1. create a Tax Return for Kyle Peterson: 1040, Schedule 1, Schedule 3, Schedule A, Schedule B, Schedule D.

2. create a 1040 tax return for Loretta.

Kyle Peterson (born 3/1/1980, Social Security #914-33-2342) is divorced and blind. He lives with his girlfriend, Loretta Smith all year.

Loretta Smith is a full-time student at SFSU (born 1/31/2000, SS #565-33-2222). She is on a scholarship of $8,000 for tuition, books and supplies + $1500 for room and board. Kyle provides more than half her support. In addition, Loretta earns $900 interest income from Bank of America and $1100 salary. She had $84 Social Security taxes withheld, Fed Tax Withholding of $102, and Ca. State Tax withholding of $55. Loretta paid $1100 in medical expenses in 2019.

Kyle is divorced from his wife Nancy Drew. They were divorced in 2012. They have one daughter Hillary, born 4/15/2002, (SS #888-88-888) who lives with Kyle for 6 months and with Nancy for 6 months. Nancy provides more than half her support. Hillary has no income. Nancys AGI is $130,000. Kyle pays $12,000 alimony in 2019 to Nancy Drew and $14,000 in child support to Hillary.

In addition Kyle has three children with his second wife, Ramona Harrison. Randy (Born 8/2 2006), SS # 818-44-3312) and Karl born 9/3/2004) (SS # 513-313-3333) and Marcy (Born 11/3/2001) (SS # 513-66-6667). Marcy is a full-time student at SFSU. Kyle has custody of all three children. Randy and Karl live with him all year. Marcy lives on campus and has a job in which she earns $8500. Kyle provide more than half her support. Kyle provides more than half the support for Karl and Randy. Marcy comes home during summer vacations.

Kyle also provides more than half of the support for his mother Harriet Lam, Age 68, (412-33-1243) who lives in her own apartment. Harriet is single. Her only income is social security of $12,121, interest income of $2200, and salary of $1800.

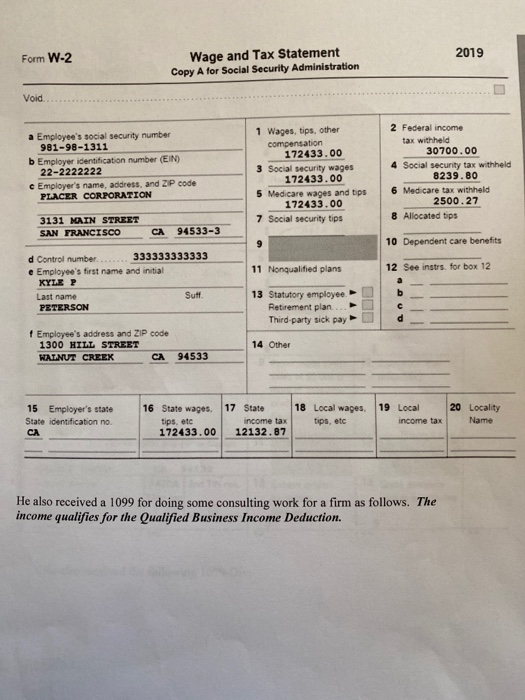

The Petersons reside at 1300 Hill Street, Walnut Creek, Ca. 94135. Kyle is an employed as a sales manager at Winthrop Corporation in San Francisco. Kyle received the following W-2 form from his employer

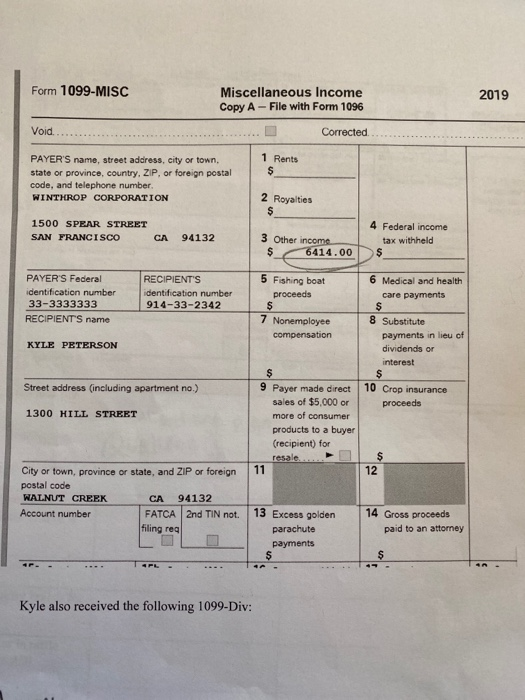

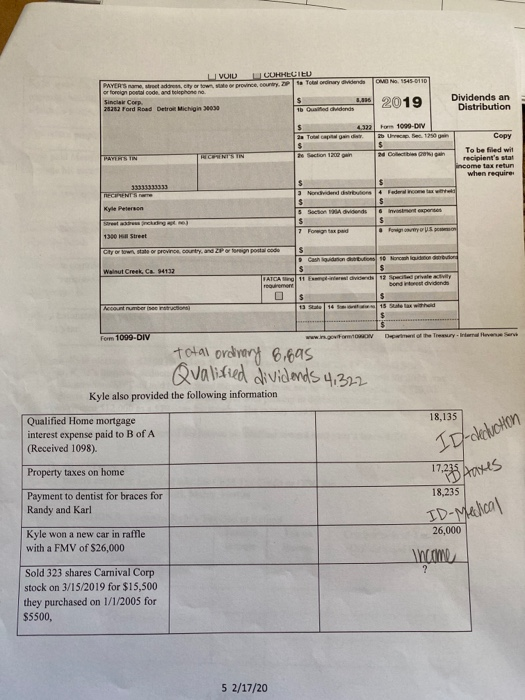

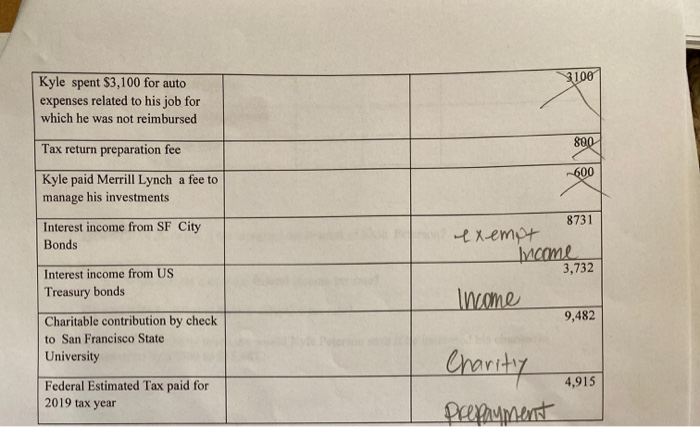

2019 Form W-2 Wage and Tax Statement Copy A for Social Security Administration Void a Employee's social security number 981-98-1311 b Employer identification number (EIN) 22-2222222 c Employer's name, address, and ZIP code PLACER CORPORATION 1 Wages, tips, other compensation 172433.00 3 Social security wages 172433.00 5 Medicare wages and tips 172433.00 7 Social Security tips 2 Federal income tax withheld 30700.00 4 Social security tax withheld 8239.80 6 Medicare tax withheld 2500.27 8 Allocated tips 3131 MAIN STREET SAN FRANCISCO CA 94533-3 10 Dependent care benefits 11 Nonqualified plans 12 See instrs, for box 12 d Control number... 333333333333 e Employee's first name and initial KYLE P Last name Suff PETERSON 13 Statutory employee Retirement plan... Third-party sick pay 1 Employee's address and ZIP code 1300 HILL STREET WALNUT CREEK CA 14 Other 94533 15 Employer's state State identification no. CA 16 State wages. tips, etc 172433.00 17 State income tax 12132.87 18 Local wages. tips, etc 19 Local income tax 20 Locality Name He also received a 1099 for doing some consulting work for a firm as follows. The income qualifies for the Qualified Business Income Deduction. Form 1099-MISC 2019 Miscellaneous Income Copy A - File with Form 1096 Corrected Void 1 Rants PAYER'S name, street address, city or town, state or province, country, ZIP, or foreign postal code, and telephone number WINTHROP CORPORATION 2 Royalties 1500 SPEAR STREET SAN FRANCISCO CA 94132 3 Other income $ 6414.00 4 Federal income tax withheld $ PAYER'S Federal identification number 33-3333333 RECIPIENTS name RECIPIENTS identification number 914-33-2342 5 Fishing boat proceeds 6 Medical and health care payments 7 Nonemployee compensation KYLE PETERSON 8 Substitute payments in lieu of dividends or interest Street address (including apartment no.) 10 Crop insurance proceeds 1300 HILL STREET 9 Payer made direct sales of $5,000 or more of consumer products to a buyer (recipient) for reale City or town, province or state, and ZIP or foreign postal code WALNUT CREEK CA 94132 Account number FATCA 2nd TIN not. filing real 13 Excess golden parachute payments 14 Gross proceeds paid to an attorney Kyle also received the following 1099-Div: HIMUN P a acTED ONICE OF PATCRIS Sincia Corp 28282 Ford Road Detro Michigan 2009 2019 Dividends an Distribution 4 Form 1090-DIV To be filled wil recipient's sta when requires 3333333333 Kyle Petersen Walnut Creek, CA 94132 CORO Form 1099-DIV total ordrary 8.6as Qualified dividends 4,322 Kyle also provided the following information 18,135 Qualified Home mortgage interest expense paid to B of A (Received 1098). ID-deduction Property taxes on home Payment to dentist for braces for Randy and Karl 17:33 Haxes 18,235 ID-Mechical Kyle won a new car in raffle with a FMV of $26,000 26,000 Income Sold 323 shares Carnival Corp stock on 3/15/2019 for $15,500 they purchased on 1/1/2005 for $5500, 5 2/17/20 Kyle spent $3,100 for auto expenses related to his job for which he was not reimbursed Tax return preparation fee 800 -600 Kyle paid Merrill Lynch a fee to manage his investments Interest income from SF City Bonds Interest income from US Treasury bonds 8731 exempt Income 3,732 Income 9,482 Charitable contribution by check to San Francisco State University Charity 4,915 Federal Estimated Tax paid for 2019 tax year Prepayment 2019 Form W-2 Wage and Tax Statement Copy A for Social Security Administration Void a Employee's social security number 981-98-1311 b Employer identification number (EIN) 22-2222222 c Employer's name, address, and ZIP code PLACER CORPORATION 1 Wages, tips, other compensation 172433.00 3 Social security wages 172433.00 5 Medicare wages and tips 172433.00 7 Social Security tips 2 Federal income tax withheld 30700.00 4 Social security tax withheld 8239.80 6 Medicare tax withheld 2500.27 8 Allocated tips 3131 MAIN STREET SAN FRANCISCO CA 94533-3 10 Dependent care benefits 11 Nonqualified plans 12 See instrs, for box 12 d Control number... 333333333333 e Employee's first name and initial KYLE P Last name Suff PETERSON 13 Statutory employee Retirement plan... Third-party sick pay 1 Employee's address and ZIP code 1300 HILL STREET WALNUT CREEK CA 14 Other 94533 15 Employer's state State identification no. CA 16 State wages. tips, etc 172433.00 17 State income tax 12132.87 18 Local wages. tips, etc 19 Local income tax 20 Locality Name He also received a 1099 for doing some consulting work for a firm as follows. The income qualifies for the Qualified Business Income Deduction. Form 1099-MISC 2019 Miscellaneous Income Copy A - File with Form 1096 Corrected Void 1 Rants PAYER'S name, street address, city or town, state or province, country, ZIP, or foreign postal code, and telephone number WINTHROP CORPORATION 2 Royalties 1500 SPEAR STREET SAN FRANCISCO CA 94132 3 Other income $ 6414.00 4 Federal income tax withheld $ PAYER'S Federal identification number 33-3333333 RECIPIENTS name RECIPIENTS identification number 914-33-2342 5 Fishing boat proceeds 6 Medical and health care payments 7 Nonemployee compensation KYLE PETERSON 8 Substitute payments in lieu of dividends or interest Street address (including apartment no.) 10 Crop insurance proceeds 1300 HILL STREET 9 Payer made direct sales of $5,000 or more of consumer products to a buyer (recipient) for reale City or town, province or state, and ZIP or foreign postal code WALNUT CREEK CA 94132 Account number FATCA 2nd TIN not. filing real 13 Excess golden parachute payments 14 Gross proceeds paid to an attorney Kyle also received the following 1099-Div: HIMUN P a acTED ONICE OF PATCRIS Sincia Corp 28282 Ford Road Detro Michigan 2009 2019 Dividends an Distribution 4 Form 1090-DIV To be filled wil recipient's sta when requires 3333333333 Kyle Petersen Walnut Creek, CA 94132 CORO Form 1099-DIV total ordrary 8.6as Qualified dividends 4,322 Kyle also provided the following information 18,135 Qualified Home mortgage interest expense paid to B of A (Received 1098). ID-deduction Property taxes on home Payment to dentist for braces for Randy and Karl 17:33 Haxes 18,235 ID-Mechical Kyle won a new car in raffle with a FMV of $26,000 26,000 Income Sold 323 shares Carnival Corp stock on 3/15/2019 for $15,500 they purchased on 1/1/2005 for $5500, 5 2/17/20 Kyle spent $3,100 for auto expenses related to his job for which he was not reimbursed Tax return preparation fee 800 -600 Kyle paid Merrill Lynch a fee to manage his investments Interest income from SF City Bonds Interest income from US Treasury bonds 8731 exempt Income 3,732 Income 9,482 Charitable contribution by check to San Francisco State University Charity 4,915 Federal Estimated Tax paid for 2019 tax year Prepayment