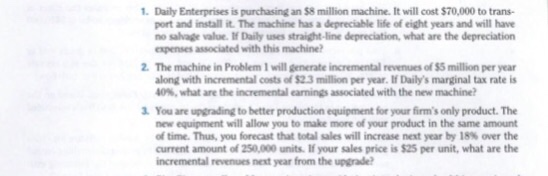

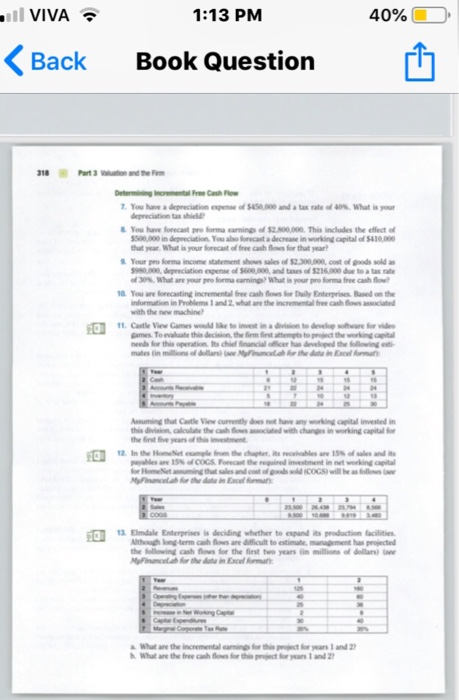

1. Daily Enterprises is purchasing an $8 million machine. It will cost $70,000 to trans- port and install it. The machine has a depreciable life of eight years and will have no salage value. If Daily uses straight-line depreciation, what are the depreciation epenses associated with this machine The machine in Problem 1 will generate incremental revenues of $5 million per year along with incremental costs of $2.3 million per year. If Daily's marginal tax rate is 40%, what are the incremental earnings associated with the new machine? 2. 3. You are upgrading to better production equipment for your firm's only product. The new equipment will allow you to make more of your product in the same amount of time. Thus, you forecast that total sales will increase next year by 18% over the current amount of 250,000 units. If your sales price is $25 per unit, what are the incremental revenues next year from the upgrade 40% (10, VIVA 1:13 PM Back Book Question 7. You havu adepreciation coense of $450, and a tax rate of 40%, what is your depreciation tax shiel You have forecast pro forma earnings of $2.800,000 This includes the effecto 500000 in depreciation You also forecast a decrease in working capital of $410.000 that year. WThat is your forecast of free cash flows for that year? Your pro forma income statement shows sales of $2.300000 ost of goods sold as 000 depreciation espense of 5600.00, and tanes of $216.000 due to a tas rate 3% What are your pro forma earnings? What is your pro forma free cash 10. You are forecasting incremental free ash Ims Daily Enterprises. Based on nformation in Problems 1 and 2, what ane the incremental free cash lows associated with the new machine 11 Castle View Games would like to invest in a division to develop soltware for vide games To valuate this decision the irm first attempts to project the working capital Assuming that Castle View curently does t have any working capital invested in this divisioncalculate the cash lows asociated with changs in working capital o the first ive years of this investment 2 the HomeNet eunele bum mbles an. 15% of COOS Fomast ee mp-ed investment in net working orHomeNet assuming that sales and ost of ds sold COGS) will be as ollows . its eecehalles are 15% of sales and its 3. Eindle Enterprises is deciding whether to expand its production faclities. lthough long-term cash ows are ifficult to estimate, management has projecte the following cash flows for the first two years in millions of dellars) e a Whait are the incremental earning for this peoject or years 1 and 2 h. Whait ane the free cash flows for this pject for years 1 and 2 1. Daily Enterprises is purchasing an $8 million machine. It will cost $70,000 to trans- port and install it. The machine has a depreciable life of eight years and will have no salage value. If Daily uses straight-line depreciation, what are the depreciation epenses associated with this machine The machine in Problem 1 will generate incremental revenues of $5 million per year along with incremental costs of $2.3 million per year. If Daily's marginal tax rate is 40%, what are the incremental earnings associated with the new machine? 2. 3. You are upgrading to better production equipment for your firm's only product. The new equipment will allow you to make more of your product in the same amount of time. Thus, you forecast that total sales will increase next year by 18% over the current amount of 250,000 units. If your sales price is $25 per unit, what are the incremental revenues next year from the upgrade 40% (10, VIVA 1:13 PM Back Book Question 7. You havu adepreciation coense of $450, and a tax rate of 40%, what is your depreciation tax shiel You have forecast pro forma earnings of $2.800,000 This includes the effecto 500000 in depreciation You also forecast a decrease in working capital of $410.000 that year. WThat is your forecast of free cash flows for that year? Your pro forma income statement shows sales of $2.300000 ost of goods sold as 000 depreciation espense of 5600.00, and tanes of $216.000 due to a tas rate 3% What are your pro forma earnings? What is your pro forma free cash 10. You are forecasting incremental free ash Ims Daily Enterprises. Based on nformation in Problems 1 and 2, what ane the incremental free cash lows associated with the new machine 11 Castle View Games would like to invest in a division to develop soltware for vide games To valuate this decision the irm first attempts to project the working capital Assuming that Castle View curently does t have any working capital invested in this divisioncalculate the cash lows asociated with changs in working capital o the first ive years of this investment 2 the HomeNet eunele bum mbles an. 15% of COOS Fomast ee mp-ed investment in net working orHomeNet assuming that sales and ost of ds sold COGS) will be as ollows . its eecehalles are 15% of sales and its 3. Eindle Enterprises is deciding whether to expand its production faclities. lthough long-term cash ows are ifficult to estimate, management has projecte the following cash flows for the first two years in millions of dellars) e a Whait are the incremental earning for this peoject or years 1 and 2 h. Whait ane the free cash flows for this pject for years 1 and 2