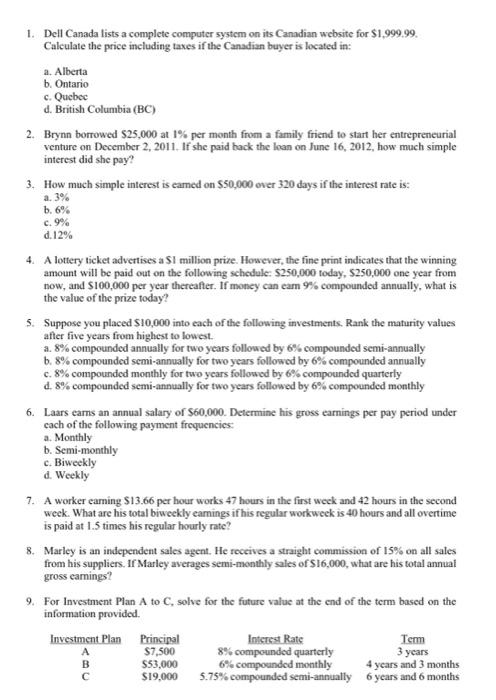

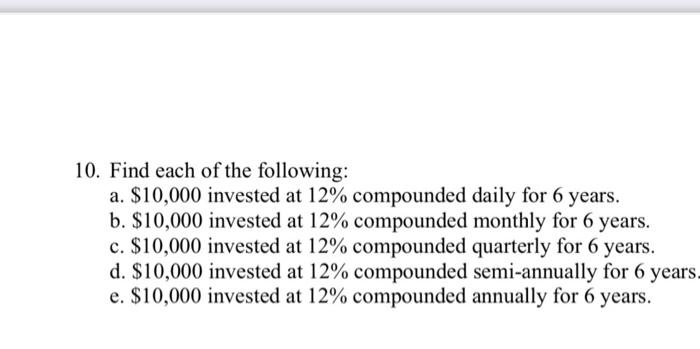

1. Dell Canada lists a complete computer system on its Canadian website for $1,999.99. Calculate the price including taxes if the Canadian buyer is located in: a. Alberta b. Ontario c. Quebec d. British Columbia (BC) 2. Brynn borrowed $25,000 at 1% per month from a family friend to start her entrepreneurial venture on December 2, 2011. If she paid back the loan on June 16, 2012, how much simple interest did she pay? 3. How much simple interest is eamed on $50,000 over 320 days if the interest rate is: a. 3% b. 6% c. 9% d. 12% 4. A lottery ticket advertises a $1 million prive. However, the fine print indicates that the winning amount will be paid out on the following schedule: $250,000 today, $250,000 one year from now, and $100,000 per year thereafter. If money can eam 9% compounded annually, what is the value of the prize today? 5. Suppose you placed $10,000 into each of the following investments. Rank the maturity values after five years from highest to lowest. a. 8% compounded annually for two years followed by 6% compounded semi-annually b. 8% compounded semi-annually for two years followed by 6% compounded annually c. 8% compounded monthly for two years followed by 6% compounded quarterly d. 8% compounded semi-annually for two years followed by 6% compounded monthly 6. Laars earns an annual salary of $60,000. Determine his gross earnings per pay period under cach of the following payment frequencies: a. Monthly b. Scmi-monthly c. Biweekly d. Weekly 7. A worker earning $13.66 per hour works 47 hours in the first weck and 42 hours in the second week. What are his total biweekly eamings if his regular workweek is 40 hours and all overtime is paid at 1.5 times his regular hourly rate? 8. Marley is an independent sales agent. He reccives a straight commission of 15% on all sales from his suppliers. If Marley averages semi-monthly sales of $16,000, what are his total annual gross camings? 9. For Investment Plan A to C, solve for the future value at the end of the term based on the information provided. 10. Find each of the following: a. $10,000 invested at 12% compounded daily for 6 years. b. $10,000 invested at 12% compounded monthly for 6 years. c. $10,000 invested at 12% compounded quarterly for 6 years. d. $10,000 invested at 12% compounded semi-annually for 6 years e. $10,000 invested at 12% compounded annually for 6 years