Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Consider the following technology: C() = 4+10% +7. Many firms have access to this technology, in fact so many that there is not

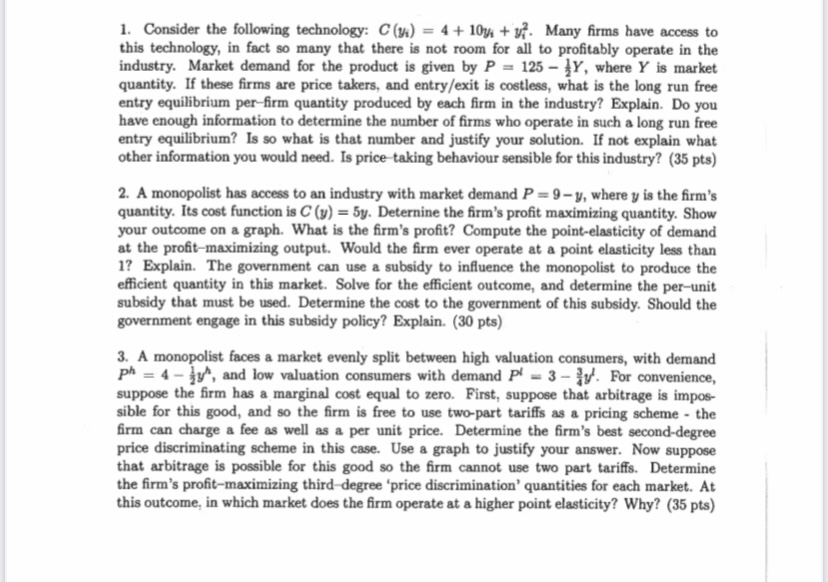

1. Consider the following technology: C() = 4+10% +7. Many firms have access to this technology, in fact so many that there is not room for all to profitably operate in the industry. Market demand for the product is given by P=125-Y, where Y is market quantity. If these firms are price takers, and entry/exit is costless, what is the long run free entry equilibrium per-firm quantity produced by each firm in the industry? Explain. Do you have enough information to determine the number of firms who operate in such a long run free entry equilibrium? Is so what is that number and justify your solution. If not explain what other information you would need. Is price taking behaviour sensible for this industry? (35 pts) 2. A monopolist has access to an industry with market demand P=9-y, where y is the firm's quantity. Its cost function is C (y) = 5y. Determine the firm's profit maximizing quantity. Show your outcome on a graph. What is the firm's profit? Compute the point-elasticity of demand at the profit-maximizing output. Would the firm ever operate at a point elasticity less than 1? Explain. The government can use a subsidy to influence the monopolist to produce the efficient quantity in this market. Solve for the efficient outcome, and determine the per-unit subsidy that must be used. Determine the cost to the government of this subsidy. Should the government engage in this subsidy policy? Explain. (30 pts) 3. A monopolist faces a market evenly split between high valuation consumers, with demand ph 4-, and low valuation consumers with demand P-3-. For convenience, suppose the firm has a marginal cost equal to zero. First, suppose that arbitrage is impos- sible for this good, and so the firm is free to use two-part tariffs as a pricing scheme - the firm can charge a fee as well as a per unit price. Determine the firm's best second-degree price discriminating scheme in this case. Use a graph to justify your answer. Now suppose that arbitrage is possible for this good so the firm cannot use two part tariffs. Determine the firm's profit-maximizing third-degree 'price discrimination' quantities for each market. At this outcome, in which market does the firm operate at a higher point elasticity? Why? (35 pts)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started