Answered step by step

Verified Expert Solution

Question

1 Approved Answer

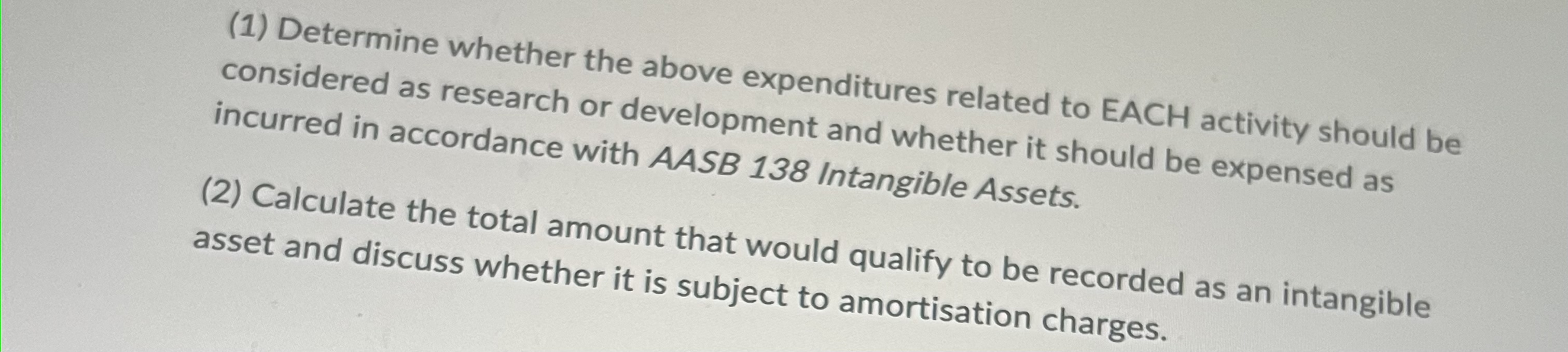

(1) Determine whether the above expenditures related to EACH activity should be considered as research or development and whether it should be expensed as

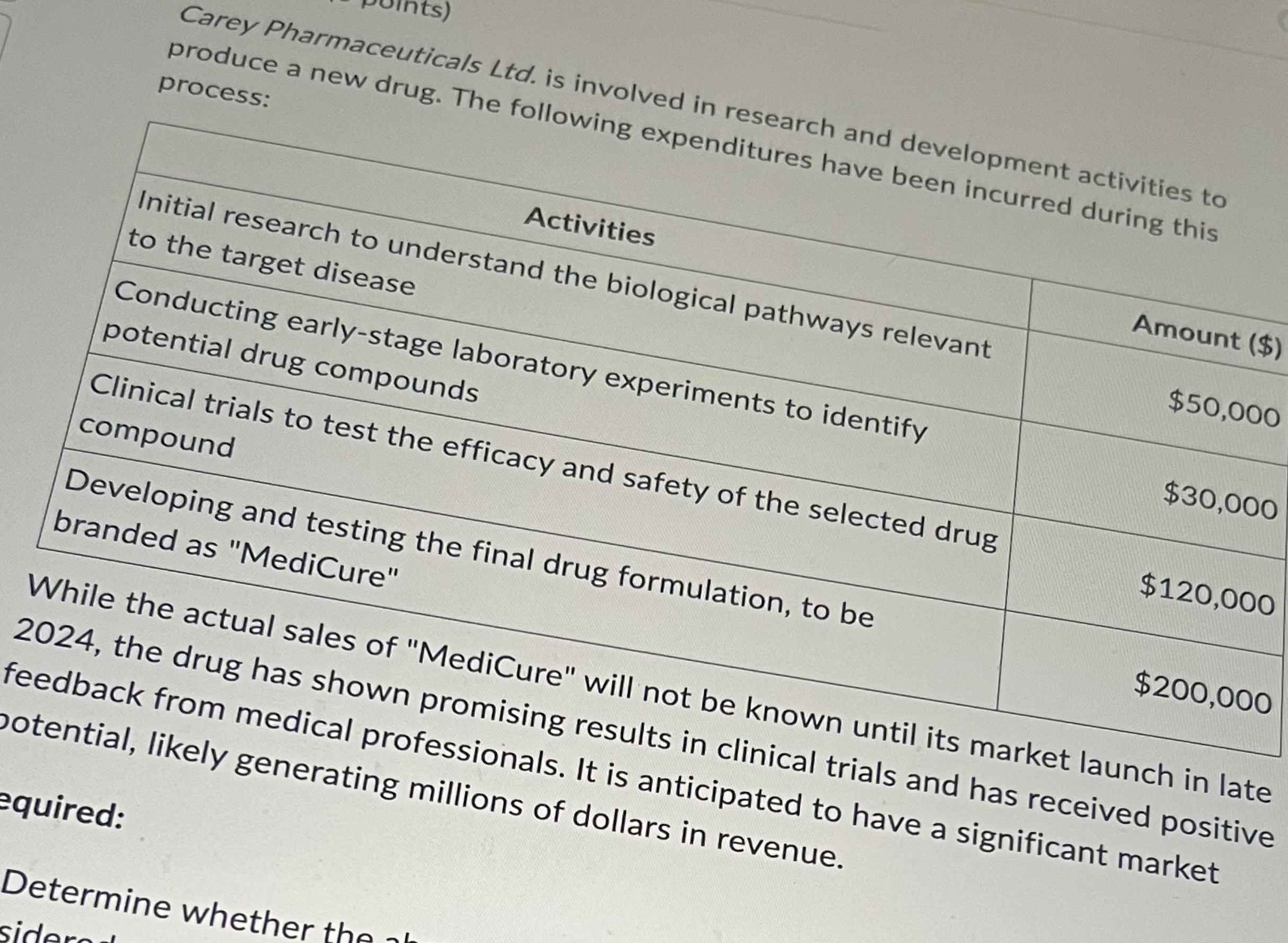

(1) Determine whether the above expenditures related to EACH activity should be considered as research or development and whether it should be expensed as incurred in accordance with AASB 138 Intangible Assets. (2) Calculate the total amount that would qualify to be recorded as an intangible asset and discuss whether it is subject to amortisation charges. Carey Pharmaceuticals Ltd. is involved in research and development activities to produce a new drug. The following expenditures have been incurred during this process: Activities Amount ($) Initial research to understand the biological pathways relevant to the target disease $50,000 Conducting early-stage laboratory experiments to identify $30,000 potential drug compounds Clinical trials to test the efficacy and safety of the selected drug compound $120,000 Developing and testing the final drug formulation, to be branded as "MediCure" $200,000 While the actual sales of "MediCure" will not be known until its market launch in late 2024, the drug has shown promising results in clinical trials and has received positive feedback from medical professionals. It is anticipated to have a significant market potential, likely generating millions of dollars in revenue. equired: Determine whether the sidere

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started