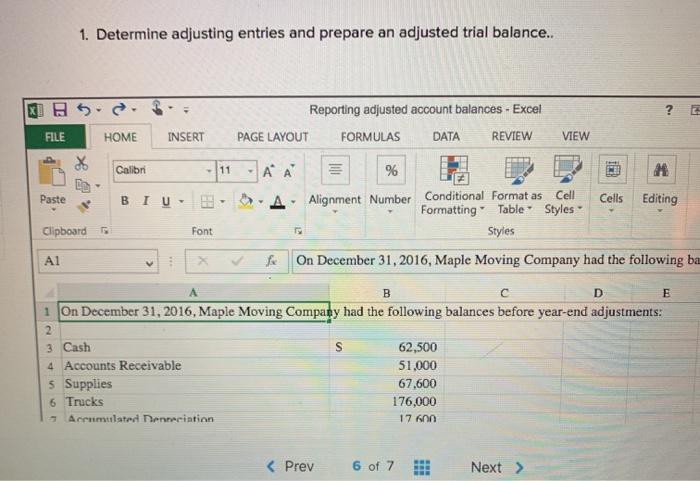

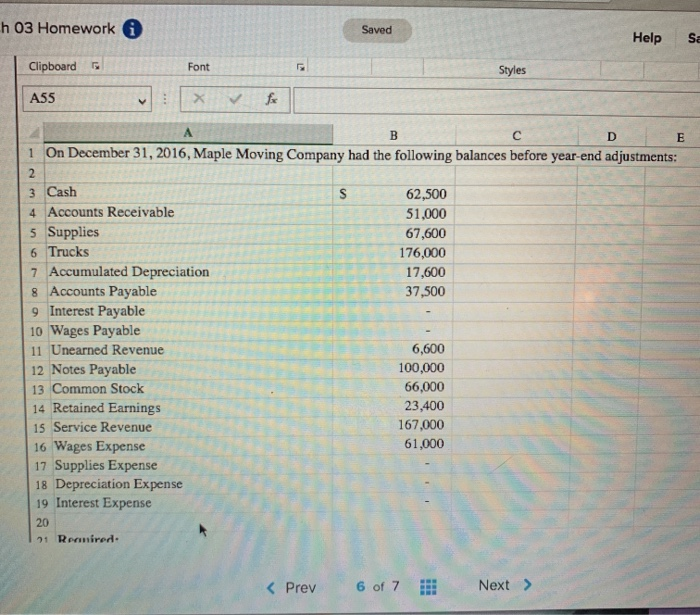

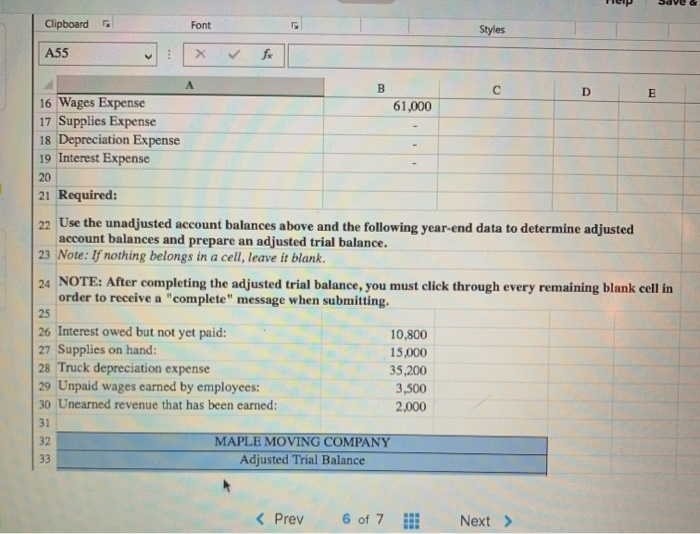

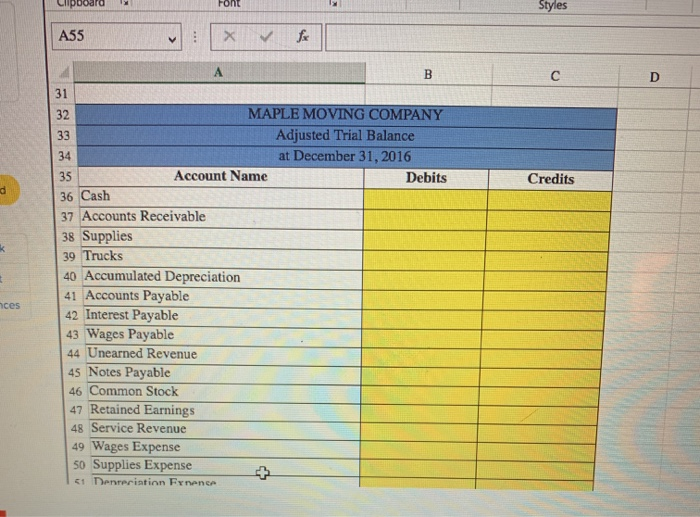

1. Determine adjusting entries and prepare an adjusted trial balance.. XI. ? IN Reporting adjusted account balances - Excel PAGE LAYOUT FORMULAS DATA REVIEW FILE HOME INSERT VIEW Calibri - 11 -A Paste BIU A % Alignment Number Conditional Format as Cell Formatting" Table Styles Styles Cells Editing Clipboard Font A1 fx On December 31, 2016, Maple Moving Company had the following ba B D E 1 On December 31, 2016, Maple Moving Company had the following balances before year-end adjustments: 2 3 Cash S 62,500 4 Accounts Receivable 51,000 5 Supplies 67,600 6 Trucks 176,000 Accumulated Tenreciation 17 600 7 h 03 Homework Saved Help sa Clipboard Font Styles A55 V X fx B D E 1 On December 31, 2016, Maple Moving Company had the following balances before year-end adjustments: 2 3 Cash S 62,500 4 Accounts Receivable 51,000 5 Supplies 67,600 6 Trucks 176,000 7 Accumulated Depreciation 17,600 8 Accounts Payable 37,500 9 Interest Payable 10 Wages Payable 11 Unearned Revenue 6,600 12 Notes Payable 100,000 13 Common Stock 66,000 14 Retained Earnings 23,400 15 Service Revenue 167,000 16 Wages Expense 61,000 17 Supplies Expense 18 Depreciation Expense 19 Interest Expense 20 21 Rerumired. IND Clipboard Font Styles A55 fx A D E B 16 Wages Expense 61,000 17 Supplies Expense 18 Depreciation Expense 19 Interest Expense 20 21 Required: 22 Use the unadjusted account balances above and the following year-end data to determine adjusted account balances and prepare an adjusted trial balance. 23 Note: If nothing belongs in a cell, leave it blank. 24 NOTE: After completing the adjusted trial balance, you must click through every remaining blank cell in order to receive a "complete" message when submitting. 25 26 Interest owed but not yet paid: 10,800 27 Supplies on hand: 15,000 28 Truck depreciation expense 35,200 29 Unpaid wages earned by employees: 3,500 30 Unearned revenue that has been earned: 2,000 31 32 MAPLE MOVING COMPANY 33 Adjusted Trial Balance Font Styles A55 fx B D Credits d K 31 32 MAPLE MOVING COMPANY 33 Adjusted Trial Balance 34 at December 31, 2016 35 Account Name Debits 36 Cash 37 Accounts Receivable 38 Supplies 39 Trucks 40 Accumulated Depreciation 41 Accounts Payable 42 Interest Payable 43 Wages Payable 44 Unearned Revenue 45 Notes Payable 46 Common Stock 47 Retained Earnings 48 Service Revenue 49 Wages Expense 50 Supplies Expense