Answered step by step

Verified Expert Solution

Question

1 Approved Answer

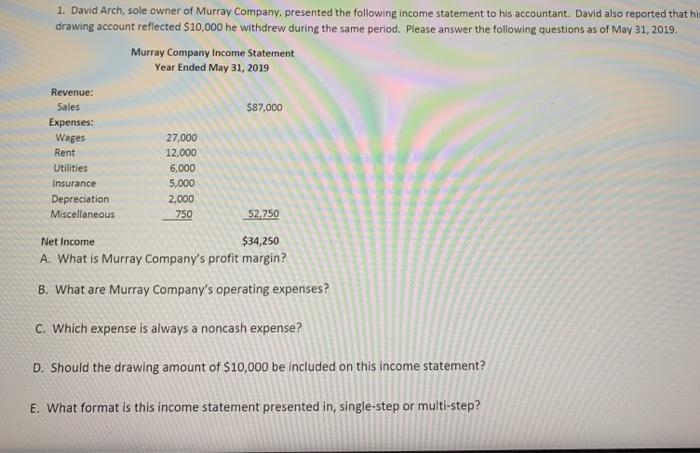

1. David Arch, sole owner of Murray Company, presented the following income statement to his accountant. David also reported that his drawing account reflected

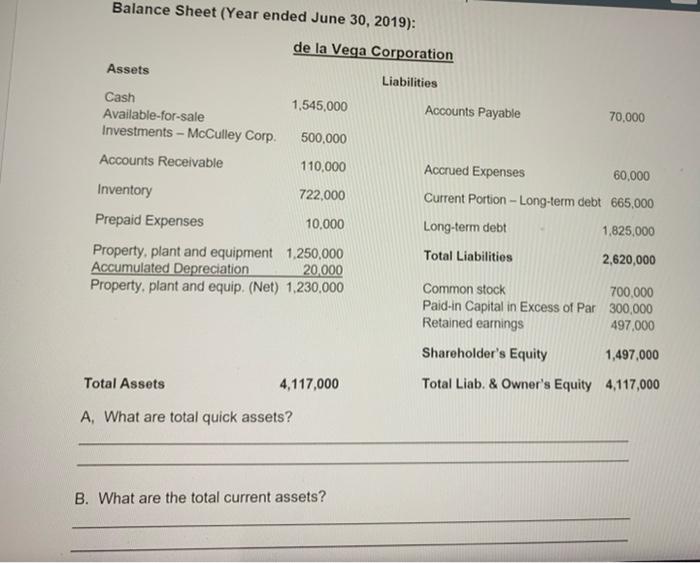

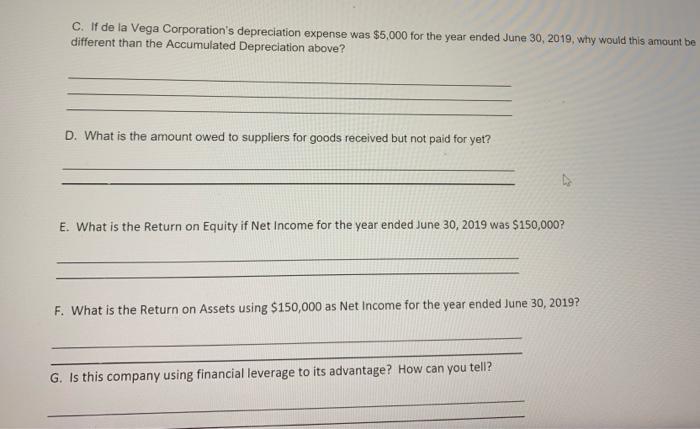

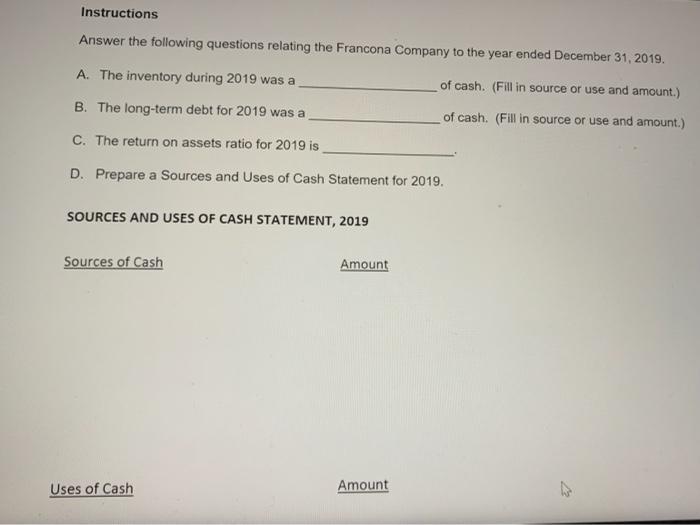

1. David Arch, sole owner of Murray Company, presented the following income statement to his accountant. David also reported that his drawing account reflected $10,000 he withdrew during the same period. Please answer the following questions as of May 31, 2019. Revenue: Sales Expenses: Wages Rent Utilities Insurance Depreciation Miscellaneous Murray Company Income Statement Year Ended May 31, 2019 27,000 12,000 6,000 5,000 2,000 750 $87,000 52,750 Net Income $34,250 A. What is Murray Company's profit margin? B. What are Murray Company's operating expenses? C. Which expense is always a noncash expense? D. Should the drawing amount of $10,000 be included on this income statement? E. What format is this income statement presented in, single-step or multi-step? Balance Sheet (Year ended June 30, 2019): Assets Cash 1,545,000 500,000 110,000 722,000 10,000 1,250,000 20,000 Property, plant and equip. (Net) 1,230,000 Available-for-sale Investments - McCulley Corp. Accounts Receivable Inventory Prepaid Expenses Property, plant and equipment Accumulated Depreciation de la Vega Corporation Liabilities Total Assets 4,117,000 A, What are total quick assets? B. What are the total current assets? Accounts Payable 70,000 Accrued Expenses 60,000 Current Portion - Long-term debt 665,000 Long-term debt 1,825,000 Total Liabilities 2,620,000 Common stock 700,000 Paid-in Capital in Excess of Par 300,000 Retained earnings 497,000 Shareholder's Equity 1,497,000 Total Liab. & Owner's Equity 4,117,000 C. If de la Vega Corporation's depreciation expense was $5,000 for the year ended June 30, 2019, why would this amount be different than the Accumulated Depreciation above? D. What is the amount owed to suppliers for goods received but not paid for yet? E. What is the Return on Equity if Net Income for the year ended June 30, 2019 was $150,000? F. What is the Return on Assets using $150,000 as Net Income for the year ended June 30, 2019? G. Is this company using financial leverage to its advantage? How can you tell? 3. Selected information from the comparative financial statements of Francona Company for the year ended December 31 appears below: Cash Accounts receivable (net) Inventory Property, plant and equipment Total assets Current liabilities Long-term debt Owner's equity Total liabilities and owner's equity Net sales Cost of goods sold Interest expense Income tax expense Net income Net cash provided by operating activities 2019 $370,000 $ 175,000 130,000 425,000 1,100,000 140,000 410,000 550,000 1,100,000 900,000 600,000 40,000 60,000 120,000 220,000 2018 $135,000 $200,000 170,000 295,000 800,000 110,000 300,000 390,000 800,000 700,000 530,000 25,000 29,000 85,000 135,000 Instructions Answer the following questions relating the Francona Company to the year ended December 31, 2019. A. The inventory during 2019 was a of cash. (Fill in source or use and amount.) B. The long-term debt for 2019 was a of cash. (Fill in source or use and amount.) C. The return on assets ratio for 2019 is D. Prepare a Sources and Uses of Cash Statement for 2019. SOURCES AND USES OF CASH STATEMENT, 2019 Sources of Cash Uses of Cash Amount Amount

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 A Answer 39 Explanations Profit Margin Net income Sales Net income 34250 Sales 87000 34250 87000 039 39 B Answer 13000 Explanations Utilities 6000 I...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started