Question

1. Construct a Market Value Balance Sheet for Trump Toppers, Inc. (TT), manufacturer of custom-made hairpieces, given the following data (FYI: There are no other

1. Construct a Market Value Balance Sheet for Trump Toppers, Inc. (TT), manufacturer of custom-made hairpieces, given the following data (FYI: There are no other liabilities or stock issues other than those mentioned below.): (parts a,b,c)

a. The company has issued $1,000 face value bonds that will mature in 7 years with a total book value of $33,000,000. The coupon rate on the bond is 6.0%, but market interest rate on similar bonds is now 4.0%. What is the market value of these bonds?

b. The company also has 7,000,000 shares of common stock outstanding. The companys earnings are expected to be $12 per share and it plans to pay out 35% of its earnings to its shareholders. With the growing popularity of fashionable cover-ups providing new expansion opportunities, the company expects that it can realize a return on invested funds (ROE) estimated at 18% and, given the 2 riskiness of the stock, the required rate of return is 15%. Calculate the price per share and the market value of the total equity position.

c. The book value of assets in place (plant and equipment) is $492,000,000. Indicate the value of investment opportunities.

2. Answer both (unrelated) parts a and b.

a. Nipper Corp., which sells glow-in-the-dark pacifiers to anxious parents, wants to expand its capacity. Nipper is considering buying a new piece of equipment that would cut the radioactivity in each pacifier. One alternative would cost them $75,000 for new machinery and provide them with cash flows of $28,000 per year for the next four years. The other would cost $187,000 but would result in cash flows of $65,000 a year over the same 4 year period. Assuming that the cost of capital Nipper faces is 12.5%, evaluate the NPV and IRR of these projects and determine which one of these two mutually exclusive alternatives you would choose. Explain your reasoning. Show all work!

b.Assume you are the financial manager with a hard capital rationing constraint of $18 million. You may invest in the following independent projects. Investment and cash flow figures are in millions.

PROJECT, INVESTMENT, NPV

A, 6, 2

B, 4, 1

C, 9, 3

D, 5, 1

E, 2, 1

Using the Profitability Index, which projects should you choose given the budget constraint and which would you choose if there was no capital rationing? Show all work

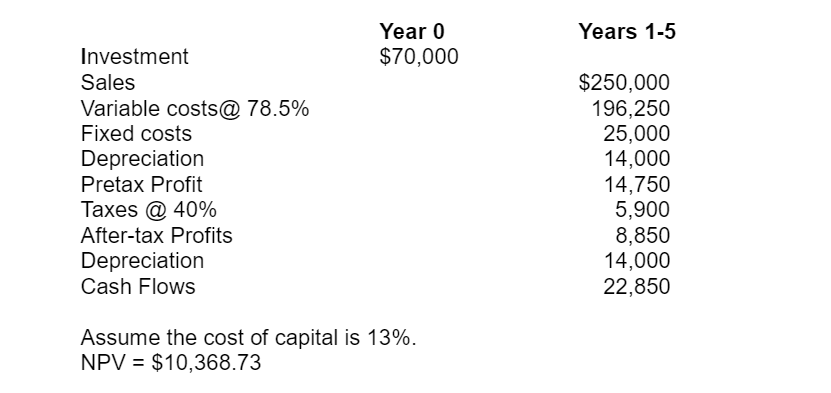

3. The new hole-maker/donut-filler at Dunker Doughnuts is projected to cost $70,000. According to the base case cited in a secret management report, the following cash flows can be expected in each of the five years of the machines life. There is no salvage value or change in working capital.

Answer parts a through d

a.) What if the price of the machine turns out to be $85,000 instead of $70,000 (assume straight-line depreciation)? What is the new net present value?

b.) Instead, what if the economy booms and sales come in at $385,000 per year (variable costs remain at 78.5% of sales)? What is the new net present value?

c.) Assume the following scenario: Due to strong competitive pressures sales are now expected to be 15% below expectations and variable costs will represent 80% of sales. Calculate the new net present value given this scenario.

d.) Calculate the accounting break-even level of sales of the base (given) case (FYI: each doughnut sells for $2).

Year 0 $70,000 Investment Sales Variable costs a 78.5% Fixed costs Depreciation Pretax Profit Taxes 40% After-tax Profits Depreciation Cash Flows Assume the cost of capital is 13%. NPV $10,368.73 Years 1-5 $250,000 196,250 25,000 14,000 14,750 5,900 8,850 14,000 22,850

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started