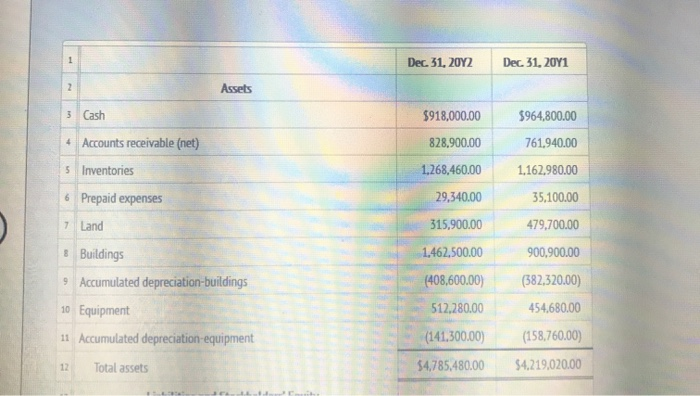

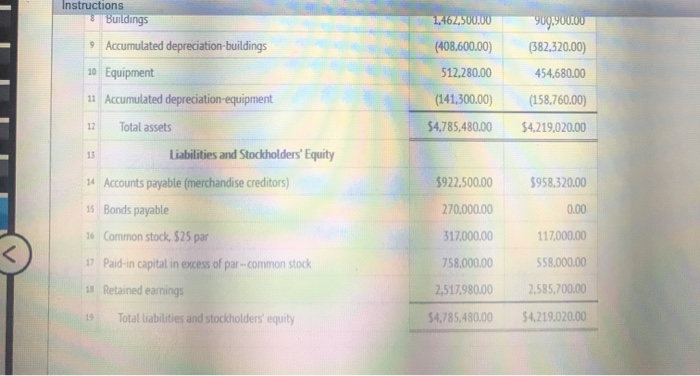

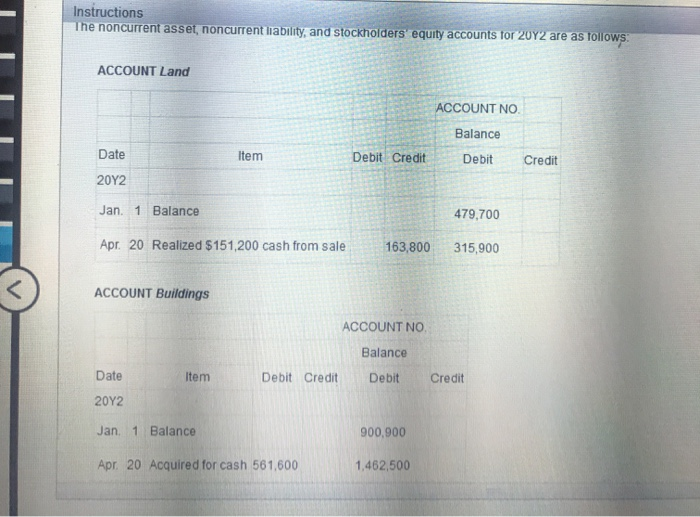

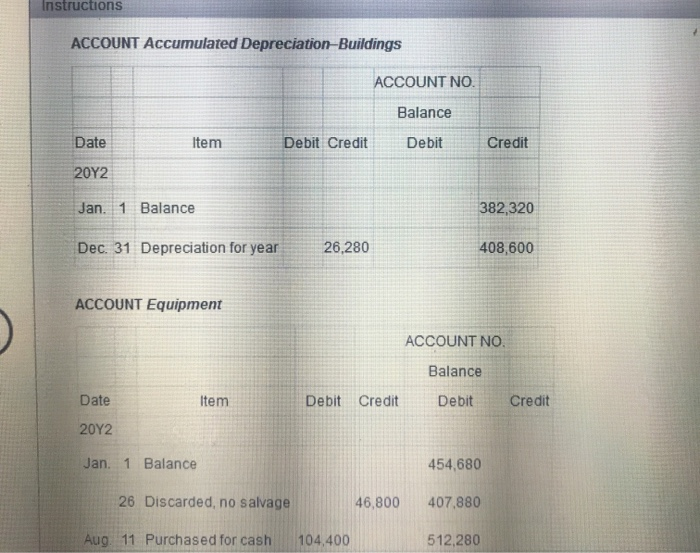

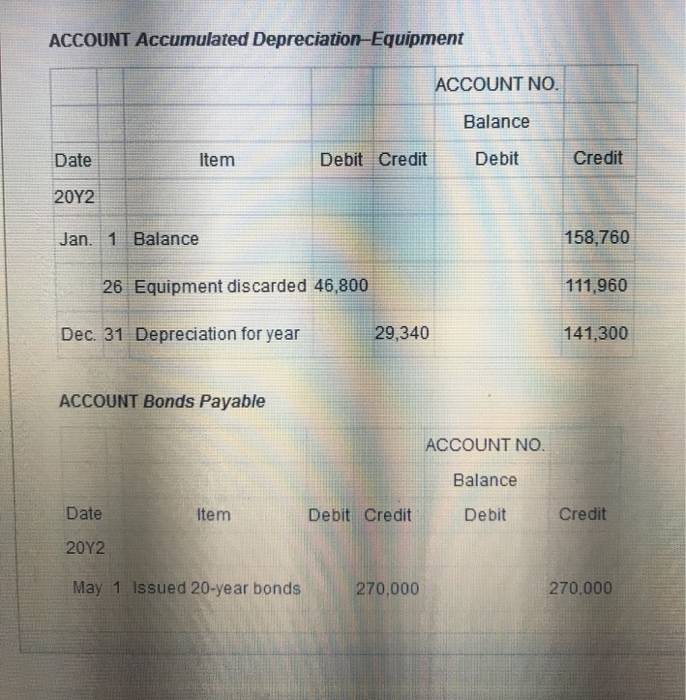

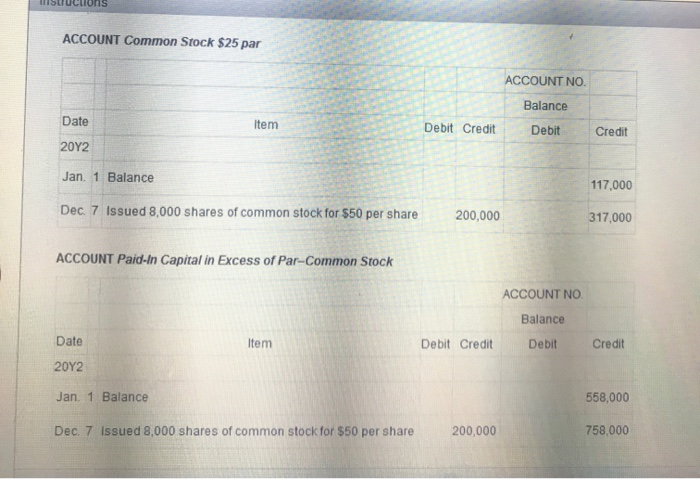

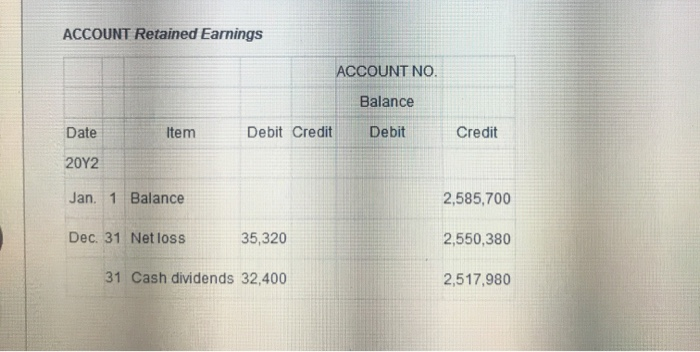

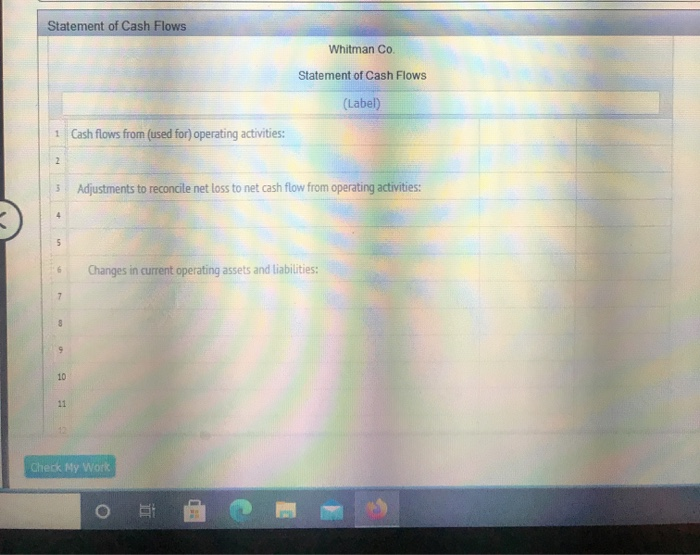

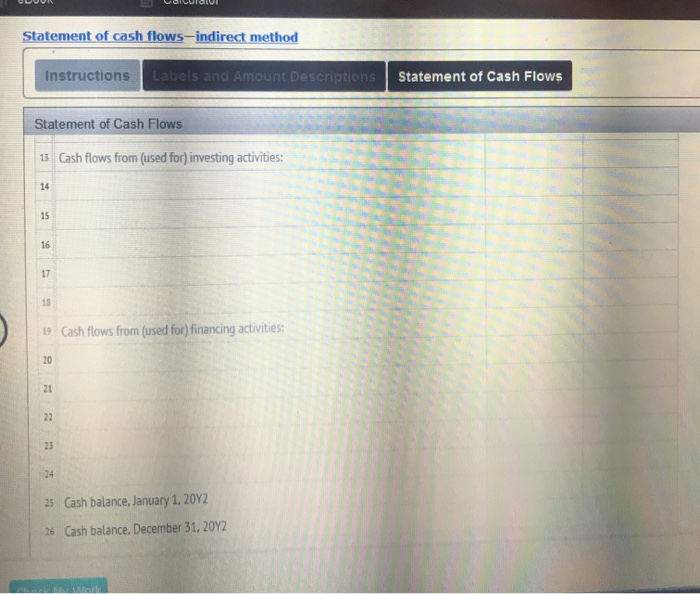

1 Dec 31, 2022 Dec 31, 2011 2 Assets 3 Cash $918,000.00 828,900.00 $964,800.00 761.940.00 + Accounts receivable (net) 5 Inventories 1,268,460.00 6 Prepaid expenses 29,340.00 1,162.980.00 35,100.00 479,700.00 7 Land 315,900.00 1.462.500.00 900,900.00 (408,600.00) (382,320.00) 8 Buildings 9 Accumulated depreciation buildings 10 Equipment 11 Accumulated depreciation equipment 512,280.00 454,680.00 (141,300.00) (158,760.00) 12 Total assets $4,785,480.00 $4,219,020,00 1,462,500.00 (408.600.00) 512.280.00 (141,300.00) Instructions Buildings 9 Accumulated depreciation-buildings 10 Equipment 11. Accumulated depreciation-equipment Total assets Liabilities and Stockholders' Equity 14 Accounts payable (merchandise creditors) 15 Bonds payable 16 Common stock, $25 par 909.900.00 (382,320.00) 454,680.00 (158.760.00) $4,219,020.00 12 $4,785,480.00 13 $922,500.00 $958.320.00 270,000.00 0.00 317,000.00 117,000.00 17 Paid-in capital in excess of par-common stock 758.000.00 558,000.00 13 Retained earnings 2,517.980.00 2,585,700.00 19 Total liabilities and stockholders' equity 54,785.480,00 $4,219.020.00 Instructions The noncurrent asset, noncurrent liability, and stockholders' equity accounts for 2012 are as follows: ACCOUNT Land ACCOUNT NO Balance Debit Date Item Debit Credit Credit 20Y2 Jan. 1 Balance 479,700 Apr. 20 Realized $151,200 cash from sale 163,800 315,900 ACCOUNT Buildings ACCOUNT NO Balance Date Item Debit Credit Debit Credit 2012 Jan 1 Balance 900,900 Apr. 20 Acquired for cash 561,600 1,462,500 Instructions ACCOUNT Accumulated Depreciation-Buildings ACCOUNT NO Balance Date Item Debit Credit Debit Credit 20Y2 Jan. 1 Balance 382,320 Dec. 31 Depreciation for year 26,280 408,600 ACCOUNT Equipment ACCOUNT NO. Balance Date Item Debit Credit Debit Credit 20Y2 Jan. 1 Balance 454,680 26 Discarded, no salvage 46,800 407,880 Aug. 11 Purchased for cash 104,400 512,280 ACCOUNT Accumulated Depreciation Equipment ACCOUNT NO. Balance Date Item Debit Credit Debit Credit 20Y2 Jan. 1 Balance 158,760 26 Equipment discarded 46,800 111,960 Dec. 31 Depreciation for year 29,340 141,300 ACCOUNT Bonds Payable ACCOUNT NO. Balance Date Item Debit Credit Debit Credit 20Y2 May 1 Issued 20-year bonds 270.000 270.000 ACCOUNT Common Stock $25 par ACCOUNT NO. Balance Date Item Debit Credit Debit Credit 20Y2 Jan. 1 Balance 117,000 Dec 7 Issued 8,000 shares of common stock for $50 per share 200,000 317,000 ACCOUNT Paid-In Capital in Excess of Par-Common Stock ACCOUNT NO Balance Date Item Debit Credit Debit Credit 2012 Jan. 1 Balance 558,000 Dec. 7 Issued 8,000 shares of common stock for $50 per share 200,000 758,000 ACCOUNT Retained Earnings ACCOUNT NO. Balance Date Item Debit Credit Debit Credit 20Y2 Jan 1 Balance 2,585,700 Dec. 31 Netloss 35,320 2,550,380 31 Cash dividends 32,400 2,517,980 Statement of Cash Flows Whitman Co. Statement of Cash Flows (Label) 1 Cash flows from (used for) operating activities: 2 3 Adjustments to reconcile net loss to net cash flow from operating activities: 4 5 Changes in current operating assets and liabilities: 7 3 10 11 Check My Work o Statement of cash flows-indirect method Instructions Labels and Amount Descriptions Statement of Cash Flows Statement of Cash Flows 13 Cash flows from (used for) investing activities: 14 15 16 17 13 19 Cash flows from (used for) financing activities: 20 21 22 23 24 25 Cash balance, January 1, 20Y2 26 Cash balance. December 31, 2012