Answered step by step

Verified Expert Solution

Question

1 Approved Answer

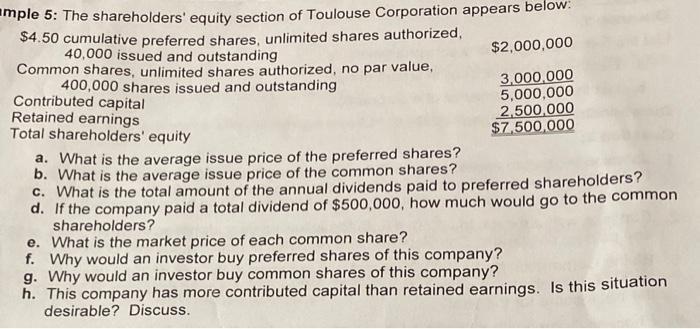

mple 5: The shareholders' equity section of Toulouse Corporation appears belo $4.50 cumulative preferred shares, unlimited shares authorized, 40,000 issued and outstanding $2,000,000 Common

mple 5: The shareholders' equity section of Toulouse Corporation appears belo $4.50 cumulative preferred shares, unlimited shares authorized, 40,000 issued and outstanding $2,000,000 Common shares, unlimited shares authorized, no par value, 400,000 shares issued and outstanding Contributed capital Retained earnings Total shareholders' equity 3,000,000 5,000,000 2,500,000 $7,500,000 a. What is the average issue price of the preferred shares? b. What is the average issue price of the common shares? c. What is the total amount of the annual dividends paid to preferred shareholders? d. If the company paid a total dividend of $500,000, how much would go to the common shareholders? e. What is the market price of each common share? f. Why would an investor buy preferred shares of this company? g. Why would an investor buy common shares of this company? h. This company has more contributed capital than retained earnings. Is this situation desirable? Discuss.

Step by Step Solution

★★★★★

3.44 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

a The average issue price of the preferred shares is 50 per share b The average issue price of the c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started