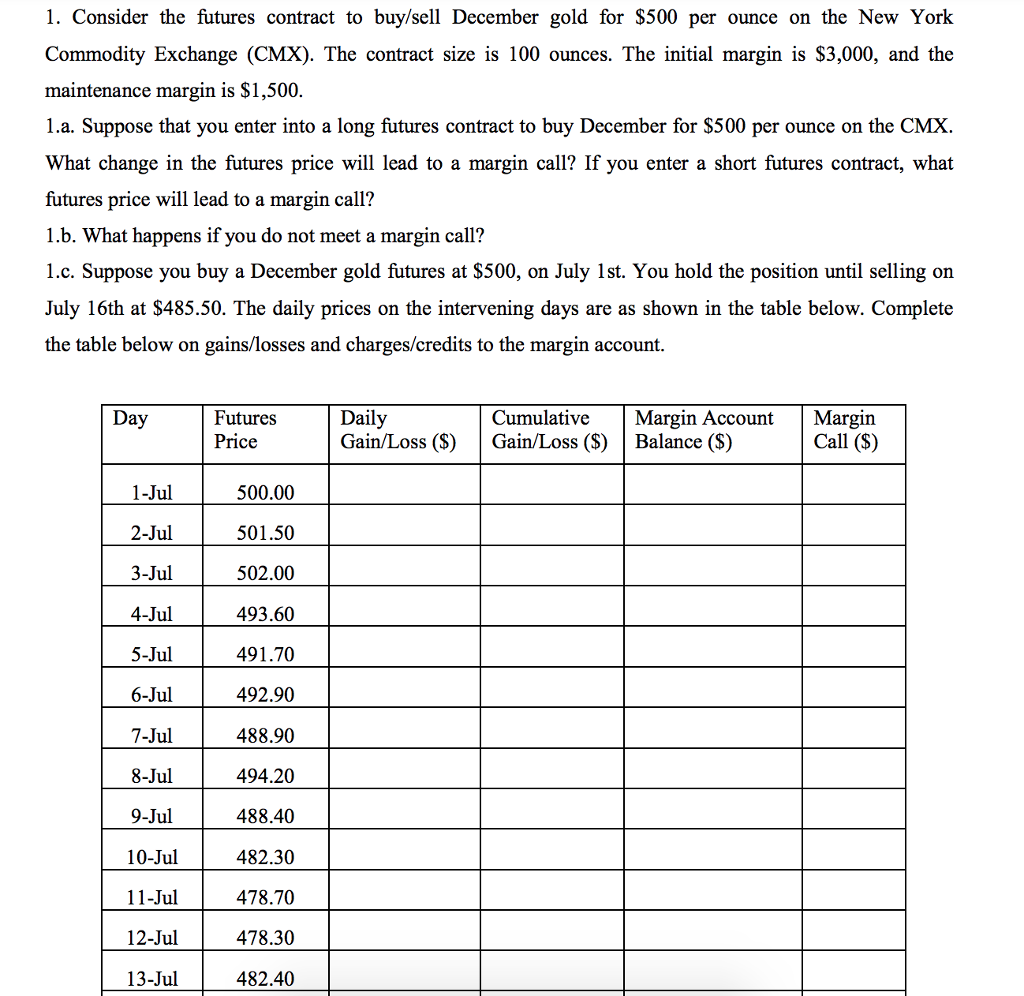

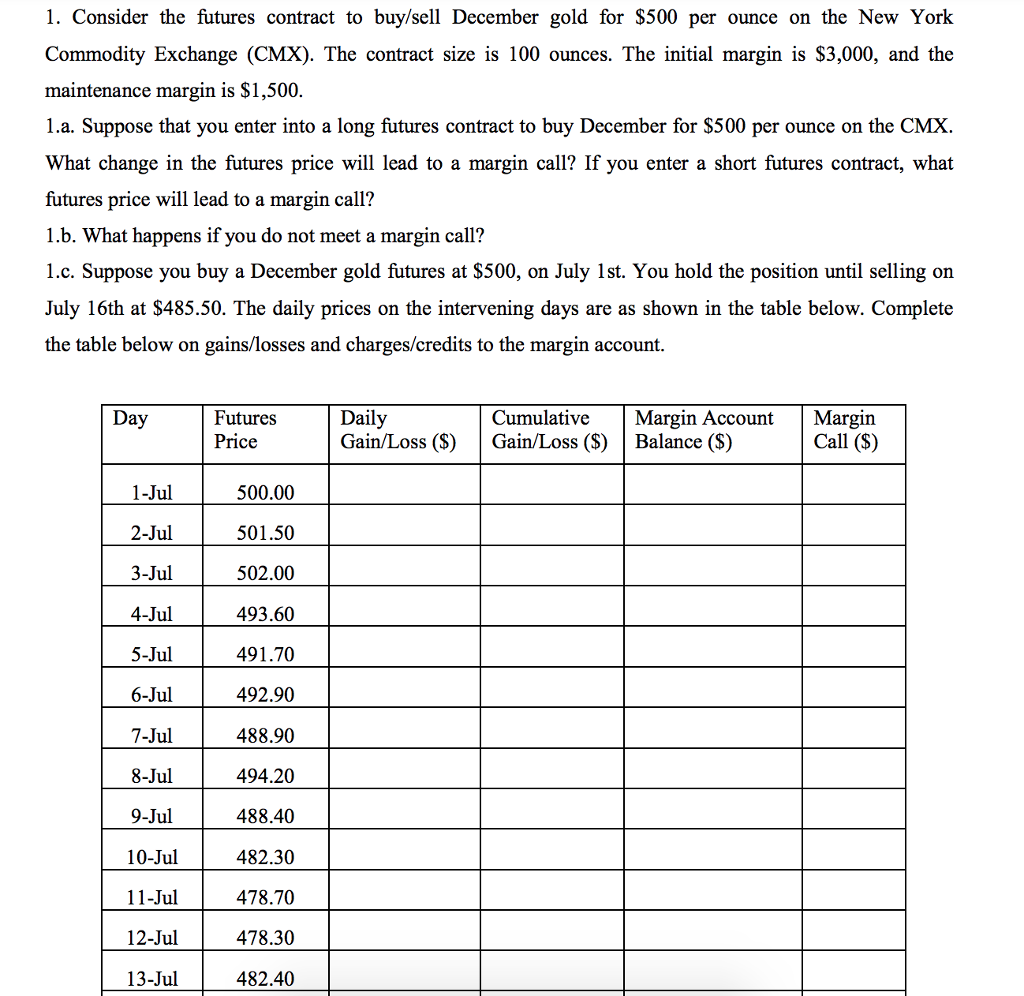

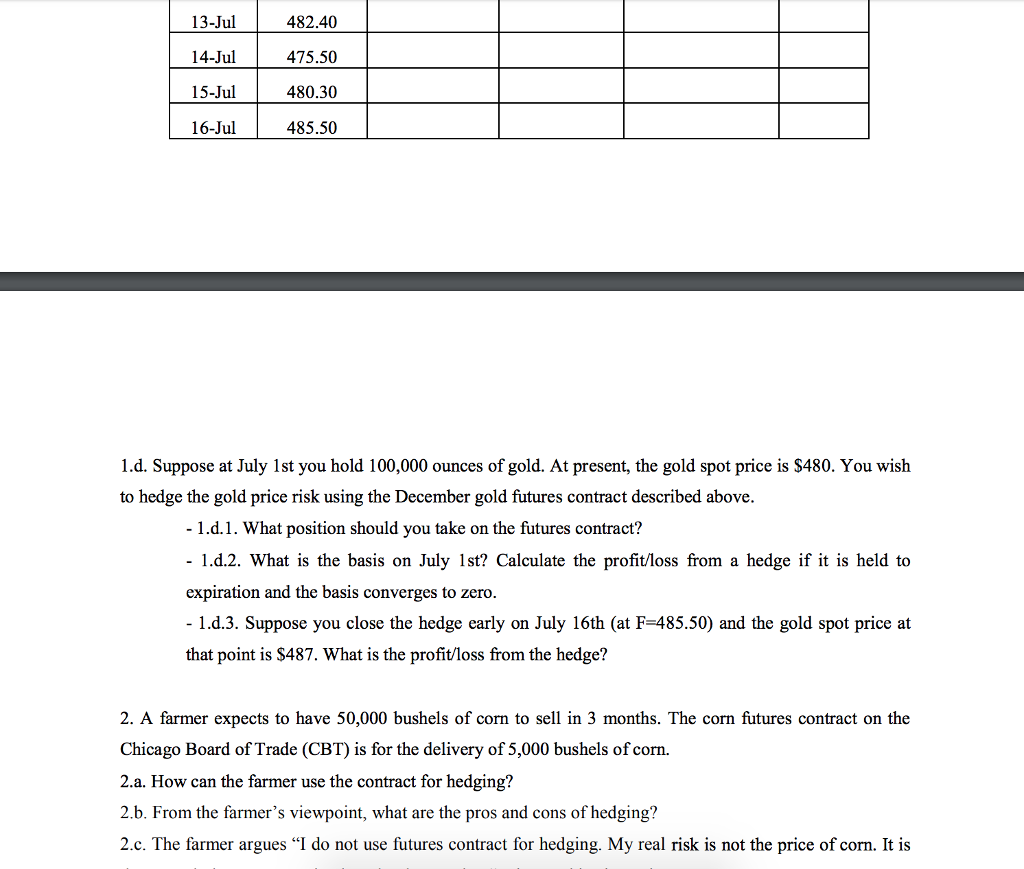

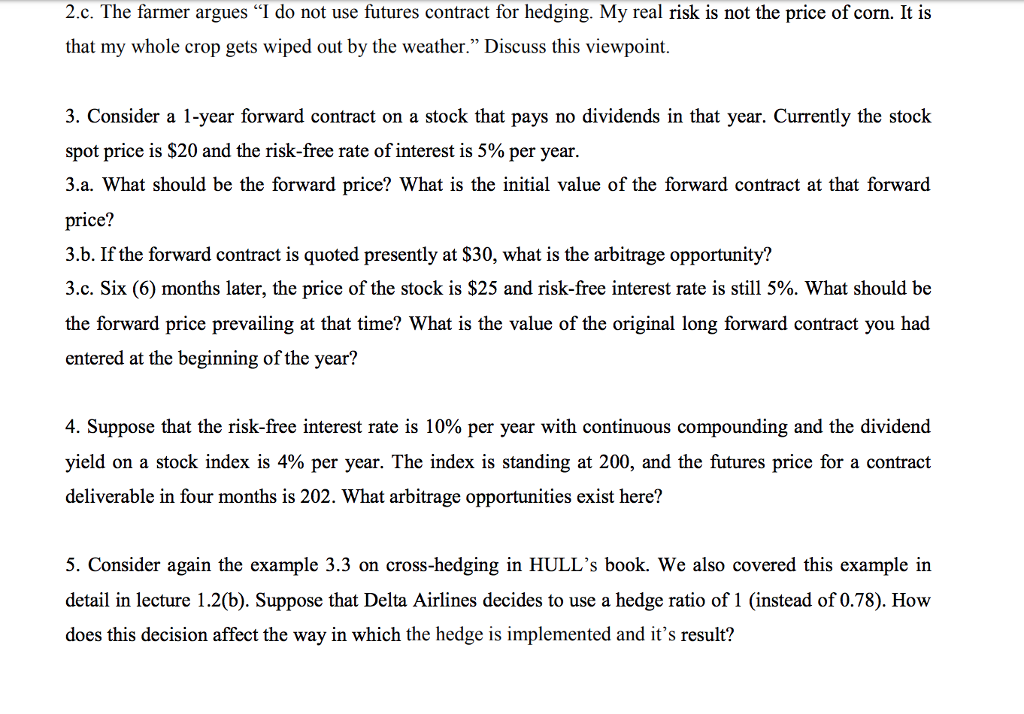

1. Consider the futures contract to buy/sell December gold for $500 per ounce on the New York Commodity Exchange (CMX). The contract size is 100 ounces. The initial margin is S3,000, and the maintenance margin is $1,500. 1.a. Suppose that you enter into a long futures contract to buy December for $500 per ounce on the CMX What change in the futures price will lead to a margin call? If you enter a short futures contract, what futures price will lead to a margin call? 1.b. What happens if you do not meet a margin call? 1.c. Suppose you buy a December gold futures at $500, on July 1st. You hold the position until selling on July 16th at $485.50. The daily prices on the intervening days are as shown in the table below. Complete the table below on gains/losses and charges/credits to the margin account. Daily Gain/Loss (S) Gain/Loss () Balance (S) Cumulative Margin Acco unt Margin Call (S) Day Futures Price 1-Jul 2-Jul 3-Jul 4-Jul 5-Jul 6-Jul 7-Jul 8-Jul 9-Jul 10-Jul 11-Jul 12-Jul 13-Jul 500.00 501.50 502.00 493.60 491.70 492.90 488.90 494.20 488.40 482.30 478.70 478.30 482.40 13-Jul 482.40 14-Jul 475.50 480.30 15-J 80 30 16-Jul 485.50 1.d. Suppose at July 1st you hold 100,000 ounces of gold. At present, the gold spot price is $480. You wish to hedge the gold price risk using the December gold futures contract described above. 1.d.1. What position should you take on the futures contract? I.d.2. What is the basis on July 1st? Calculate the profitloss from a hedge if it is held to expiration and the basis converges to zero. 1.d.3. Suppose you close the hedge early on July 16th (at F-485.50) and the gold spot price at that point is $487. What is the profit/loss from the hedge? 2. A farmer expects to have 50,000 bushels of corn to sell in 3 months. The corn futures contract on the Chicago Board of Trade (CBT) is for the delivery of 5,000 bushels of corn 2.a. How can the farmer use the contract for hedging? 2.b. From the farmer's viewpoint, what are the pros and cons of hedging? 2.c. The farmer argues "I do not use futures contract for hedging. My real risk is not the price of corn. It is 2.c. The farmer argues "I do not use futures contract for hedging. My real risk is not the price of corn. It is that my whole crop gets wiped out by the weather." Discuss this viewpoint. 3. Consider a 1-year forward contract on a stock that pays no dividends in that year. Currently the stock spot price is $20 and the risk-free rate of interest is 5% per year. 3.a. What should be the forward price? What is the initial value of the forward contract at that forward price? 3.b. If the forward contract is quoted presently at S30, what is the arbitrage opportunity? 3.c. Six (6) months later, the price of the stock is $25 and risk-free interest rate is still 5%. What should be the forward price prevailing at that time? What is the value of the original long forward contract you had entered at the beginning of the year? 4. Suppose that the risk-free interest rate is 10% per year with continuous compounding and the dividend yield on a stock index is 4% per year. The index is standing at 200, and the futures price for a contract deliverable in four months is 202. What arbitrage opportunities exist here? 5. Consider again the example 3.3 on cross-hedging in HULL's book. We also covered this example in detail in lecture 1.2(b). Suppose that Delta Airlines decides to use a hedge ratio of 1 (instead of 0.78). Hovw does this decision affect the way in which the hedge is implemented and it's result