Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Consider the futures contract to buy/sell December gold for $500 per ounce on the New York Commodity Exchange (CMX). The contract size is

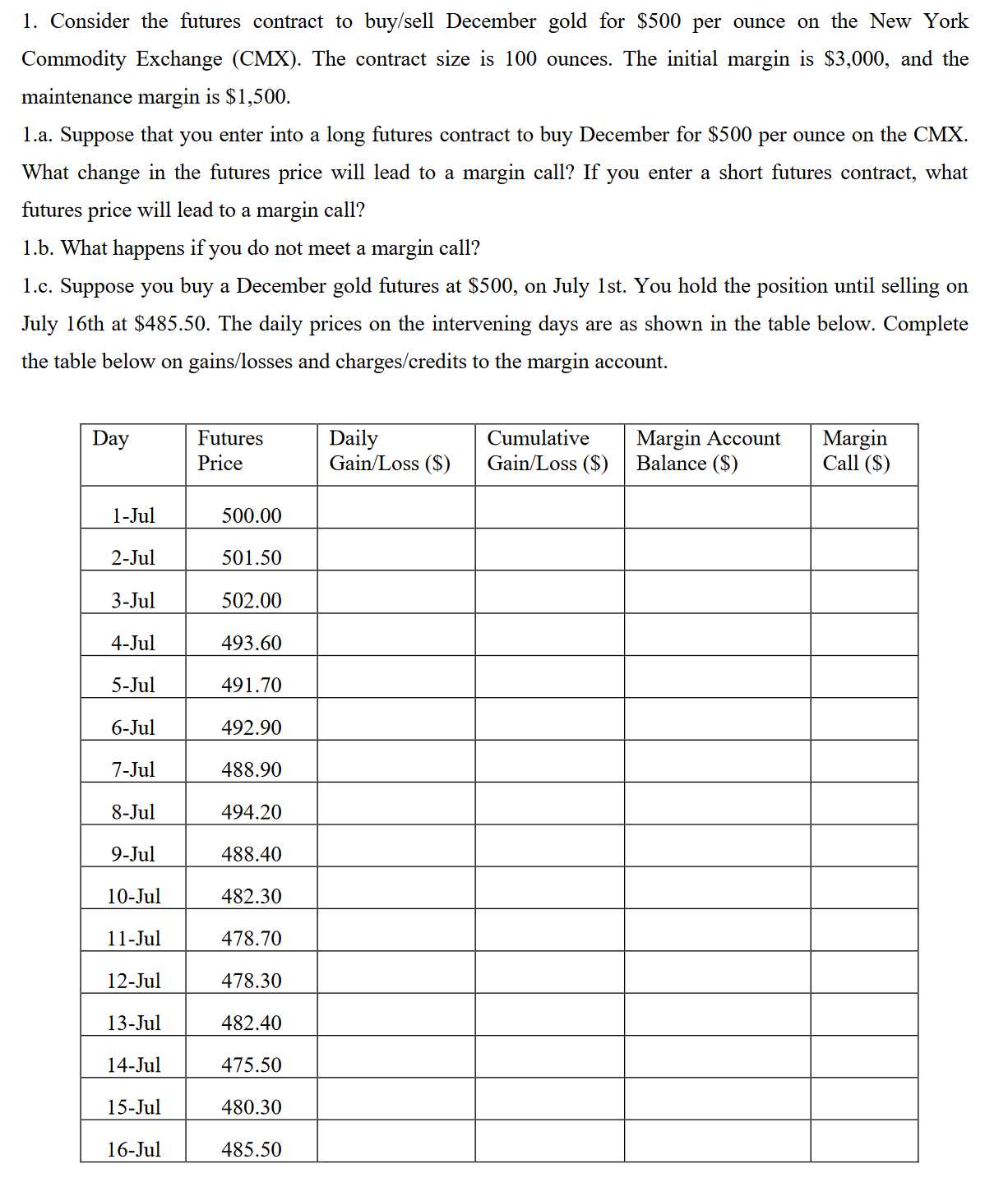

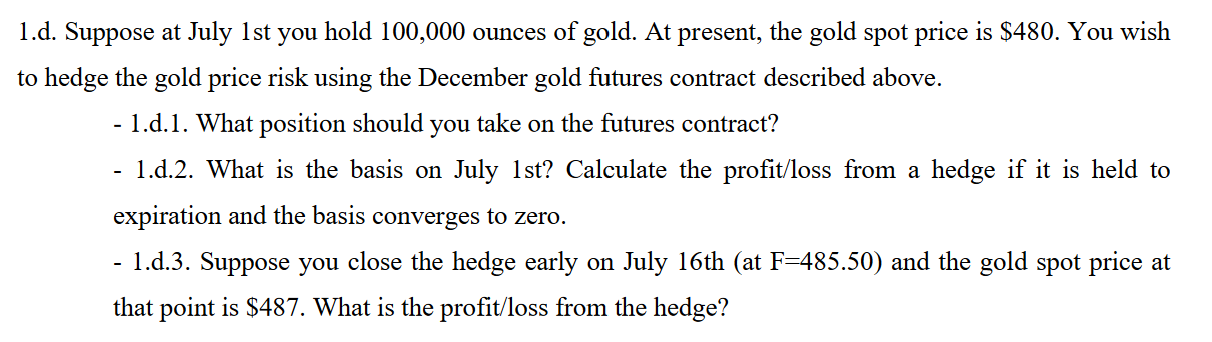

1. Consider the futures contract to buy/sell December gold for $500 per ounce on the New York Commodity Exchange (CMX). The contract size is 100 ounces. The initial margin is $3,000, and the maintenance margin is $1,500. 1.a. Suppose that you enter into a long futures contract to buy December for $500 per ounce on the CMX. What change in the futures price will lead to a margin call? If you enter a short futures contract, what futures price will lead to a margin call? 1.b. What happens if you do not meet a margin call? 1.c. Suppose you buy a December gold futures at $500, on July 1st. You hold the position until selling on July 16th at $485.50. The daily prices on the intervening days are as shown in the table below. Complete the table below on gains/losses and charges/credits to the margin account. Day 1-Jul 2-Jul 3-Jul 4-Jul 5-Jul 6-Jul 7-Jul 8-Jul 9-Jul 10-Jul 11-Jul 12-Jul 13-Jul 14-Jul 15-Jul 16-Jul Futures Price 500.00 501.50 502.00 493.60 491.70 492.90 488.90 494.20 488.40 482.30 478.70 478.30 482.40 475.50 480.30 485.50 Daily Gain/Loss ($) Cumulative Gain/Loss ($) Margin Account Balance ($) Margin Call ($) 1.d. Suppose at July 1st you hold 100,000 ounces of gold. At present, the gold spot price is $480. You wish to hedge the gold price risk using the December gold futures contract described above. - 1.d.1. What position should you take on the futures contract? 1.d.2. What is the basis on July 1st? Calculate the profit/loss from a hedge if it is held to expiration and the basis converges to zero. 1.d.3. Suppose you close the hedge early on July 16th (at F=485.50) and the gold spot price at that point is $487. What is the profit/loss from the hedge?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets break down the questions step by step 1 Margin Call Scenarios 1a To calculate the change in futures price that will lead to a margin call For a l...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started