Answered step by step

Verified Expert Solution

Question

1 Approved Answer

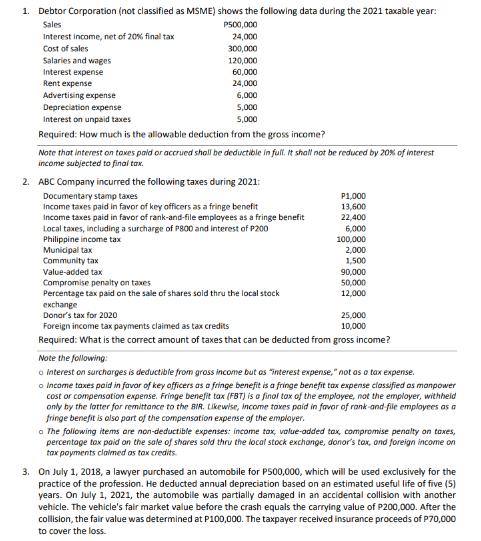

1. Debtor Corporation (not classified as MSME) shows the following data during the 2021 taxable year: Sales Interest income, net of 20% final tax

1. Debtor Corporation (not classified as MSME) shows the following data during the 2021 taxable year: Sales Interest income, net of 20% final tax Cost of sales Salaries and wages Interest expense Rent expense Advertising expense Depreciation expense P500,000 24,000 300,000 120,000 60,000 24,000 6,000 5,000 5,000 Interest on unpaid taxes Required: How much is the allowable deduction from the gross income? Note that interest on taxes paid or accrued shall be deductible in full. It shall not be reduced by 20% of interest income subjected to final tax. 2. ABC Company incurred the following taxes during 2021: Documentary stamp taxes Income taxes paid in favor of key officers as a fringe benefit Income taxes paid in favor of rank-and-file employees as a fringe benefit Local taxes, including a surcharge of P800 and interest of P200 P1,000 13,600 22,400 6,000 100,000 Philippine income tax Municipal tax Community tax Value-added tax Compromise penalty on taxes Percentage tax paid on the sale of shares sold thru the local stock exchange Donor's tax for 2020 Foreign income tax payments claimed as tax credits Required: What is the correct amount of taxes that can be deducted from gross income? 2,000 1,500 90,000 50,000 12,000 25,000 10,000 Note the following: o interest on surcharges is deductible from gross income but as "interest expense," not as a tax expense. o Income taxes paid in favor of key officers as a fringe benefit is a fringe benefit tax expense classified as manpower cost or compensation expense. Fringe benefit tax (FBT) is a final tax of the employee, not the employer, withheld only by the latter for remittance to the BIR. Likewise, income taxes paid in favor of rank-and-file employees as a fringe benefit is also part of the compensation expense of the employer. a The following items are non-deductible expenses: income tax, value-added tax, compromise penalty on taxes, percentage tox paid on the sale of shares sold thru the local stock exchange, donor's tax, and foreign income on tax payments claimed as tax credits 3. On July 1, 2018, a lawyer purchased an automobile for P500,000, which will be used exclusively for the practice of the profession. He deducted annual depreciation based on an estimated useful life of five (5) years. On July 1, 2021, the automobile was partially damaged in an accidental collision with another vehicle. The vehicle's fair market value before the crash equals the carrying value of P200,000. After the collision, the fair value was determined at P100,000. The taxpayer received insurance proceeds of P70,000 to cover the loss.

Step by Step Solution

★★★★★

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

1 Debtor Corporation Gross Income Sales P500000 Interest income net of 20 final tax P24000 Total Gro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started