Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Download BIR Forms 1700 AND 2316 Version 2018 at www.bir.gov.ph. 2. Input ALL the necessary information in the returns (see below). 3. Compute

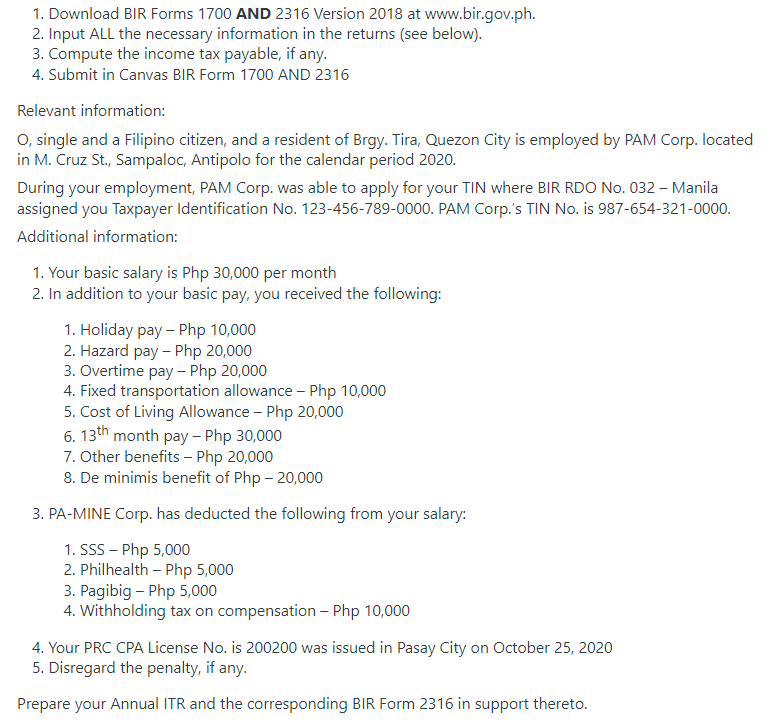

1. Download BIR Forms 1700 AND 2316 Version 2018 at www.bir.gov.ph. 2. Input ALL the necessary information in the returns (see below). 3. Compute the income tax payable, if any. 4. Submit in Canvas BIR Form 1700 AND 2316 Relevant information: O, single and a Filipino citizen, and a resident of Brgy. Tira, Quezon City is employed by PAM Corp. located in M. Cruz St., Sampaloc, Antipolo for the calendar period 2020. During your employment, PAM Corp. was able to apply for your TIN where BIR RDO No. 032 - Manila assigned you Taxpayer Identification No. 123-456-789-0000. PAM Corp.'s TIN No. is 987-654-321-0000. Additional information: 1. Your basic salary is Php 30,000 per month 2. In addition to your basic pay, you received the following: 1. Holiday pay - Php 10,000 2. Hazard pay - Php 20,000 3. Overtime pay - Php 20,000 4. Fixed transportation allowance - Php 10,000 5. Cost of Living Allowance - Php 20,000 6. 13th month pay - Php 30,000 7. Other benefits - Php 20,000 8. De minimis benefit of Php - 20,000 3. PA-MINE Corp. has deducted the following from your salary: 1. SSS - Php 5,000 2. Philhealth - Php 5,000 3. Pagibig - Php 5,000 4. Withholding tax on compensation - Php 10,000 4. Your PRC CPA License No. is 200200 was issued in Pasay City on October 25, 2020 5. Disregard the penalty, if any. Prepare your Annual ITR and the corresponding BIR Form 2316 in support thereto.

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To compute your income tax payable and prepare your Annual Income Tax Return ITR using BIR Form 1700 for the year 2020 and the corresponding BIR Form ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started