Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 - Dillons Corporation, made credit sales of $30,000 which are subject to 6% sales tax. The corporation also made cash sales which totaled

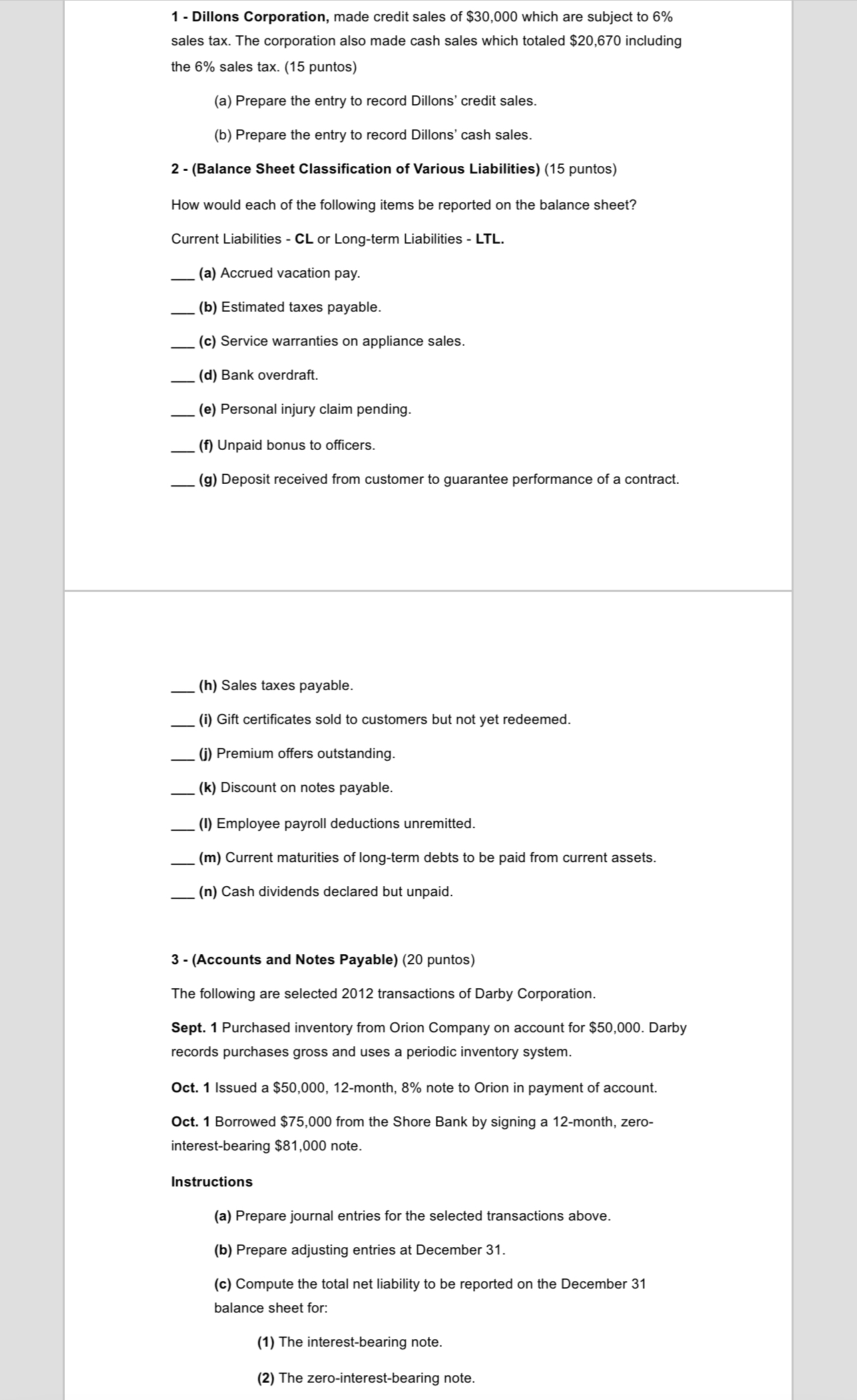

1 - Dillons Corporation, made credit sales of $30,000 which are subject to 6% sales tax. The corporation also made cash sales which totaled $20,670 including the 6% sales tax. (15 puntos) (a) Prepare the entry to record Dillons' credit sales. (b) Prepare the entry to record Dillons' cash sales. 2- (Balance Sheet Classification of Various Liabilities) (15 puntos) How would each of the following items be reported on the balance sheet? Current Liabilities - CL or Long-term Liabilities - LTL. (a) Accrued vacation pay. (b) Estimated taxes payable. (c) Service warranties on appliance sales. (d) Bank overdraft. (e) Personal injury claim pending. (f) Unpaid bonus to officers. (g) Deposit received from customer to guarantee performance of a contract. (h) Sales taxes payable. (i) Gift certificates sold to customers but not yet redeemed. (j) Premium offers outstanding. (k) Discount on notes payable. (I) Employee payroll deductions unremitted. (m) Current maturities of long-term debts to be paid from current assets. (n) Cash dividends declared but unpaid. 3-(Accounts and Notes Payable) (20 puntos) The following are selected 2012 transactions of Darby Corporation. Sept. 1 Purchased inventory from Orion Company on account for $50,000. Darby records purchases gross and uses a periodic inventory system. Oct. 1 Issued a $50,000, 12-month, 8% note to Orion in payment of account. Oct. 1 Borrowed $75,000 from the Shore Bank by signing a 12-month, zero- interest-bearing $81,000 note. Instructions (a) Prepare journal entries for the selected transactions above. (b) Prepare adjusting entries at December 31. (c) Compute the total net liability to be reported on the December 31 balance sheet for: (1) The interest-bearing note. (2) The zero-interest-bearing note.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started