Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Consider the following data for Company Y: Balance Sheet Balance Sheet as of: Currency ASSETS Cash and Equivalents Total Cash & ST Investments

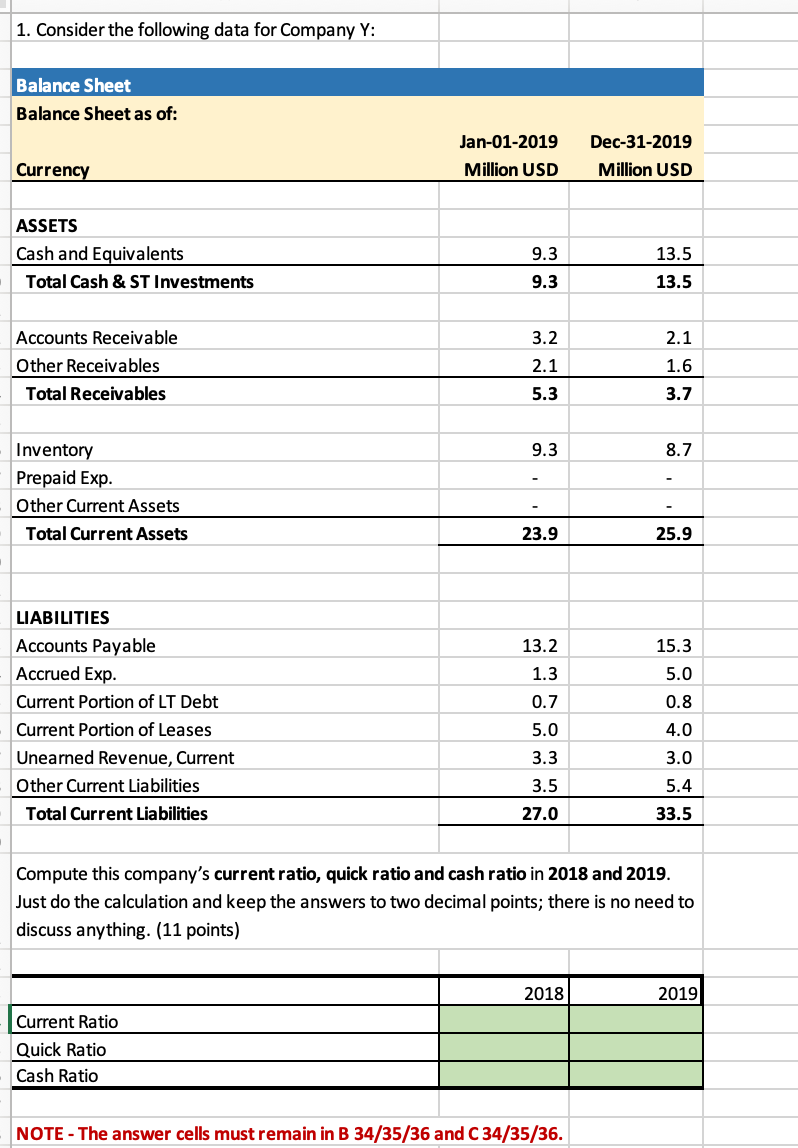

1. Consider the following data for Company Y: Balance Sheet Balance Sheet as of: Currency ASSETS Cash and Equivalents Total Cash & ST Investments Accounts Receivable Other Receivables Total Receivables Inventory Prepaid Exp. Other Current Assets Total Current Assets Jan-01-2019 Million USD Dec-31-2019 Million USD 9.3 13.5 9.3 13.5 3.2 2.1 2.1 1.6 5.3 3.7 9.3 - 8.7 - 23.9 25.9 LIABILITIES Accounts Payable 13.2 15.3 Accrued Exp. 1.3 5.0 Current Portion of LT Debt 0.7 0.8 Current Portion of Leases 5.0 4.0 Unearned Revenue, Current 3.3 3.0 Other Current Liabilities 3.5 5.4 Total Current Liabilities 27.0 33.5 Compute this company's current ratio, quick ratio and cash ratio in 2018 and 2019. Just do the calculation and keep the answers to two decimal points; there is no need to discuss anything. (11 points) Current Ratio Quick Ratio Cash Ratio 2018 2019 NOTE - The answer cells must remain in B 34/35/36 and C 34/35/36.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the current ratio quick ratio and cash ratio for Company Y in 201...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started