1. Discuss the message that's hidden in the financial ratios you collected/calculated. Provide suggestions if possible A: Ratio Analysis for Year 2021 Ratio Current Ratio

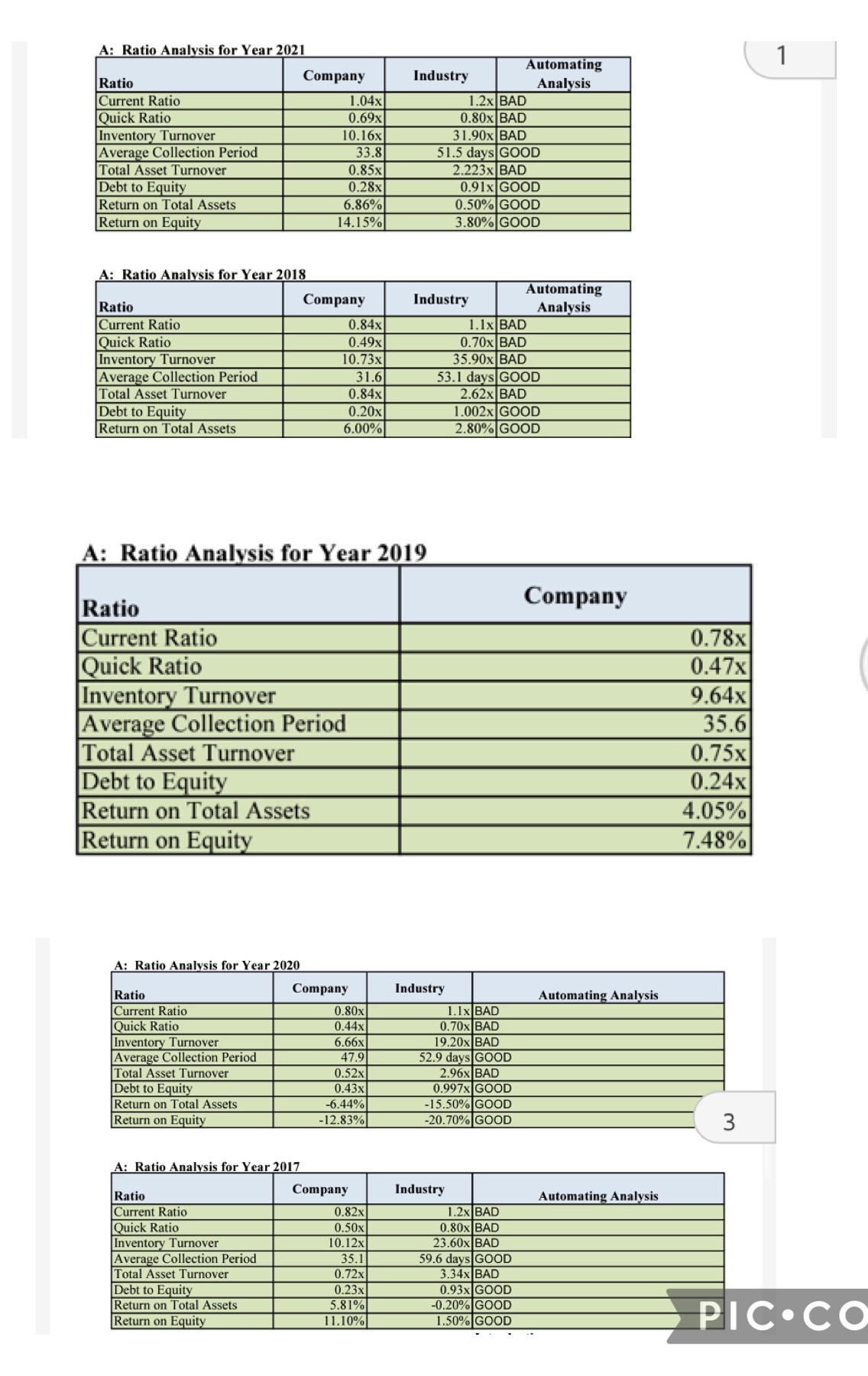

1. Discuss the message that's hidden in the financial ratios you collected/calculated. Provide suggestions if possible

A: Ratio Analysis for Year 2021 Ratio Current Ratio Quick Ratio Inventory Turnover Average Collection Period Total Asset Turnover Debt to Equity Return on Total Assets Return on Equity A: Ratio Analysis for Year 2018 Ratio Current Ratio Quick Ratio Inventory Turnover Average Collection Period Total Asset Turnover Debt to Equity Return on Total Assets Ratio Current Ratio Quick Ratio A: Ratio Analysis for Year 2020 Total Asset Turnover Debt to Equity Return on Total Assets Return on Equity Ratio Current Ratio Quick Ratio Inventory Turnover Average Collection Period Company Total Asset Turnover Debt to Equity Return on Total Assets Return on Equity Inventory Turnover Average Collection Period A: Ratio Analysis for Year 2019 A: Ratio Analysis for Year 2017 Ratio Current Ratio Quick Ratio 1.04x 0.69x 10.16x 33.8 0.85x 0.28x Inventory Turnover Average Collection Period Total Asset Turnover Debt to Equity Return on Total Assets Return on Equity 6.86% 14.15% Company 0.84x 0.49x 10.73x 31.6 0.84x 0.20x 6.00% Company 0.80x 0.44x 6.66x 47.9 0.52x 0.43x -6.44% -12.83% Company 0.82x 0.50x 10.12x Industry 35.1 0.72x 0.23x 5.81% 11.10% 1.2x BAD 0.80x BAD 31.90x BAD 51.5 days GOOD 2.223x BAD 0.91x GOOD Industry Industry 0.50% GOOD 3.80% GOOD 53.1 days GOOD 2.62x BAD 1.1x BAD 0.70x BAD 35.90x BAD 1.1x| BAD 0.70x BAD 19.20x BAD Industry Automating Analysis 52.9 days GOOD 2.96x BAD 0.997x GOOD 1.002x GOOD 2.80% GOOD -15.50% GOOD -20.70% GOOD Automating Analysis 1.2x BAD 0.80x BAD 23.60x BAD 59.6 days GOOD 3.34x BAD 0.93x GOOD -0.20% GOOD 1.50% GOOD Company Automating Analysis Automating Analysis 0.78x 0.47x 9.64x 35.6 0.75x 0.24x 4.05% 7.48% 3 1 PIC CO

Step by Step Solution

3.35 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

Hidden Messages in the Financial Ratios The financial ratios for Company A reveal several key messages about its financial performance and health Liqu...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started