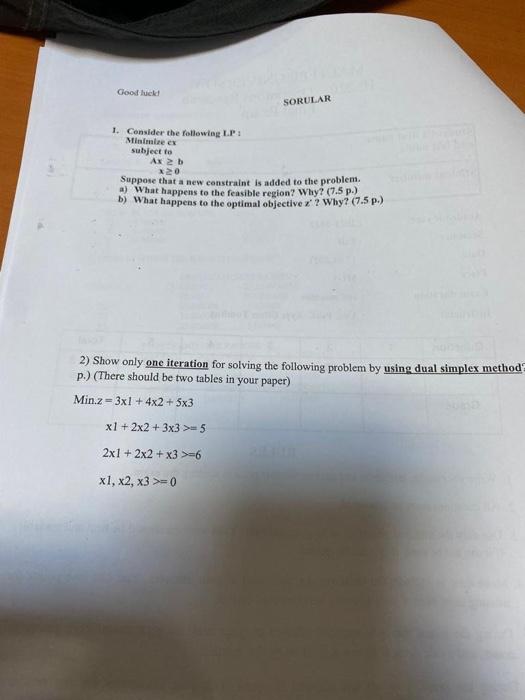

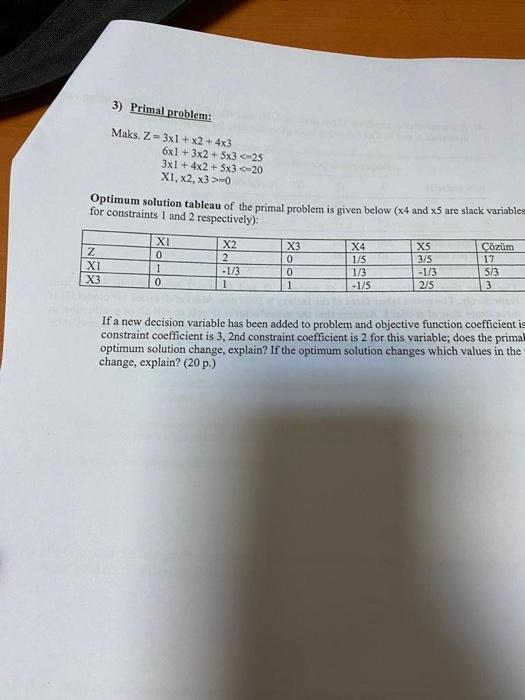

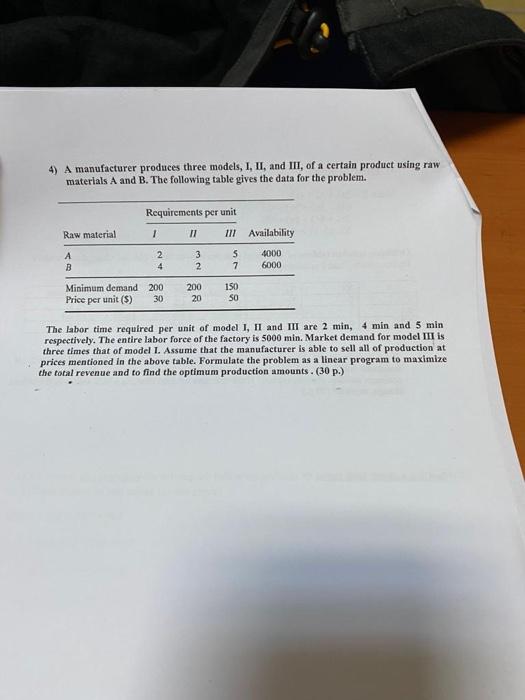

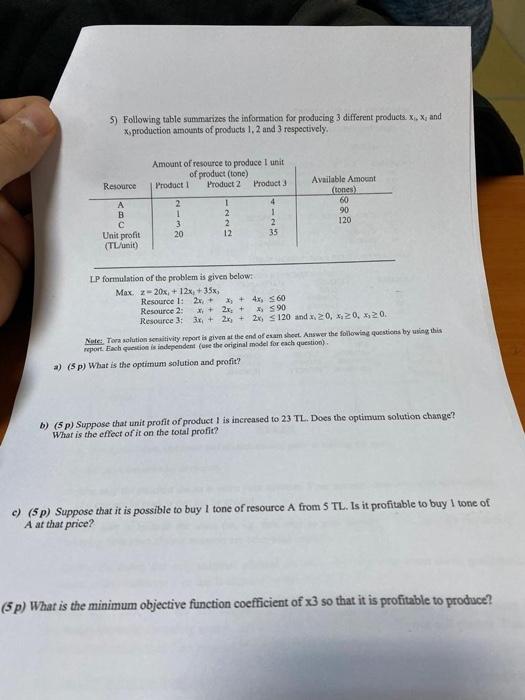

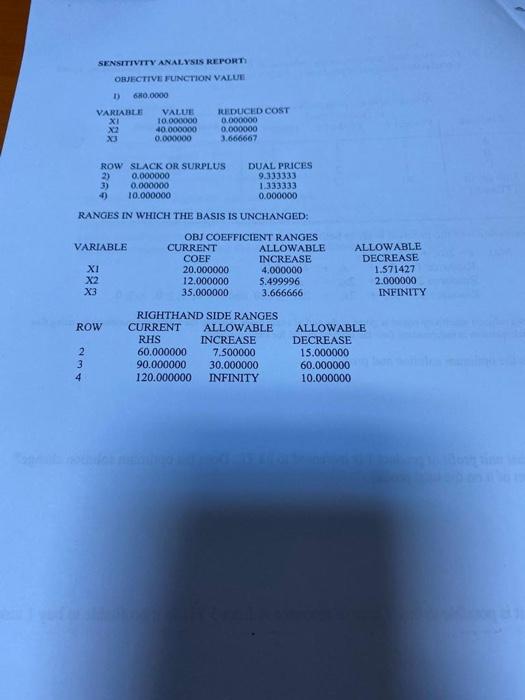

1. Consider the followiog I.F. I Milifialee ex subject to Axbx0 Suppose that a new constraint is added to the problem. a) What happens to the feasible region? Why? (7.5 p.) b) What happens to the optimal objective x; 2 Why? (7.5 p.) 2) Show only one iteration for solving the following problem by using dual simplex method p.) (There should be two tables in your paper) Min.2=31+42+53x1+22+33>=521+22+3>=61,2,3>=0 3) Primal problem: Maks.Z=31+2+4361+32+53=0 Optimum solution tableau of the primal problem is given below ( 4 and 5 are slack variables for constraints 1 and 2 respectively): If a new decision variable has been added to problem and objective function coefficient is constraint coefficient is 3,2 nd constraint coefficient is 2 for this variable; does the primal optimum solution change, explain? If the optimum solution changes which values in the change, explain? (20 p.) 4) A manufacturer produces three models, I, II, and III, of a certain product using raw materials A and B. The following table gives the data for the problem. The labor time required per unit of model I, II and III are 2min,4min and 5min respectively. The entire labor force of the factory is 5000min. Market demand for model III is three times that of model I. Assume that the manufacturer is able to sell all of production at prices mentioned in the above table. Formulate the problem as a linear program to maximize the total revenue and to find the optimum production amounts . ( 30 p.) 5) Following table summarizes the information for producing 3 different products x1,x1 and x, production amounts of products 1,2 and 3 respoctively. IP formulation of the problem is given belowr- Max.Resource1:2x1+x1+4x160Resource2:xi+2x2+x390Resoarce3:3x1+2x1+2x1120andx10,x20,x10.z=20x1+12xi+35x3 Note: Tonn wolution sonitivity mport in given at the end of eaun soet. Answar the foliowing questions by using this repor:- Each quevion is iedrependemt (ere the original model for each question), a) (S p) What is the optimum solution and profit? b) (5 p) Suppose that unit profit of product 1 is increased to 23 TL. Does the optimum solution change? What is the effect of it on the total profit? c) (5 p) Suppose that it is possible to buy 1 tone of resource A from 5 TL. Is it profitable to buy I tone of A at that price? 5 5 ) What is the minimum objective function cocfficient of x3 so that it is profitable to produce? SENBTTIVTTY ANALNSIS RERORT OBJETIVI JUNCTION VALUI RANGES IN WHICH THE BASIS IS UNCHANGED