Answered step by step

Verified Expert Solution

Question

1 Approved Answer

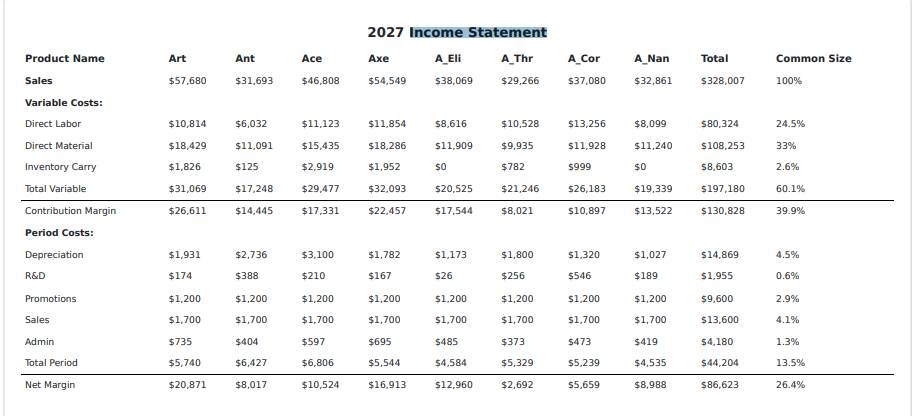

1 . Currently Art is charged $ 1 , 9 3 0 , 9 3 3 depreciation on the income statement of Andrews. Andrew planning

Currently Art is charged $ depreciation on the income statement of Andrews. Andrew planning for an increase in this depreciation on the Financial Statement of Andrews will this?

a Decrease net cash from operations on the cash flow statement.

b Increase net cash from operations on the cash flow statement.

c Have no impact on the net cash from operations previous depreciation.

d Just impact the balanced sheet.

Depreciation and Cash Flow:

Answers are as following which option is correct

Impact:c Have no impact on the net cash from operations on the cash flow statement.

Reasoning: Depreciation is a noncash expense. It reflects the allocation of an asset's cost over its useful life. While it reduces net income on the income statement, it doesn't involve any cash outflow. Cash flow statements track actual cash movements, so depreciation adjustments wouldn't affect net cash from operations.

Option c is correct

Increase net cash from operations on the cash flow statement. because the increase in operating cash flow is the tax shield on depreciation due to which the net income increases Income Statement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started