Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Considering only the levels of debt discussed, what is the capital structure that minimizes GSs WACC? 2. What would be the new stock price

1. Considering only the levels of debt discussed, what is the capital structure that minimizes GSs WACC?

1. Considering only the levels of debt discussed, what is the capital structure that minimizes GSs WACC?

2. What would be the new stock price if GS recapitalizes with $250,000 of debt? $500,000? $750,000?$ 1,000,000? Recall that the payout ratio is 100%, so g = 0.

3. Is EPS maximized at the debt level that maximizes share price? Why or why not?

4. Considering only the levels of debt discussed, what is GSs optimal capital structure?

5. What is the WACC at the optimal capital structure?

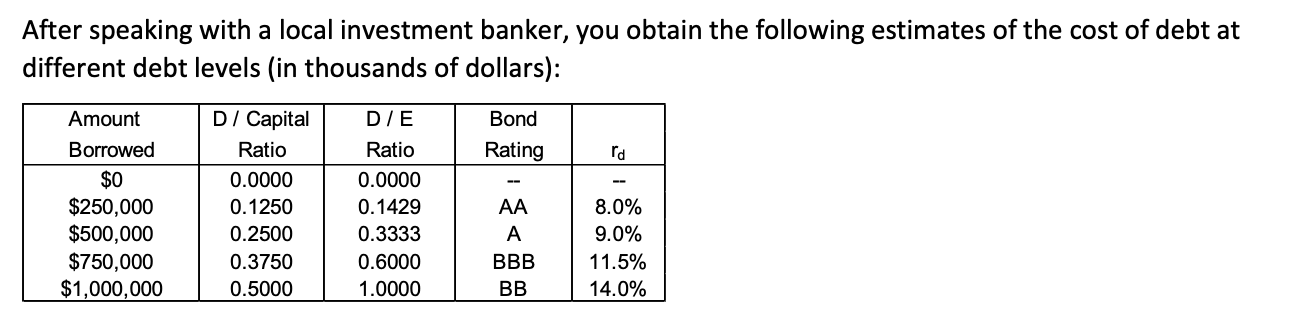

After speaking with a local investment banker, you obtain the following estimates of the cost of debt at different debt levels in thousands of dollars): Bond Rating rd Amount Borrowed $0 $250,000 $500,000 $750,000 $1,000,000 D/ Capital Ratio 0.0000 0.1250 0.2500 0.3750 0.5000 DE Ratio 0.0000 0.1429 0.3333 0.6000 1.0000 AA BBB BB 8.0% 9.0% 11.5% 14.0% After speaking with a local investment banker, you obtain the following estimates of the cost of debt at different debt levels in thousands of dollars): Bond Rating rd Amount Borrowed $0 $250,000 $500,000 $750,000 $1,000,000 D/ Capital Ratio 0.0000 0.1250 0.2500 0.3750 0.5000 DE Ratio 0.0000 0.1429 0.3333 0.6000 1.0000 AA BBB BB 8.0% 9.0% 11.5% 14.0%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started