Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Construct a Statement of financial position for Den Store Taber Corporation for both 2021 and 2022. In constructing the SFP, please use three

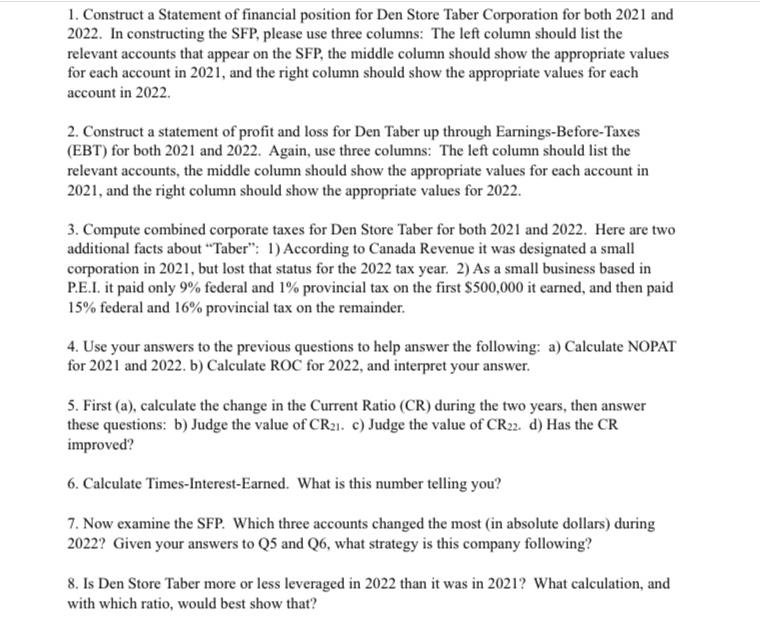

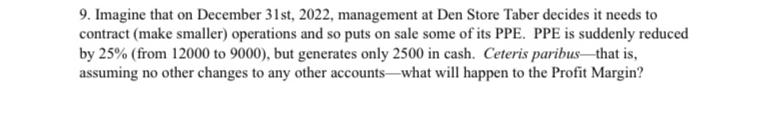

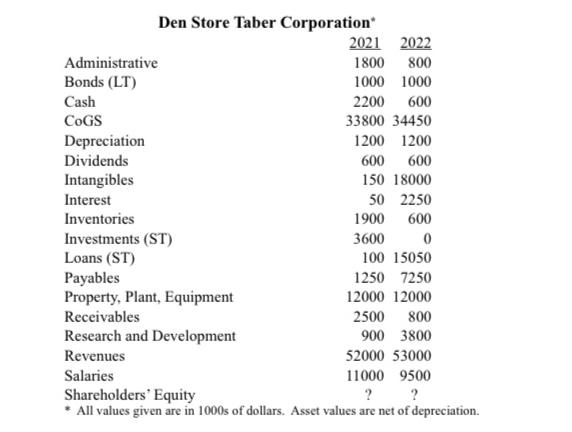

1. Construct a Statement of financial position for Den Store Taber Corporation for both 2021 and 2022. In constructing the SFP, please use three columns: The left column should list the relevant accounts that appear on the SFP, the middle column should show the appropriate values for each account in 2021, and the right column should show the appropriate values for each account in 2022. 2. Construct a statement of profit and loss for Den Taber up through Earnings-Before-Taxes (EBT) for both 2021 and 2022. Again, use three columns: The left column should list the relevant accounts, the middle column should show the appropriate values for each account in 2021, and the right column should show the appropriate values for 2022. 3. Compute combined corporate taxes for Den Store Taber for both 2021 and 2022. Here are two additional facts about "Taber": 1) According to Canada Revenue it was designated a small corporation in 2021, but lost that status for the 2022 tax year. 2) As a small business based in P.E.I. it paid only 9% federal and 1% provincial tax on the first $500,000 it earned, and then paid 15% federal and 16% provincial tax on the remainder. 4. Use your answers to the previous questions to help answer the following: a) Calculate NOPAT for 2021 and 2022. b) Calculate ROC for 2022, and interpret your answer. 5. First (a), calculate the change in the Current Ratio (CR) during the two years, then answer these questions: b) Judge the value of CR21. c) Judge the value of CR22. d) Has the CR improved? 6. Calculate Times-Interest-Earned. What is this number telling you? 7. Now examine the SFP. Which three accounts changed the most (in absolute dollars) during 2022? Given your answers to Q5 and Q6, what strategy is this company following? 8. Is Den Store Taber more or less leveraged in 2022 than it was in 2021? What calculation, and with which ratio, would best show that? 9. Imagine that on December 31st, 2022, management at Den Store Taber decides it needs to contract (make smaller) operations and so puts on sale some of its PPE. PPE is suddenly reduced by 25% (from 12000 to 9000), but generates only 2500 in cash. Ceteris paribus-that is, assuming no other changes to any other accounts what will happen to the Profit Margin? Den Store Taber Corporation* Administrative Bonds (LT) Cash COGS Depreciation Dividends Intangibles Interest Inventories Investments (ST) Loans (ST) Payables Property, Plant, Equipment Receivables Research and Development Revenues Salaries 2021 2022 1800 800 1000 1000 2200 600 33800 34450 1200 1200 600 600 150 18000 50 2250 1900 600 3600 0 100 15050 1250 7250 12000 12000 2500 800 900 3800 52000 53000 11000 9500 Shareholders' Equity 2 ? All values given are in 1000s of dollars. Asset values are net of depreciation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To construct the Statement of Financial Position SFP and Statement of Profit and Loss for Den Store Taber Corporation for both 2021 and 2022 and to answer the subsequent questions well follow the form...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started