Question

1. Current market rate is 8%, the corporation issues the Bond at 10%. The bonds will be issued at a Discount Face Value Premium

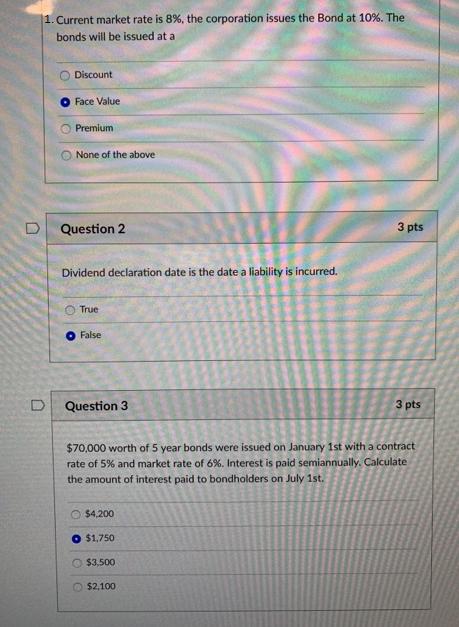

1. Current market rate is 8%, the corporation issues the Bond at 10%. The bonds will be issued at a Discount Face Value Premium None of the above Question 2 3 pts Dividend declaration date is the date a liability is incurred. True False Question 3 3 pts $70,000 worth of 5 year bonds were issued on January 1st with a contract rate of 5% and market rate of 6%. Interest is paid semiannually. Calculate the amount of interest paid to bondholders on July 1st. O $4,200 $1,750 O $3,500 O $2,100

Step by Step Solution

3.48 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

1 Premium 2 True 3 1750 If the Bond interest rate is more than the market i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: Walter Jr. Harrison, Charles T. Horngren, C. William Thomas, Greg Berberich, Catherine Seguin

6th Canadian edition

134564146, 978-0134141091, 134141091, 978-0134564142

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App