Identifying Outstanding Checks and Deposits in Transit and Preparing a Bank Reconciliation and Journal Entries The August bank statement and cash T-account for Martha Company

- Identifying Outstanding Checks and Deposits in Transit and Preparing a Bank Reconciliation and Journal Entries

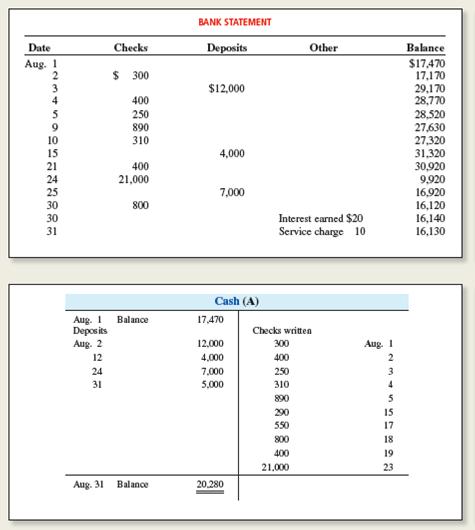

The August bank statement and cash T-account for Martha Company follow:

No deposits were in transit and no checks were outstanding at the end of July.

Required:

1. Identify and list the deposits in transit at the end of August.

TIP: Put a check mark beside each item that appears on both the bank statement and what’s already been recorded in the accounting records (shown in the T-account).

2. Identify and list the outstanding checks at the end of August.

3. Prepare a bank reconciliation for August.

TIP: Any item in the accounting records without check marks should appear on the bank statement side of the bank reconciliation. Any items in the bank statement without check marks should appear on the company’s books side of the bank reconciliation.

4. Give any journal entries that the company should make as a result of the bank reconciliation.

5. After the reconciliation journal entries are posted, what balance will be reflected in the Cash account in the ledger?

6. If the company also has $100 of petty cash on hand, which is recorded in a different account called Petty Cash on Hand, what total amount of Cash and Cash Equivalents should be reported on the August 31 balance sheet?

BANK STATEMENT Date Checks Deposits Other Balance Aug. ! $17,470 17,170 29,170 28,770 $ 300 $12,000 4 400 250 890 28,520 27,630 9. 310 27,320 31,320 30,920 9,920 16,920 16,120 16,140 4,000 15 21 400 21,000 24 25 7,000 30 800 30 Interest carned $20 31 Service charge 16,130 Cash (A) Aug. 1 Deposits Aug. 2 Balance 17,470 Checks written 12,000 300 Aug. 1 12 4,000 400 24 7,000 250 3. 31 5,000 310 4 890 5 290 15 550 17 800 18 400 19 21.000 23 Aug. 31 Balance 20.280

Step by Step Solution

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Ques 1 d 400 Comparing the bank statement and cash statement the deposit in tr...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started