Question

1. Consider the journal entry required using the Cost of Goods Sold Method assuming the use of the perpetual system. Determine the impact on net

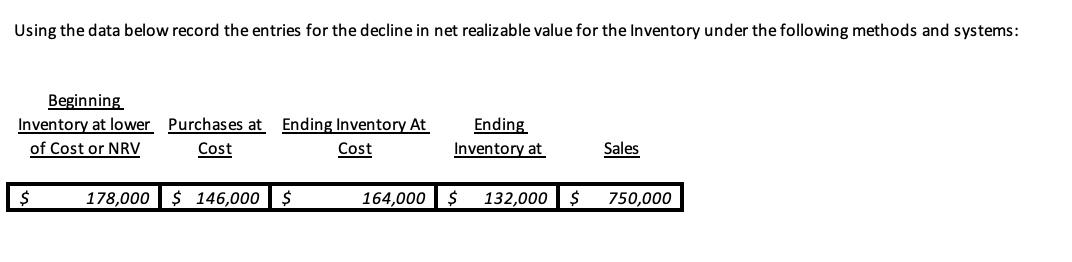

1. Consider the journal entry required using the Cost of Goods Sold Method assuming the use of the perpetual system. Determine the impact on net income. If net income increases input the number. If net income decreases input the number with a minus in front such as -100. If no impact on net income input the number "0".

2. Assume that the company records the adjustment of lower of cost or net realizable value using the Cost of Goods Sold Method. Also, assume the company used the perpetual inventory system. Calculate the Cost of Goods Sold.

3. Assume that the company records the adjustment for lower of cost or net realizable value using the Loss Method. Also, assume the company uses the periodic inventory system. The journal entry required to properly state Cost of Goods Sold is a debit to loss on write down inventory and a credit to what account?

Using the data below record the entries for the decline in net realizable value for the Inventory under the following methods and systems: Beginning Inventory at lower of Cost or NRV $ Purchases at Ending Inventory At Cost Cost 178,000 $ 146,000 S 164,000 Ending Inventory at $ 132,000 $ Sales 750,000

Step by Step Solution

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Using the Cost of Goods Sold Method and the perpetual system the journal entry required to record th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started