Question

1. Construct a collar using out-of-the-money June options. What is the maximum profit? What is maximum loss? What is the breakeven stock price? 2. Using

1. Construct a collar using out-of-the-money June options. What is the maximum profit? What is maximum loss? What is the breakeven stock price?

2. Using the March 45 options, determine if there is an arbitrage opportunity, and if so, describe the strategy to use to take advantage of it.

3. Each of the following is a hedging strategy except a. box spread b. a protective put c. covered call d. collar e. None of the above

A bull spread using call options is a credit spread". This statement is:" a. TRUE because the call option at the lower strike price is worth more than the call option at the higher strike price b. TRUE because the call option at the higher strike price is worth more than the call option at the lower strike price c. FALSE because the call option at the lower strike price is worth more than the call option at the higher strike price d. FALSE because the call option at the higher strike price is worth more than the call option at the lower strike price e. None of the above

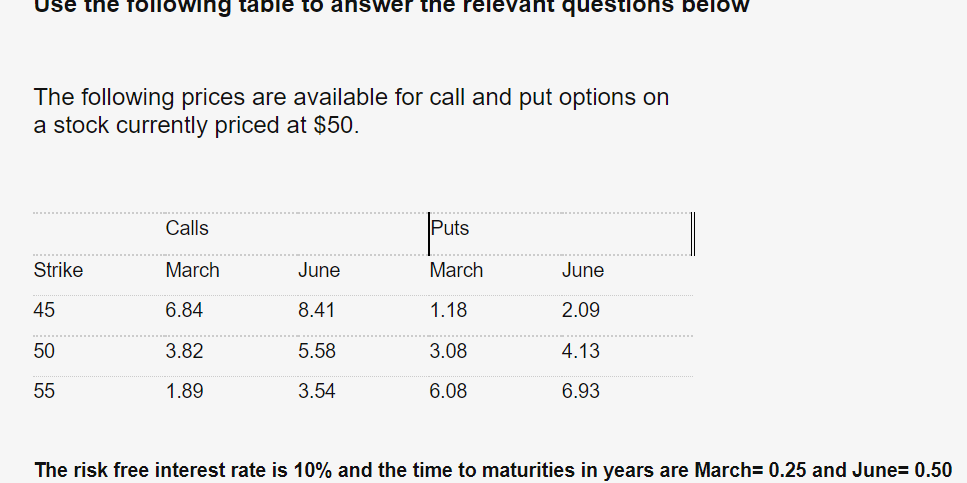

Use the following table to answer the relevant question below The following prices are available for call and put options on a stock currently priced at $50. Calls puts Strike March June March June 45 6.84 8.41 1.18 2.09 50 3.82 5.58 3.08 4.13 55 1.89 3.54 6.08 6.93 The risk free interest rate is 10% and the time to maturities in years are March= 0.25 and June= 0.50 Use the following table to answer the relevant question below The following prices are available for call and put options on a stock currently priced at $50. Calls puts Strike March June March June 45 6.84 8.41 1.18 2.09 50 3.82 5.58 3.08 4.13 55 1.89 3.54 6.08 6.93 The risk free interest rate is 10% and the time to maturities in years are March= 0.25 and June= 0.50

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started