Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Develop a monthly cash budget for Bluffton Pharmacy for the upcoming year. 2. If you were Bluffton Pharmacy's banker, would you be comfortable extending

1. Develop a monthly cash budget for Bluffton Pharmacy for the upcoming year.

2. If you were Bluffton Pharmacy's banker, would you be comfortable extending a line of credit to the pharmacy?

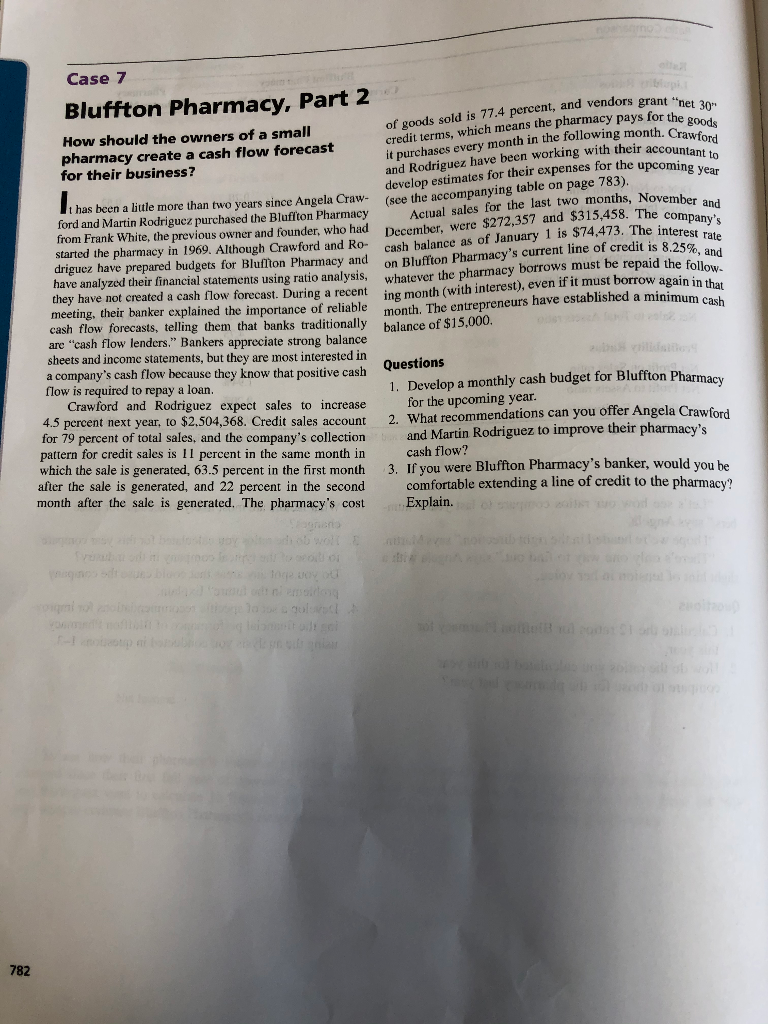

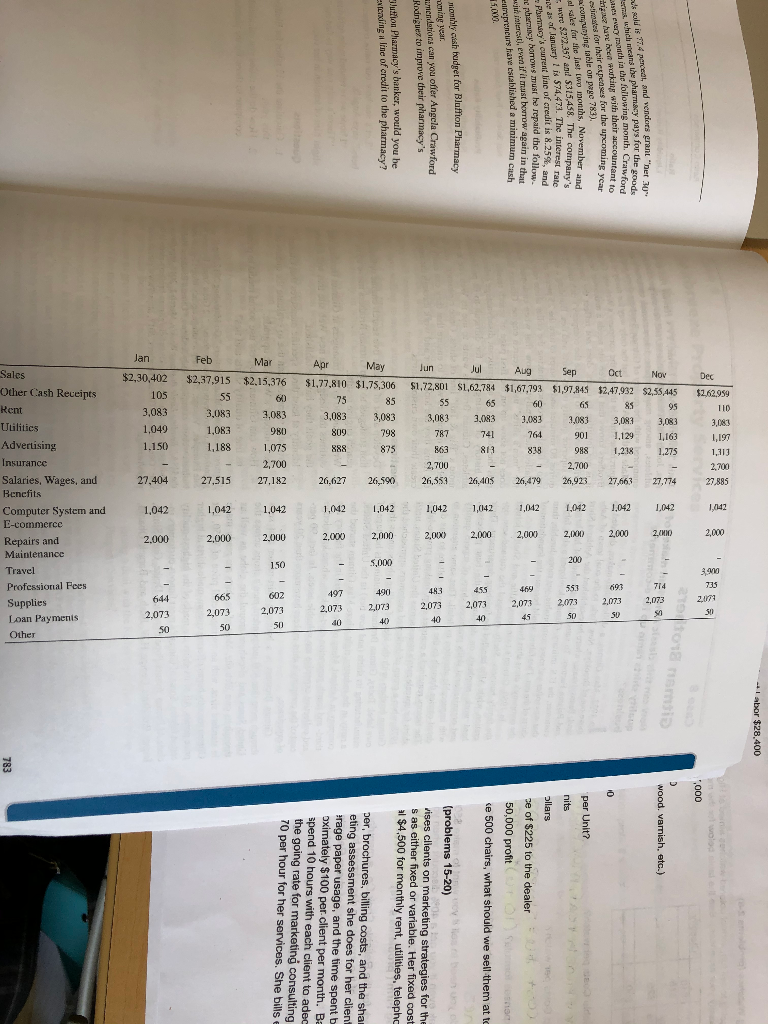

dors grant "net 30" ays for the goods month. Crawford the upcoming year November and The interest rate e repaid the follow- Case 7 Bluffton Pharmacy, Part 2 of goods sold is 77.4 percent, and vendors grant How should the owners of a small credit terms, which means ms, which means the pharmacy pays for the pharmacy create a cash flow forecast it purchases every month in the following month. for their business? ey have been working with their accounta develop estimates for their expenses for the upcomin 2) ana the necompanying table on page It has been a little more than two years since Angela Craw- ford and Martin Rodriguez purchased the Bluffton Pharmacy Actual sales for the last two months, Novemh from Frank White, the previous owner and founder, who had December, were $272,357 and $315,458. The ce started the pharmacy in 1969. Although Crawford and Ro cash balance as of January 1 is $74,473. The intere driguez have prepared budgets for Bluflton Pharmacy and on Bluffton Pharmacy's current line of credit is 8.25% have analyzed their financial statements using ratio analysis, using ratio analysis, whatever the pharmacy borrows must be repaid the foll they have not created a cash flow forecast. During a recent ine month (with interest), even if it must borrow again in th meeting, their banker explained the importance of reliable month The entrepreneurs have established a minimum cash cash flow forecasts, telling them that banks traditionally are "cash flow lenders." Bankers appreciate strong balance balance of $15,000. sheets and income statements, but they are most interested in a company's cash flow because they know that positive cash Questions flow is required to repay a loan. 1. Develop a monthly cash budget for Bluffton Pharmac Crawford and Rodriguez expect sales to increase for the upcoming year. 4.5 percent next year, to $2.504,368. Credit sales account 2. What recommendations can you offer Angela Crawford for 79 percent of total sales, and the company's collection and Martin Rodriguez to improve their pharmacy's pattern for credit sales is Il percent in the same month in cash flow? which the sale is generated, 63.5 percent in the first month after the sale is generated, and 22 percent in the second 3. If you were Bluffton Pharmacy's banker, would you be comfortable extending a line of credit to the pharmacy? month after the sale is generated. The pharmacy's cost E xplain. bordowoltt D oor du blog od niemi 10 782 extenxing line of credit to the pharmacy? Slution Pharmacy's banker, would you be ning year. Rodrigues to improve their pharmacy's mendations can you offer Angela Crawford monthly cash budget for Bluffton Pharmacy time jih interest), even if zumepreneurs have said ac pharminc borows er bare wyr $22.357 al which micans le pa Phucys current line of credit is 8.25%, and com using table on page 783) at e as ar lancut' ? 18 374.47. The interest rate for their expenses for the al sales for alle Jast two montas, November and S DOTDW again in that y auts sold is 77.4 perced, and vendors grant "ner perty manha e Orlowing month, Crawf a minimum Cash 3,438. The company's repard the follow en wokalist with their accountan coming ye pays for the Jan Feb Mar $2,15,376 Apr $1,77,810 75 May $1,75,306 85 Aug $1,67,793 Nov $2,55,445 09 $2,30,402 105 3,083 1,049 1.150 Sep Oct $1,97,845 $2,47,932 65 3,083 3,083 85 $2,37,915 55 3,083 1,083 1,188 $80"E Jun Jul $1.72.801 $1,62,784 55 65 3,083 3.083 787 741 663813 2,700 26,553 26.405 Dec $2.62.959 TID 3,083 1,197 80'E 086 $80'S 3,083 809 888 798 875 3.083 764 838 901 6211 91' 886 1,218 1,275 1,113 1,075 2,700 27,182 2,700 2 6,923 2.700 27.885 27,404 27,515 26,590 26,479 27,663 LL'IZ Sales Other Cash Receipts Rent Utilitics Advertising Insurance Salaries, Wages, and Benefits Computer System and E-commerce Repairs and Maintenance Travel Professional Fees Supplies Loan Payments Other 1,0421,0421,042 26,627 1,042 2,000 0*1 Z' ZO' CHO'L 1,042 1,042 1,042 1,042 2,000 2,000 2.000 2.000 2,000 2,000 2.MN 2,100 2,000 2,000 2.000 150 5,000 200 3.900 553 269 735 209 490 2,073 665 2,073 483 2,073 2.072 2,073 2,073 2,073 644 2,073 so 2.073 2,073 50 as 417 50 n neratio -1 abor $28.400 000'. wood. vamish, etc.) 70 per hour for her services. She bills the going rate for marketing consulting spend 10 hours with each client to adec oximately $100 per client per month. Ba erage paper usage, and the time spent b eting assessment she does for her clieni per, brochures, billing costs, and the sha (problems 15-20) # $4,500 for monthly rent, utilities, telepho s as either fixed or variable. Her fixed cost vises clients on marketing strategies for the ollars nits 50,000 profit per Unit? se of $225 to the dealer e 500 chairs, what should we sell them at toStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started