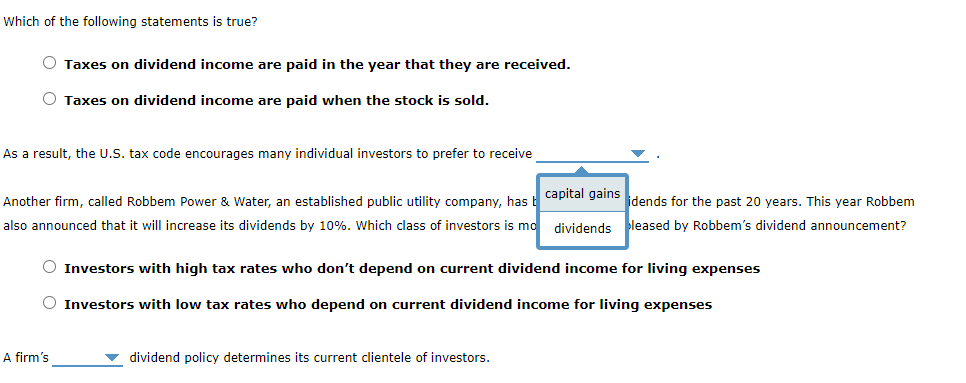

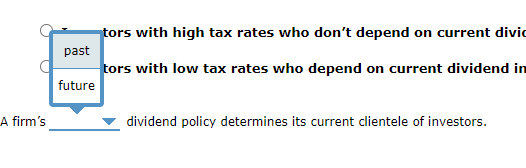

1. Dividend policy A firm's value depends on its expected free cash flow and its cost of capital. Distributions made in the form of dividends or stock repurchases impact the firm's value and the investors in different ways. In some cases, analysts notice that groups of similar investors tend to flock to stocks that have dividend policies consistent with their financial needs. This circumstance is an illustration of: the clientele effect. the residual dividend policy. dividend irrelevance theory. the signaling hypothesis. Consider the case of Blue Water Producers Inc., and answer the question that follows: Blue Water Producers Inc. is an oil drilling company and has some free cash flow that is not expected to be used to finance future growth or potential investment projects. The company plans to distribute its free cash flow to its shareholders but is still deciding whether the distribution should take the form of a stock repurchase or the payment of a cash dividend. Which of the following is a characteristic of a firm's optimal dividend policy? It maximizes the firm's stock price. It maximizes the firm's return on equity. It maximizes the firm's total assets. It maximizes the firm's earnings per share. Which of the following statements is true? O Taxes on dividend income are paid in the year that they are received. O Taxes on dividend income are paid when the stock is sold. As a result, the U.S. tax code encourages many individual investors to prefer to receive Another firm, called Robbem Power & Water, an established public utility company, has capital gains dends for the past 20 years. This year Robbem also announced that it will increase its dividends by 10%. Which class of investors is mo dividends pleased by Robbem's dividend announcement? Investors with high tax rates who don't depend on current dividend income for living expenses Investors with low tax rates who depend on current dividend income for living expenses A firm's dividend policy determines its current clientele of investors. past tors with high tax rates who don't depend on current divi tors with low tax rates who depend on current dividend in future A firm's dividend policy determines its current clientele of investors