Question

(1) CT13.1) Your parents are considering investing in Apple Inc. common stock. They ask you, as an accounting expert, to make an analysis of the

(1)

CT13.1) Your parents are considering investing in Apple Inc. common stock. They ask you, as an accounting expert, to make an analysis of the company for them. Financial statements of Apple are presented in Appendix A. The complete annual report, including the notes to its financial statements, is available at the companys website.

Instructions:

A) Make a 5-year trend analysis, using 2014 as the base year, of (1) net sales and (2) net income. Comment on the significance of the trend results.

B) Compute for 2018 and 2017 the (1) debt to assets ratio and (2) times interest earned. (See Note 3 for interest expense.) How would you evaluate Apples long-term solvency?

C) Compute for 2018 and 2017 the (1) profit margin, (2) asset turnover, (3) return on assets, and (4) return on common stockholders equity. How would you evaluate Apples profitability? Total assets at September 24, 2016, were $321,686 million and total stockholders equity at September 24, 2016, was $128,249 million.

D) What information outside the annual report may also be useful to your parents in making a decision about Apple?

*Please ensure that ALL sections are labeled and answered (A, B, C, and D). Thank you for all your help!

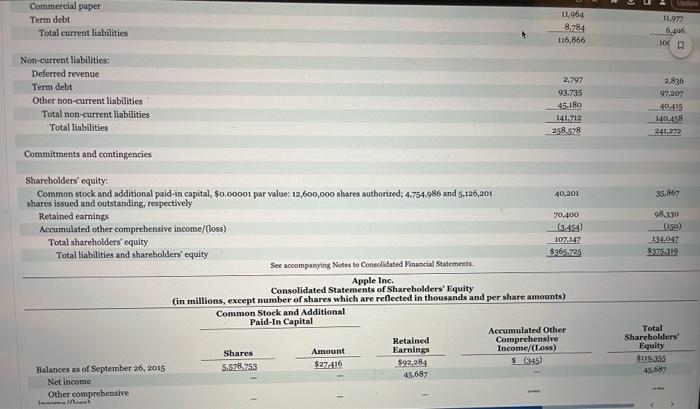

1. Debt to Assets Ratio

2018:$258,578 $365,725 = 71%

2017:$241,272 $375,319 = 64%

2. Times Interest Earned

2018:($59,531 + $13,372 + $3,240) $3,240 = 23.5 times

2017:($48,351 + $15,738 + $2,323) $2,323 = 28.6 times

Apple's long-term solvency has decreased. The debt to assets ratio indicates that creditors are providing approximately 71% of Apple's total assets, up from 64%. Also, even though the times interest earned ratio has decreased, Apple easily has the ability to pay interest payments when they come due as indicated by the times interest earned ratio of approximately 24 times.

How can I get 3,240 and 2,323 in Times Interest Earned in question 2?

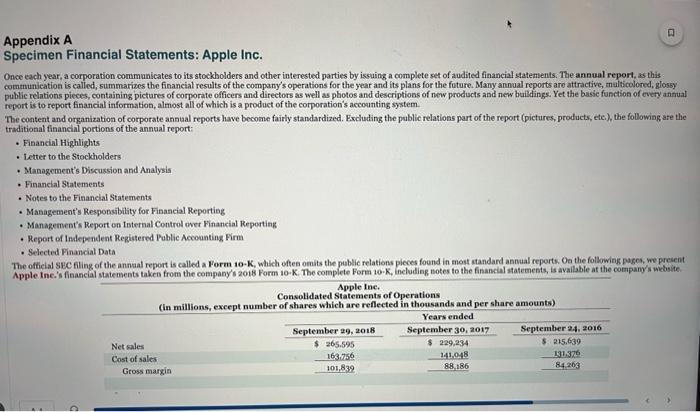

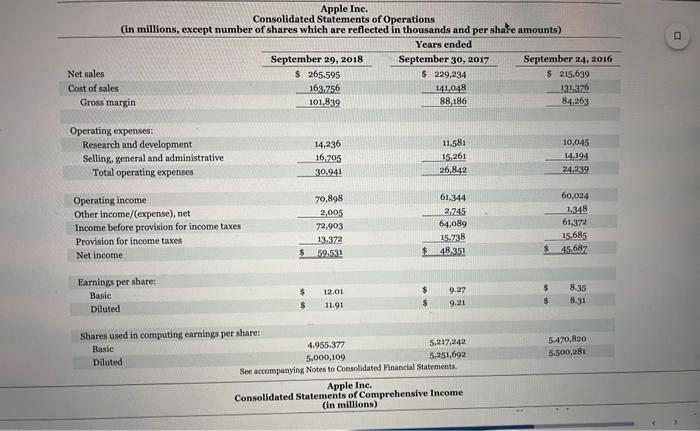

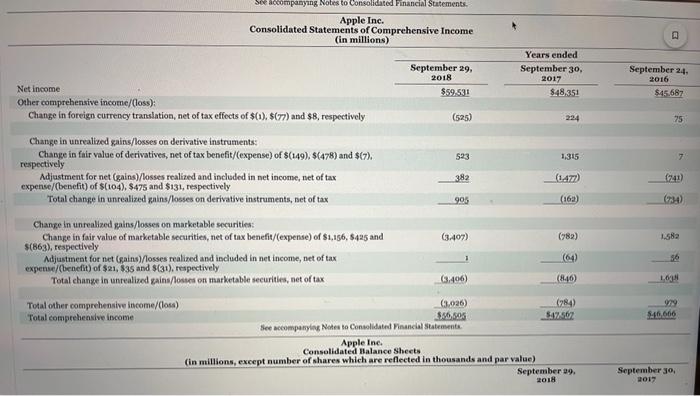

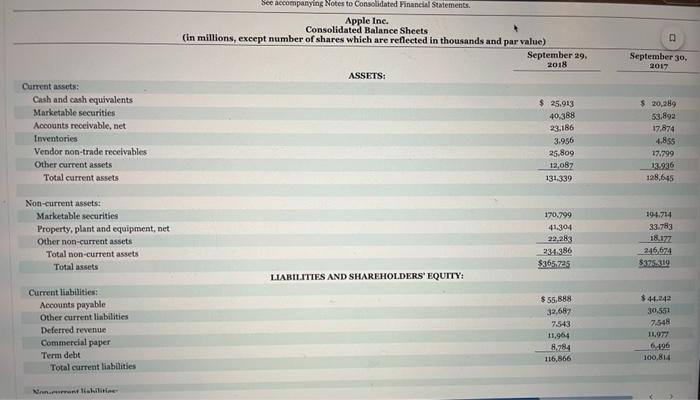

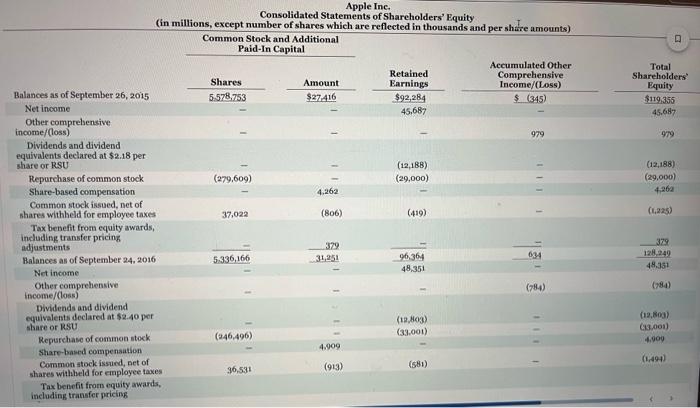

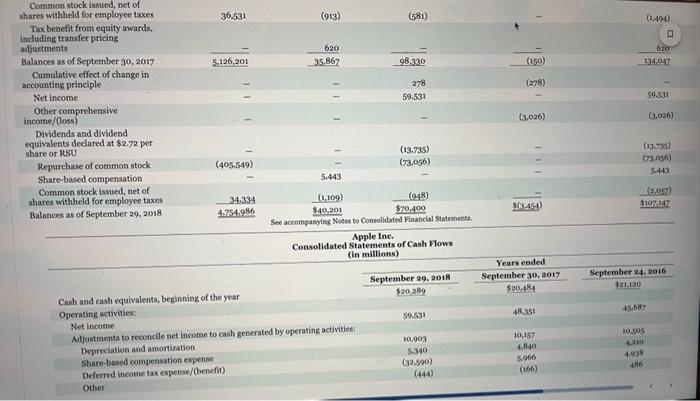

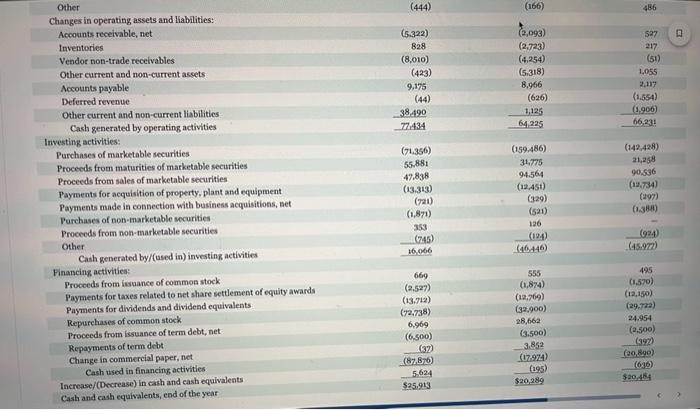

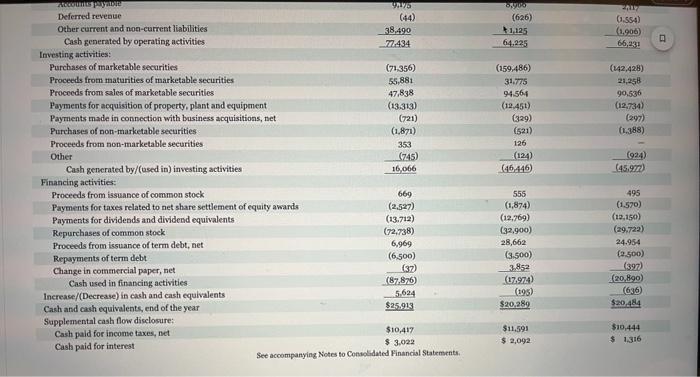

Appendix A Specimen Financial Statements: Apple Inc. Once each year, a corporation communicates to its stockholders and other interested parties by issuing a complete set of audited financial statements. The annual report, as this communication is called, summarizes the financial results of the company's operations for the year and its plans for the future. Many annual reports are attractive, malticolored, glossy public relations pieces, containing pictures of corporate officers and directors as well as plotos and descriptions of new products and new buildings. Yet the busie function of every annual report is to report financial information, almost all of which is a product of the corporation's accounting system. The content and organization of corporate annual reports have become fairly standardized. Excluding the public relations part of the report (pictures, products, etc), the following are the traditional financial portions of the annual report: - Financial Highlights - Letter to the Stockholders - Management's Discussion and Analysis - Financial Statements - Notes to the Financial Statements - Management's Responsibility for Financial Reporting - Management's Report on Isternal Control over Financial Reporting - Report of Independent Regiatered Public Acoounting Firm - Selected Financial Data The official seC filing of the annual report is called a Form 10-K, which oftes omits the public relations pieces found in most sandard annual reports. Oa the following pages, we present Apple Ine. Consolidated Statements of Operations (in millions. except number of shares which are reflected in thousands and ner shate amounts) Apple Inc. Consolidated Statements of Comprehensive Income (in millions) Net income Oqher comprehensive income/(loss): Change in foreign currency translation, net of tax effocts of $(1),$(77) and $8, respectively Change in unrealioed gains/losses on derivative instruments: Change in fair value of derivatives, net of tax benefit/(expense) of $(149),$(478) and $(7). respectively Adjastment for net (gains)//osses realioed and included in net income, net of tax expense/(benefit) of $(104);$475 and $131, respectively Total change in unrealixed gains/losses on derivative instruments, net of tax Change in unrealized gains/losses on marketable securities: Change in fair value of marketable securitien, net of tax benefit/(expense) of $1,156,$425 and $(863), fespectively Adjustment for net (gains)/losses realixed and iscluded in net income, net of tax expense/(benefit) of $21,$35 and $(31), respectively Total ehange in unrealized gains/losies on marketable securities, net of tax Total other comprehensive income/(loss) Total comprehensive iscome See acompanying Notes to Consolidated Financial Statemente. Apple Inc. Conselidated Halance Sherts (in millions, exeept number of shares which are reflected in thousands and par value) September 29, September 30, zois See accoenpanying Notes to Consolidated Financial Sqatements. Apple Ine. Consolidated Balance Shcets (in millions, except number of shares which are reflected in thousands and par value) ASSETS: \begin{tabular}{cc} September29.2018 & September302017 \\ & \\ $25,913 & 50,289 \\ 40,388 & 53.892 \\ 23,186 & 17,874 \\ 3,956 & 4,855 \\ 25,809 & 17,799 \\ 12,087 & 13,986 \\ \hline 131,339 & 128,645 \end{tabular} Non-current assets: Marketable securities Property, plant and equipment, net Other non-current assets Total non-current assets Total assets LIABILTIES AND SHAREHOLDERS' EQUTTY: Current liabilities: Accounts payable Other current liabilities Deferred revenue Commercial paper Term debt Total current liablitities Whenarqurwent 16ohailitine? Commercial paper Term debt Total current liablities Non-current liabilities: Deferred revenue Term debt Other non-current liablities Total non-current liabilities Total liabilities Commitments and contingencies Shareholders' equity: Common stock and additional paid-in capital, \$0,00001 par valse: 12,600,000 shares authorized; 4,754,986 and 5,126,201 stares issued and outstanding, respectively Retained earnings Accumulated other comprehensive income/(loss) Total shareholders' equity Total liabilities and shareholders' equity See accompanying Notes to Consolidated Finascial Statements. Apple Inc. Consolidated Statements of Shareholders' Equity (in millions, except number of shares which are reflected in thousands and per share amounts) Apple Inc. Consolidated Statements of Shareholders' Rauity Common stock issued, net of shares withheld for employee taxes 36.531(913)(581) Tax benefit from equity awards, including transfer pricing Dividends and dividend equivalents declared at $2.72 per share or RSU Repurchase of common stock Share-based compensation Common stock issued, net of commones withheld for employee taxes Balances as of September 29, 2018 34,3344,754,986 See accompunyiag Note to Consolidated Financial Statemeets. Apple Inc. (in millions) Cash and eash equivalents, beginning of the year Operating activities: Net incosse Adjostments to reconelle net income to cash geserated by operating activities: Depreciation and amortiration Sbare-based compensation expense Deferred incotne tax expense/(bencfi0) Other Other Changes in operating assets and liabilities: Investing activities: Purchases of marketable securities Proceeds from maturities of marketable securities Proceeds from sales of marketable securities Payments for acquisition of property, plant and equipment Payments made in connection with business acquisitions, net Purchases of non-marketable securities Proceeds from non-marketable securities Other Cash generated by/(used in) investing activities Financing activitiea: Proceeds from isuance of common stock Payments for taxes related to net share settlement of equity awards Payments for dividends and dividend equivalents Repurehases of common stock Proceeds from fssuance of term debt, net Repayments of term debt Change in commercial paper, net Cash used in financing activities Increase/(Decrease) in cash and eash equivalents Cash and cash equivalents, end of the year Investing activities: Purchases of marketable securities Proceeds from maturities of marketable securities Proceeds from sales of marketable securities Payments for acquisition of property, plant and equipment Payments made in connection with business acquisitions, net Purchases of non-marketable securities : Proceeds from non-marketable securities Other Cash generated by/(used in) investing activities Financing activities: See accompanying Notes to Consolidated Financial Statements. Appendix A Specimen Financial Statements: Apple Inc. Once each year, a corporation communicates to its stockholders and other interested parties by issuing a complete set of audited financial statements. The annual report, as this communication is called, summarizes the financial results of the company's operations for the year and its plans for the future. Many annual reports are attractive, malticolored, glossy public relations pieces, containing pictures of corporate officers and directors as well as plotos and descriptions of new products and new buildings. Yet the busie function of every annual report is to report financial information, almost all of which is a product of the corporation's accounting system. The content and organization of corporate annual reports have become fairly standardized. Excluding the public relations part of the report (pictures, products, etc), the following are the traditional financial portions of the annual report: - Financial Highlights - Letter to the Stockholders - Management's Discussion and Analysis - Financial Statements - Notes to the Financial Statements - Management's Responsibility for Financial Reporting - Management's Report on Isternal Control over Financial Reporting - Report of Independent Regiatered Public Acoounting Firm - Selected Financial Data The official seC filing of the annual report is called a Form 10-K, which oftes omits the public relations pieces found in most sandard annual reports. Oa the following pages, we present Apple Ine. Consolidated Statements of Operations (in millions. except number of shares which are reflected in thousands and ner shate amounts) Apple Inc. Consolidated Statements of Comprehensive Income (in millions) Net income Oqher comprehensive income/(loss): Change in foreign currency translation, net of tax effocts of $(1),$(77) and $8, respectively Change in unrealioed gains/losses on derivative instruments: Change in fair value of derivatives, net of tax benefit/(expense) of $(149),$(478) and $(7). respectively Adjastment for net (gains)//osses realioed and included in net income, net of tax expense/(benefit) of $(104);$475 and $131, respectively Total change in unrealixed gains/losses on derivative instruments, net of tax Change in unrealized gains/losses on marketable securities: Change in fair value of marketable securitien, net of tax benefit/(expense) of $1,156,$425 and $(863), fespectively Adjustment for net (gains)/losses realixed and iscluded in net income, net of tax expense/(benefit) of $21,$35 and $(31), respectively Total ehange in unrealized gains/losies on marketable securities, net of tax Total other comprehensive income/(loss) Total comprehensive iscome See acompanying Notes to Consolidated Financial Statemente. Apple Inc. Conselidated Halance Sherts (in millions, exeept number of shares which are reflected in thousands and par value) September 29, September 30, zois See accoenpanying Notes to Consolidated Financial Sqatements. Apple Ine. Consolidated Balance Shcets (in millions, except number of shares which are reflected in thousands and par value) ASSETS: \begin{tabular}{cc} September29.2018 & September302017 \\ & \\ $25,913 & 50,289 \\ 40,388 & 53.892 \\ 23,186 & 17,874 \\ 3,956 & 4,855 \\ 25,809 & 17,799 \\ 12,087 & 13,986 \\ \hline 131,339 & 128,645 \end{tabular} Non-current assets: Marketable securities Property, plant and equipment, net Other non-current assets Total non-current assets Total assets LIABILTIES AND SHAREHOLDERS' EQUTTY: Current liabilities: Accounts payable Other current liabilities Deferred revenue Commercial paper Term debt Total current liablitities Whenarqurwent 16ohailitine? Commercial paper Term debt Total current liablities Non-current liabilities: Deferred revenue Term debt Other non-current liablities Total non-current liabilities Total liabilities Commitments and contingencies Shareholders' equity: Common stock and additional paid-in capital, \$0,00001 par valse: 12,600,000 shares authorized; 4,754,986 and 5,126,201 stares issued and outstanding, respectively Retained earnings Accumulated other comprehensive income/(loss) Total shareholders' equity Total liabilities and shareholders' equity See accompanying Notes to Consolidated Finascial Statements. Apple Inc. Consolidated Statements of Shareholders' Equity (in millions, except number of shares which are reflected in thousands and per share amounts) Apple Inc. Consolidated Statements of Shareholders' Rauity Common stock issued, net of shares withheld for employee taxes 36.531(913)(581) Tax benefit from equity awards, including transfer pricing Dividends and dividend equivalents declared at $2.72 per share or RSU Repurchase of common stock Share-based compensation Common stock issued, net of commones withheld for employee taxes Balances as of September 29, 2018 34,3344,754,986 See accompunyiag Note to Consolidated Financial Statemeets. Apple Inc. (in millions) Cash and eash equivalents, beginning of the year Operating activities: Net incosse Adjostments to reconelle net income to cash geserated by operating activities: Depreciation and amortiration Sbare-based compensation expense Deferred incotne tax expense/(bencfi0) Other Other Changes in operating assets and liabilities: Investing activities: Purchases of marketable securities Proceeds from maturities of marketable securities Proceeds from sales of marketable securities Payments for acquisition of property, plant and equipment Payments made in connection with business acquisitions, net Purchases of non-marketable securities Proceeds from non-marketable securities Other Cash generated by/(used in) investing activities Financing activitiea: Proceeds from isuance of common stock Payments for taxes related to net share settlement of equity awards Payments for dividends and dividend equivalents Repurehases of common stock Proceeds from fssuance of term debt, net Repayments of term debt Change in commercial paper, net Cash used in financing activities Increase/(Decrease) in cash and eash equivalents Cash and cash equivalents, end of the year Investing activities: Purchases of marketable securities Proceeds from maturities of marketable securities Proceeds from sales of marketable securities Payments for acquisition of property, plant and equipment Payments made in connection with business acquisitions, net Purchases of non-marketable securities : Proceeds from non-marketable securities Other Cash generated by/(used in) investing activities Financing activities: See accompanying Notes to Consolidated Financial StatementsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started