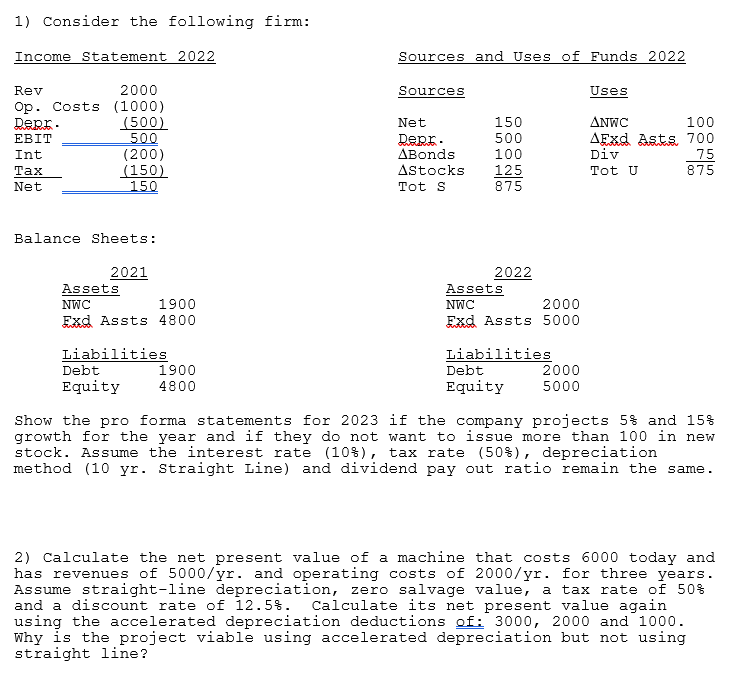

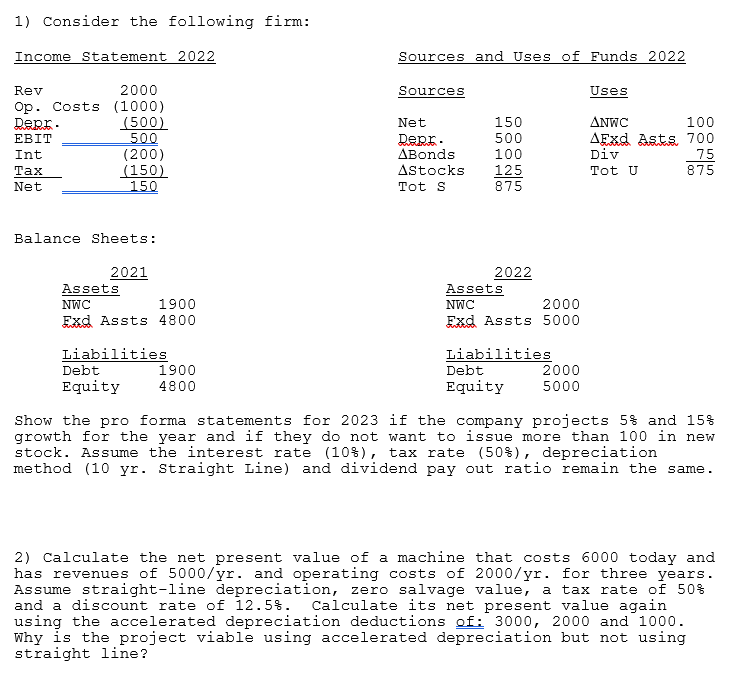

1) Consider the following firm: Income Statement 2022 Sources and Uses of Funds 2022 Sources Uses Rev 2000 Op. Costs (1000) Dept. (500) EBIT 500 Int (200) Tax (150) Net 150 Net Dept. ABonds AStocks Tot s 150 500 100 125 875 ANWC 100 AExd Asts. 700 Div 75 Tot U 875 Balance Sheets: 2021 Assets NWC 1900 Exd Assts 4800 2022 Assets NWC 2000 Exd Assts 5000 Liabilities Debt 1900 Equity 4800 Liabilities Debt 2000 Equity 5000 Show the pro forma statements for 2023 if the company projects 5% and 15% growth for the year and if they do not want to issue more than 100 in stock. Assume the interest rate (10%), tax rate (50%), depreciation method (10 yr. Straight Line) and dividend pay out ratio remain the same. 2) Calculate the net present value of a machine that costs 6000 today and has revenues of 5000/yr. and operating costs of 2000/yr. for three years. Assume straight-line depreciation, zero salvage value, a tax rate of 50% and a discount rate of 12.5%. Calculate its net present value again using the accelerated depreciation deductions of: 3000, 2000 and 1000. Why is the project viable using accelerated depreciation but not using straight line? 1) Consider the following firm: Income Statement 2022 Sources and Uses of Funds 2022 Sources Uses Rev 2000 Op. Costs (1000) Dept. (500) EBIT 500 Int (200) Tax (150) Net 150 Net Dept. ABonds AStocks Tot s 150 500 100 125 875 ANWC 100 AExd Asts. 700 Div 75 Tot U 875 Balance Sheets: 2021 Assets NWC 1900 Exd Assts 4800 2022 Assets NWC 2000 Exd Assts 5000 Liabilities Debt 1900 Equity 4800 Liabilities Debt 2000 Equity 5000 Show the pro forma statements for 2023 if the company projects 5% and 15% growth for the year and if they do not want to issue more than 100 in stock. Assume the interest rate (10%), tax rate (50%), depreciation method (10 yr. Straight Line) and dividend pay out ratio remain the same. 2) Calculate the net present value of a machine that costs 6000 today and has revenues of 5000/yr. and operating costs of 2000/yr. for three years. Assume straight-line depreciation, zero salvage value, a tax rate of 50% and a discount rate of 12.5%. Calculate its net present value again using the accelerated depreciation deductions of: 3000, 2000 and 1000. Why is the project viable using accelerated depreciation but not using straight line