), indicate which of the three securities are included in the portfolios along the efficient frontier. (6 marks) 1. Consider an eight security universe with a constant correlation across all eight securities of =0.50. The return of the risk free security is rf=2%. The returns and standard deviations for the eight securities are as follows: 12345678=0.160.140.140.110.110.100.100.0612345678=0.100.100.080.100.050.080.050.08 a) If short selling is allowed, determine the optimal allocation across each security in the construction of the risky portfolio ( 6 marks). b) If short selling is not allowed determine the optimal allocation across each security in the construction of the risky portfolio. (6 marks). Consider a portfolio selection problem without short sales based on four securities in two industrial sectors (or groups) A and B. Securities 1 and 2 belong to sector A while securities 3 and 4 belong to sector B. The correlation amongst security returns within sector A is constant at A=0.60 while the correlation amongst security returns within sector B is constant at B=0.40. The returns of securities between sectors A and B are uncorrelated. The risk free return is rf=3% while the returns and standard deviations of the four securities are as follows: 1234=.05.09.12081234=.05101205 a) Determine the relevant "cutoff rate" applicable to each security (6 marks). b) Determine the optimal allocation of investment funds for each security. (6 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started