Question

Profits have been decreasing for several years at Pegasus Airlines. In an effort to improve the companys performance, consideration is being given to dropping several

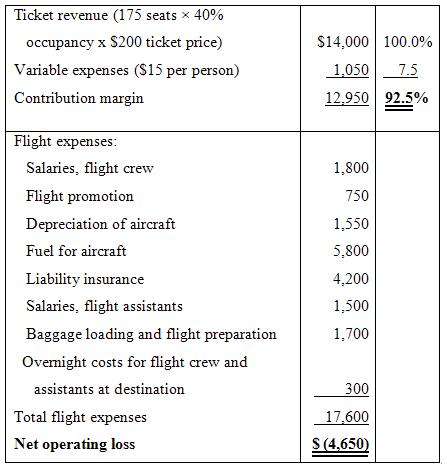

Profits have been decreasing for several years at Pegasus Airlines. In an effort to improve the company’s performance, consideration is being given to dropping several flights that appear to be unprofitable. A typical income statement for one round-trip of one such flight (flight 482) is as follows:

The following additional information is available about flight 482:

(a) Members of the flight crew are paid fixed annual salaries, whereas the flight assistants are paid based on the number of round trips they complete.

(b) One-third of the liability insurance is a special charge assessed against flight 482 because in the opinion of the insurance company, the destination of the flight is in a “high-risk” area. The remaining two-thirds would be unaffected by a decision to drop flight 482.

(c) The baggage loading and flight preparation expense is an allocation of ground crews’ salaries and depreciation of ground equipment. Dropping flight 482 would have no effect on the company’s total baggage loading and flight preparation expenses.

(d) If flight 482 is dropped, Pegasus Airlines has no authorization at present to replace it with another flight.

(e) Aircraft depreciation is due entirely to obsolescence. Depreciation due to wear and tear is negligible.

(f) Dropping flight 482 would not allow Pegasus Airlines to reduce the number of aircraft in its fleet or the number of flight crew on its payroll.

Required:

1. Prepare an analysis showing what impact dropping flight 482 would have on the airline’s profits.

2. The airline’s scheduling officer has been criticized because only about 50% of the seats on Pegasus’ flights are being filled compared to an industry average of 60%. The scheduling officer has explained that Pegasus’ average seat occupancy could be improved considerably by eliminating about 10% of its flights, but that doing so would reduce profits. Explain how this could happen.

Ticket revenue (175 seats x 40% occupancy x $200 ticket price) $14,000 100.0% Variable expenses ($15 per person) 1,050 7.5 Contribution margin 12,950 92.5% Flight expenses: Salaries, flight crew 1,800 Flight promotion 750 Depreciation of aircraft 1,550 Fuel for aircraft 5,800 Liability insurance 4,200 Salaries, flight assistants 1,500 Baggage loading and flight preparation 1,700 Ovemight costs for flight crew and assistants at destination 300 Total flight expenses 17,600 Net operating loss S(4,650)

Step by Step Solution

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Student 5417259 Minh Trang Luong Class Wednesday 1630 Started 30052018 42600 PM IP Address 102450235 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started