Answered step by step

Verified Expert Solution

Question

1 Approved Answer

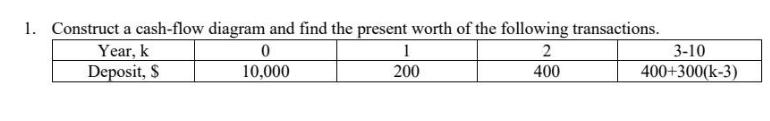

1. Construct a cash-flow diagram and find the present worth of the following transactions. Year, k Deposit, $ 0 10,000 1 200 2 400

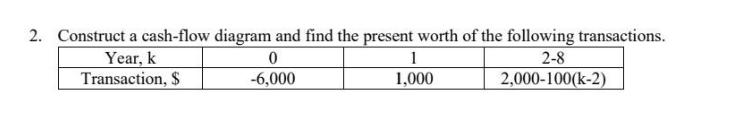

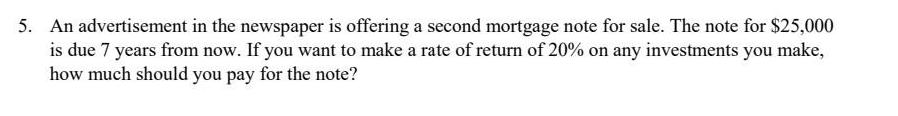

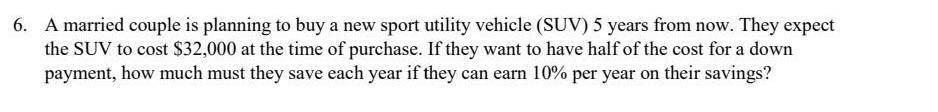

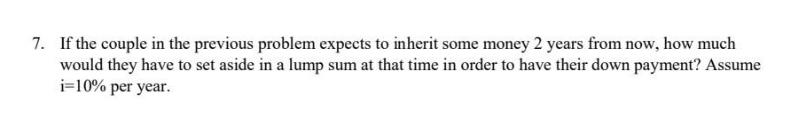

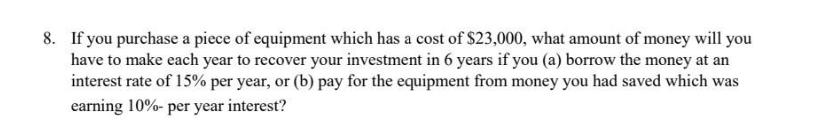

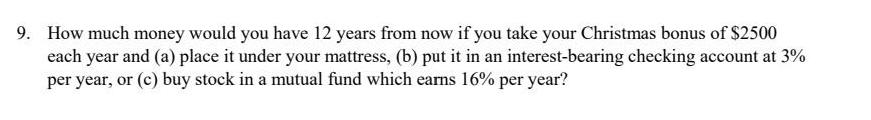

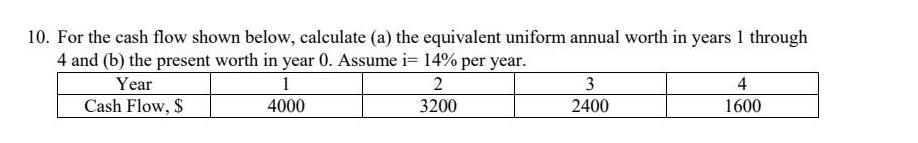

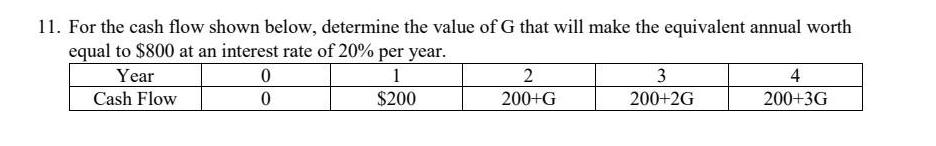

1. Construct a cash-flow diagram and find the present worth of the following transactions. Year, k Deposit, $ 0 10,000 1 200 2 400 3-10 400+300(k-3) 2. Construct a cash-flow diagram and find the present worth of the following transactions. Year, k 2-8 Transaction, $ 2,000-100(k-2) 0 -6,000 1 1,000 5. An advertisement in the newspaper is offering a second mortgage note for sale. The note for $25,000 is due 7 years from now. If you want to make a rate of return of 20% on any investments you make, how much should you pay for the note? 6. A married couple is planning to buy a new sport utility vehicle (SUV) 5 years from now. They expect the SUV to cost $32,000 at the time of purchase. If they want to have half of the cost for a down payment, how much must they save each year if they can earn 10% per year on their savings? 7. If the couple in the previous problem expects to inherit some money 2 years from now, how much would they have to set aside in a lump sum at that time in order to have their down payment? Assume i=10% per year. 8. If you purchase a piece of equipment which has a cost of $23,000, what amount of money will you have to make each year to recover your investment in 6 years if you (a) borrow the money at an interest rate of 15% per year, or (b) pay for the equipment from money you had saved which was earning 10%- per year interest? 9. How much money would you have 12 years from now if you take your Christmas bonus of $2500 each year and (a) place it under your mattress, (b) put it in an interest-bearing checking account at 3% per year, or (c) buy stock in a mutual fund which earns 16% per year? 10. For the cash flow shown below, calculate (a) the equivalent uniform annual worth in years 1 through 4 and (b) the present worth in year 0. Assume i= 14% per year. Year 1 2 Cash Flow, $ 4000 3200 3 2400 4 1600 11. For the cash flow shown below, determine the value of G that will make the equivalent annual worth equal to $800 at an interest rate of 20% per year. Year 1 Cash Flow $200 0 0 2 200+G 3 200+2G 4 200+3G

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To construct a cashflow diagram we can represent the cash inflows and outflows at different time per...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started