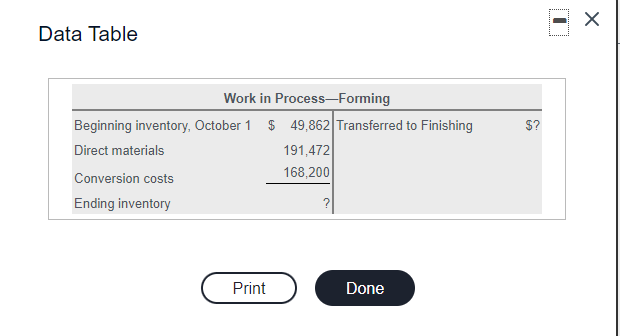

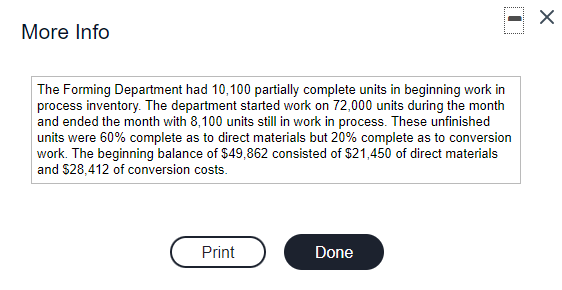

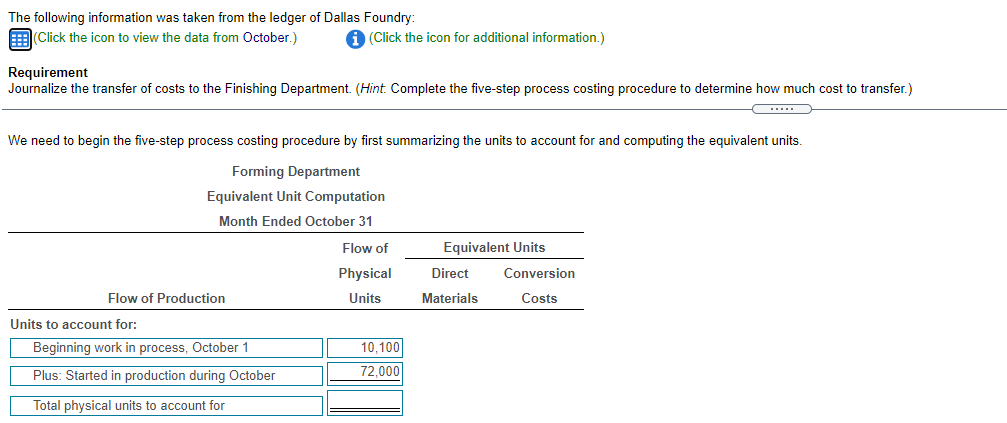

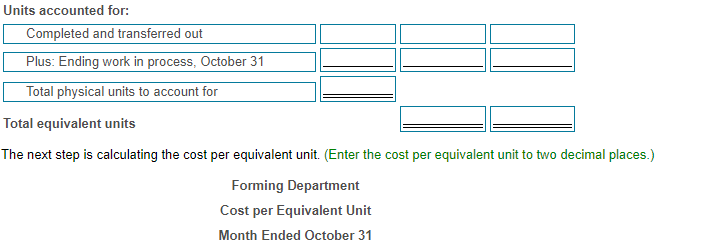

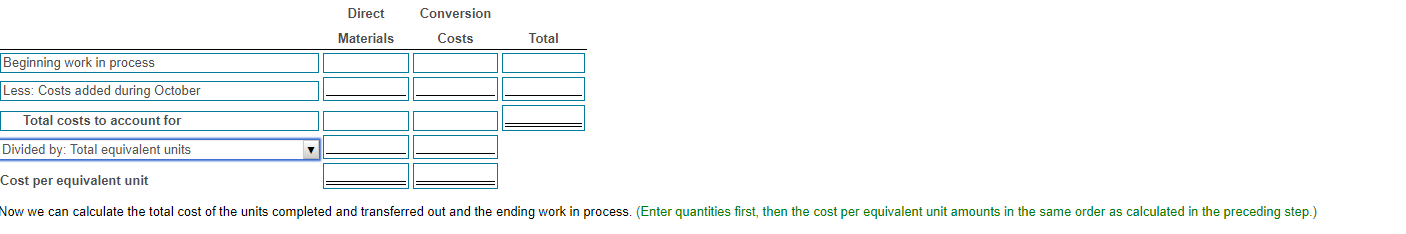

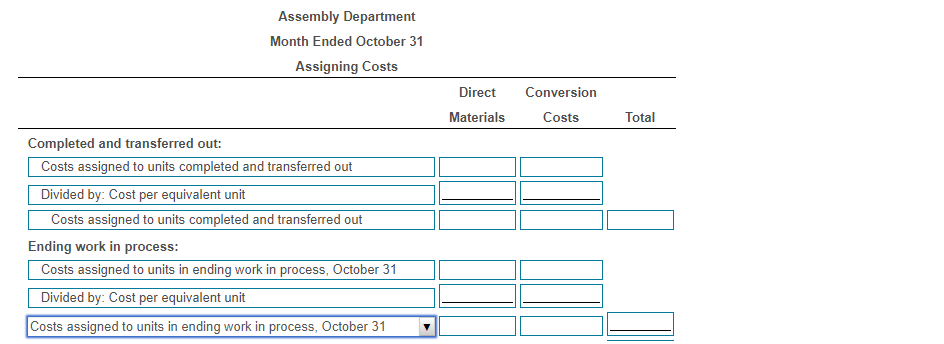

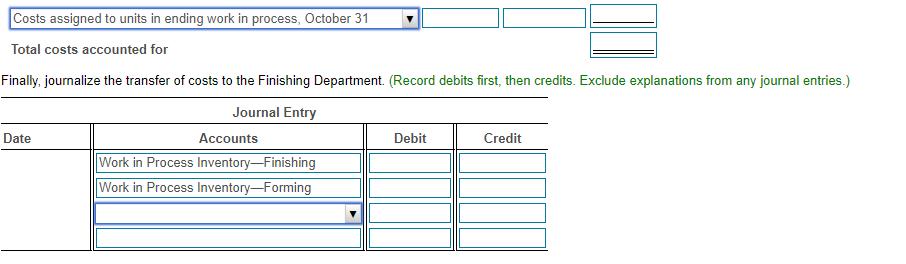

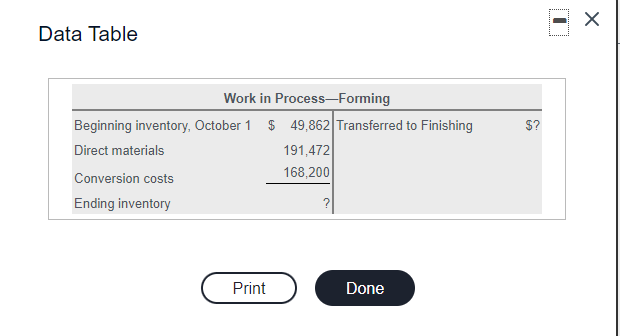

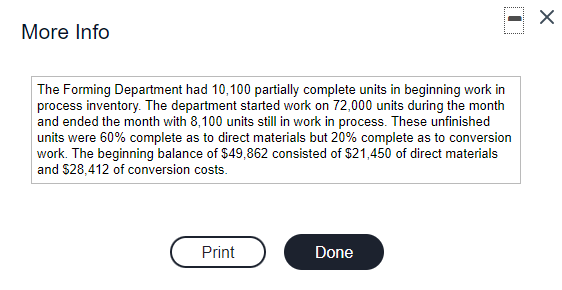

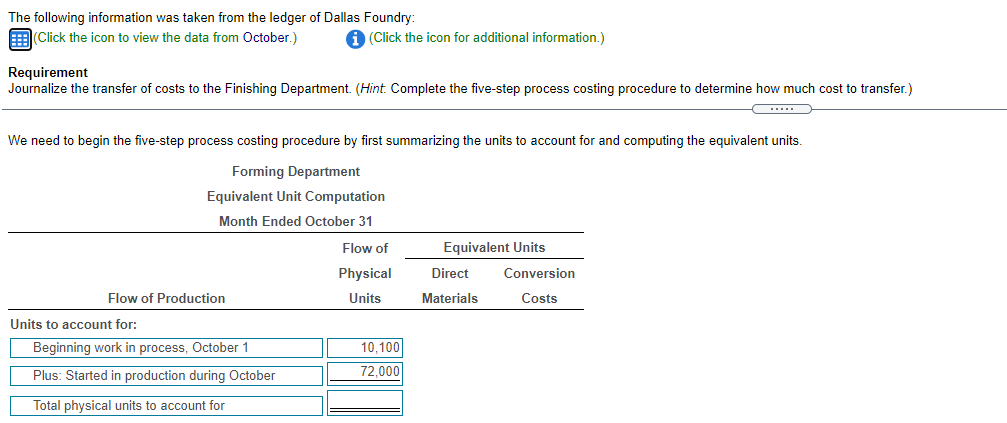

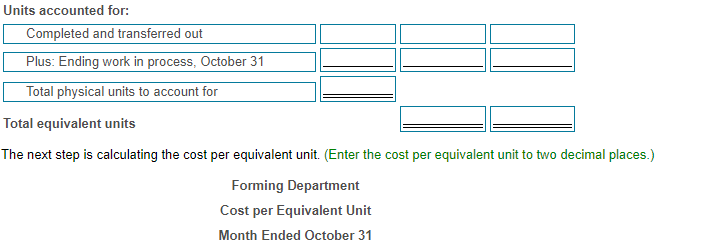

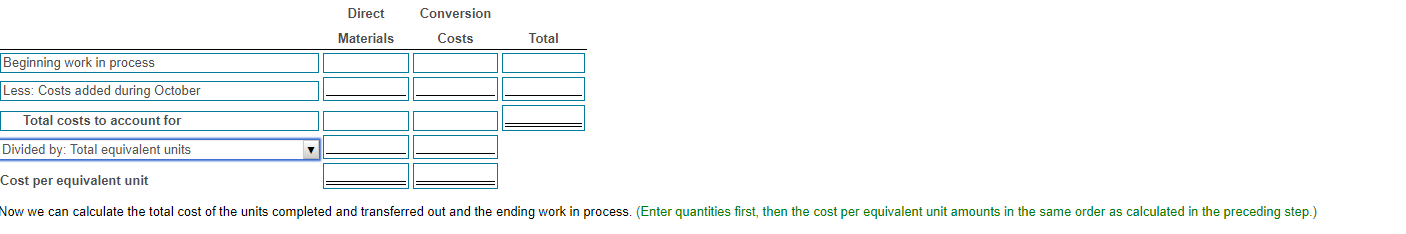

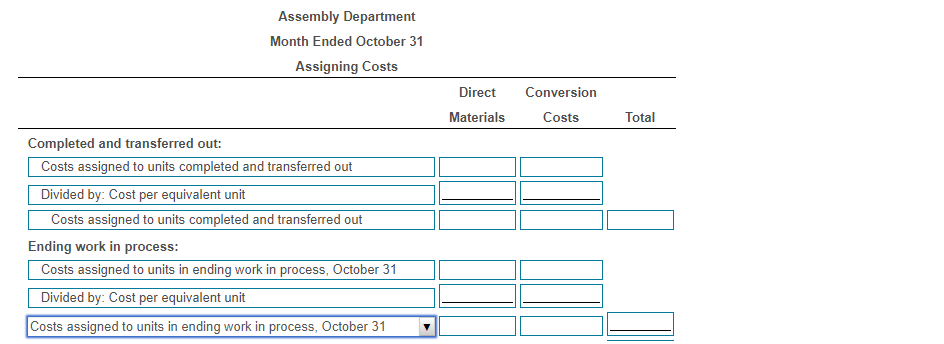

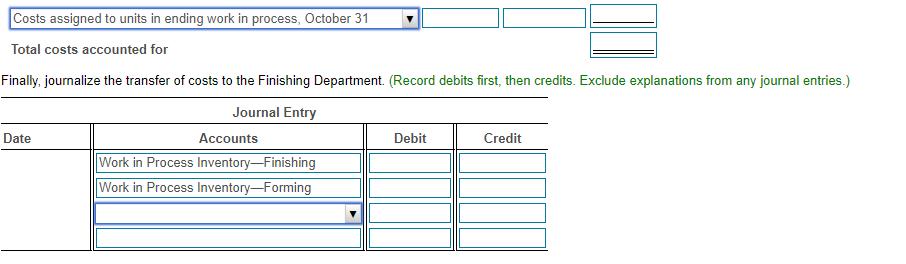

1 Data Table $? Work in ProcessForming Beginning inventory, October 1 $ 49,862 Transferred to Finishing Direct materials 191,472 Conversion costs 168,200 Ending inventory Print Done More Info The Forming Department had 10,100 partially complete units in beginning work in process inventory. The department started work on 72,000 units during the month and ended the month with 8,100 units still in work in process. These unfinished units were 60% complete as to direct materials but 20% complete as to conversion work. The beginning balance of $49,862 consisted of $21,450 of direct materials and $28,412 of conversion costs. Print Done The following information was taken from the ledger of Dallas Foundry: Click the icon to view the data from October.) (Click the icon for additional information.) Requirement Journalize the transfer of costs to the Finishing Department. (Hint. Complete the five-step process costing procedure to determine how much cost to transfer.) We need to begin the five-step process costing procedure by first summarizing the units to account for and computing the equivalent units. Forming Department Equivalent Unit Computation Month Ended October 31 Flow of Physical Units Equivalent Units Direct Conversion Materials Costs Flow of Production Units to account for: Beginning work in process, October 1 10,100 72,000 Plus: Started in production during October Total physical units to account for Units accounted for: Completed and transferred out Plus: Ending work in process, October 31 Total physical units to account for Total equivalent units The next step is calculating the cost per equivalent unit. (Enter the cost per equivalent unit to two decimal places.) Forming Department Cost per Equivalent Unit Month Ended October 31 Direct Conversion Materials Costs Total Beginning work in process Less: Costs added during October Total costs to account for Divided by: Total equivalent units Cost per equivalent unit Now we can calculate the total cost of the units completed and transferred out and the ending work in process. (Enter quantities first, then the cost per equivalent unit amounts in the same order as calculated in the preceding step.) Assembly Department Month Ended October 31 Assigning Costs Direct Conversion Costs Materials Total Completed and transferred out: Costs assigned to units completed and transferred out Divided by: Cost per equivalent unit Costs assigned to units completed and transferred out Ending work in process: Costs assigned to units in ending work in process, October 31 Divided by: Cost per equivalent unit Costs assigned to units in ending work in process, October 31 Costs assigned to units in ending work in process, October 31 Total costs accounted for Finally, journalize the transfer of costs to the Finishing Department. (Record debits first, then credits. Exclude explanations from any journal entries.) Journal Entry Date Accounts Debit Credit Work in Process Inventory-Finishing Work in Process Inventory-Forming