Question

1. Create $ amounts for each cost you described in Week 1 (to the best of your ability) and determine how much of the total

1. Create $ amounts for each cost you described in Week 1 (to the best of your ability) and determine how much of the total cost is variable and how much of it is fixed. You will use this information to give us the following information:

o Business name (remind us)

o Product (remind us)

o Contribution margin and ratio

o Discuss the impact of Break-even

o Break-even with a target profit (be realistic in your target profit)

o Discuss the level of break-even and then break-even with a target profit, is this attainable?

o Will your company be successful based on your CVP analysis?

below are previous discussions

week 3 discussion

Company name Southwest Communication

Company Location Los Angeles Company

Product Fiber Optic Cable

Manufacturing unit Relates to Fiber Optic Cable Manufacturing

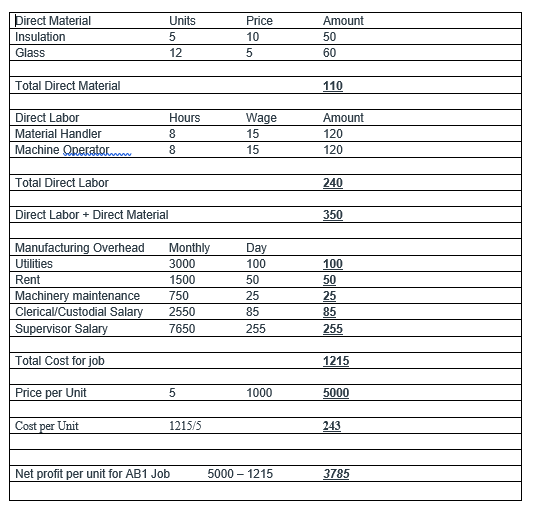

Breakdown for job order costing is as follows:

Southwest communications will use job order costing because each order is different. Orders are dependent on the order as far as the size of cable (strands of fiber per sheath) and length of cable per foot on cable reel.

I Unit = 1000 of 12 strands of insulated Fiber optic cable. Order (AB1) is for 5000 of cable

The Question is the details below; Please check it out. (It is the discussion 4)

Business Partner Group Discussion 4 - Variable versus Fixed Costs

This discussion is a continuation of weeks 2 and 3. In week 2, you identified the costs that your business would incur. This discussion will take the information a step further.

1. Create $ amounts for each cost you described in Week 1 (to the best of your ability) and determine how much of the total cost is variable and how much of it is fixed. You will use this information to give us the following information:

o Business name (remind us)

o Product (remind us)

o Contribution margin and ratio

o Discuss the impact of Break-even

o Break-even with a target profit (be realistic in your target profit)

o Discuss the level of break-even and then break-even with a target profit, is this attainable?

o Will your company be successful based on your CVP analysis?

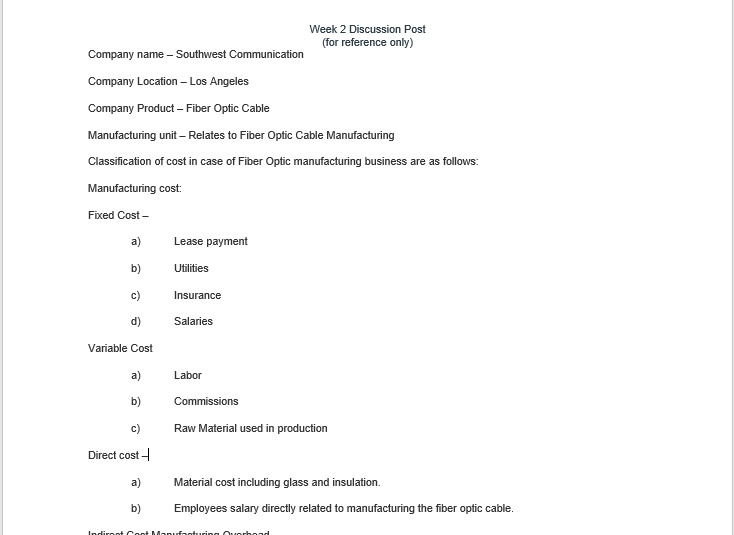

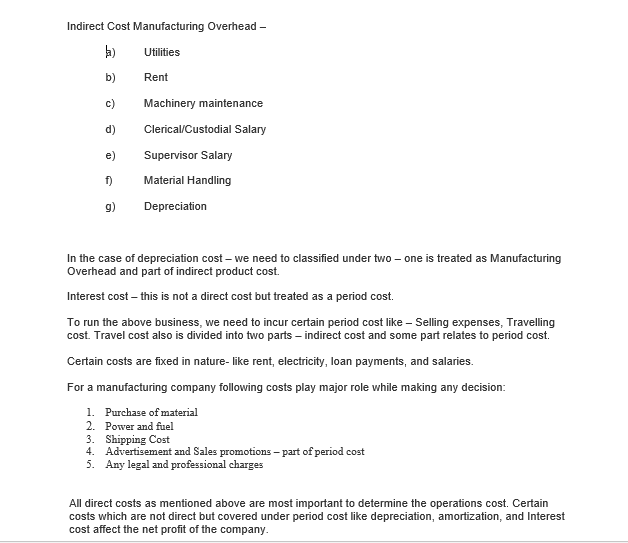

Week 2 Discussion Post (for reference only) Company name - Southwest Communication Company Location - Los Angeles Company Product - Fiber Optic Cable Manufacturing unit - Relates to Fiber Optic Cable Manufacturing Classification of cost in case of Fiber Optic manufacturing business are as follows: Manufacturing cost: Fixed Cost- Lease payment Utilities Insurance Salaries Variable Cost a) Labor b) Commissions Raw Material used in production Direct cost a) Material cost including glass and insulation Employees salary directly related to manufacturing the fiber optic cable. b) lodiroot ontManufacturina b oad Indirect Cost Manufacturing Overhead - Utilities Rent Machinery maintenance Clerical/Custodial Salary Supervisor Salary Material Handling g) Depreciation In the case of depreciation cost - we need to classified under two - one is treated as Manufacturing Overhead and part of indirect product cost. Interest cost - this is not a direct cost but treated as a period cost. To run the above business, we need to incur certain period cost like-Selling expenses, Travelling cost. Travel cost also is divided into two parts - indirect cost and some part relates to period cost. Certain costs are fixed in nature- like rent, electricity, loan payments, and salaries. For a manufacturing company following costs play major role while making any decision: 1. Purchase of material 2. Power and fuel 3. Shipping Cost 4. Advertisement and Sales promotions - part of period cost 5. Any legal and professional charges All direct costs as mentioned above are most important to determine the operations cost. Certain costs which are not direct but covered under period cost like depreciation, amortization, and Interest cost affect the net profit of the company. Amount I Direct Material Insulation Glass Units 5 125 Price 10 50 60 Total Direct Material 110 Direct Labor Material Handler Machine Operato Hours 8 Wage Amount 15 120 1 5 120 8 Total Direct Labor 240 Direct Labor + Direct Material 350 Manufacturing Overhead Utilities Rent Machinery maintenance Clerical/Custodial Salary Supervisor Salary Monthly Day 3000 150050 750 2 5 2550 8 5 7650 255 Total Cost for job 1215 Price per Unit 5 5000 Cost per Unit _ 121515 243 Net profit per unit for AB1 Job 5000 - 1215 3785 Week 2 Discussion Post (for reference only) Company name - Southwest Communication Company Location - Los Angeles Company Product - Fiber Optic Cable Manufacturing unit - Relates to Fiber Optic Cable Manufacturing Classification of cost in case of Fiber Optic manufacturing business are as follows: Manufacturing cost: Fixed Cost- Lease payment Utilities Insurance Salaries Variable Cost a) Labor b) Commissions Raw Material used in production Direct cost a) Material cost including glass and insulation Employees salary directly related to manufacturing the fiber optic cable. b) lodiroot ontManufacturina b oad Indirect Cost Manufacturing Overhead - Utilities Rent Machinery maintenance Clerical/Custodial Salary Supervisor Salary Material Handling g) Depreciation In the case of depreciation cost - we need to classified under two - one is treated as Manufacturing Overhead and part of indirect product cost. Interest cost - this is not a direct cost but treated as a period cost. To run the above business, we need to incur certain period cost like-Selling expenses, Travelling cost. Travel cost also is divided into two parts - indirect cost and some part relates to period cost. Certain costs are fixed in nature- like rent, electricity, loan payments, and salaries. For a manufacturing company following costs play major role while making any decision: 1. Purchase of material 2. Power and fuel 3. Shipping Cost 4. Advertisement and Sales promotions - part of period cost 5. Any legal and professional charges All direct costs as mentioned above are most important to determine the operations cost. Certain costs which are not direct but covered under period cost like depreciation, amortization, and Interest cost affect the net profit of the company. Amount I Direct Material Insulation Glass Units 5 125 Price 10 50 60 Total Direct Material 110 Direct Labor Material Handler Machine Operato Hours 8 Wage Amount 15 120 1 5 120 8 Total Direct Labor 240 Direct Labor + Direct Material 350 Manufacturing Overhead Utilities Rent Machinery maintenance Clerical/Custodial Salary Supervisor Salary Monthly Day 3000 150050 750 2 5 2550 8 5 7650 255 Total Cost for job 1215 Price per Unit 5 5000 Cost per Unit _ 121515 243 Net profit per unit for AB1 Job 5000 - 1215 3785Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started