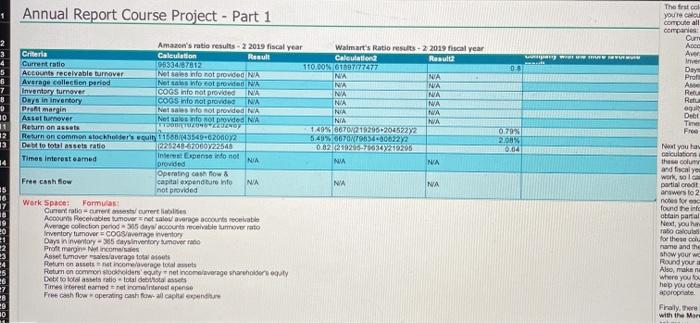

1. Download the attached excel file. It contains various ratlos that need to be calculated for Amazon & Walmart. Calculate your ratios based on the financial statements at the end of the attached excel file. To assist with calculations, see my chapter 18 supplements 2. Next, calculate the ratios contained in the attache excel workbook. Round your answers to 2 decimal places. Also, if you use outside information, make notes for each calculation as to where you found the information. This will help you obtain partial information if appropriate 3. Finally, you have a column called Company with the More Favorable result. In this column you will identify which company has the more favorable result for each ratio and why it is more favorable The rol Annual Report Course Project - Part 1 your compute all companies Qur Atel WETTE wer 0 Day Prof AN 2 3 4 5 6 7 8 3 10 11 12 13 NA Re Retu NA Debe Time 079 2700% 0704 14 Amazon's ratio results - 2 2019 fiscal year Walmart's Ratio results-22019 fiscal year Criteria Caleulation Result Calculation Resulta 9833437012 Current ratio 110.DON 61007777477 Accounts receivable turnover No no not provided NA INA NA Average collection period Net ante tot provided NA NA NA Inventory turnover COGS to not provided NA NA Days in inventory COGS hilo not provide NA NA NA Pret margin Net als info not provided NA NA NA Assoltanover Net als info not provided NA DONO NA Return on assets 1,49% 667021,206+20452272 Return on common stockholder's quity 116.80/4554962002 5.49%87079634-067272 Debt to total assets ratio 12252406000122640 0.0220020617100349210205 Times Interesteamed Interest Expens info not NA provided NA NA Operating cash flow & Free canh sow capital expenditure Info NA NA NA not provided Work Space Formulas Gumentation et les Acoours Recebe umover a average contabile Average collection period your receivable uoverrato Inventory turnover = COGS average inventory Dar invidays inventory tumoverrato Asetumover waverage total Return on assets not come average total Return on common sholders'uty net incomaleverage shareholder ty De tool ratio local debat Times best and retinom interestepense Free cash flow operating cash flow all capital 25 10 10 F. Next you a Galculations thu and fiscale work, solo partial croot answers to 2 notes for 00 found the info obtain partial Next, your rabowo for those rame and the show your Round your Also, makan where you to help you or appropriate Frally, there with the Mar 20 1. Download the attached excel file. It contains various ratlos that need to be calculated for Amazon & Walmart. Calculate your ratios based on the financial statements at the end of the attached excel file. To assist with calculations, see my chapter 18 supplements 2. Next, calculate the ratios contained in the attache excel workbook. Round your answers to 2 decimal places. Also, if you use outside information, make notes for each calculation as to where you found the information. This will help you obtain partial information if appropriate 3. Finally, you have a column called Company with the More Favorable result. In this column you will identify which company has the more favorable result for each ratio and why it is more favorable The rol Annual Report Course Project - Part 1 your compute all companies Qur Atel WETTE wer 0 Day Prof AN 2 3 4 5 6 7 8 3 10 11 12 13 NA Re Retu NA Debe Time 079 2700% 0704 14 Amazon's ratio results - 2 2019 fiscal year Walmart's Ratio results-22019 fiscal year Criteria Caleulation Result Calculation Resulta 9833437012 Current ratio 110.DON 61007777477 Accounts receivable turnover No no not provided NA INA NA Average collection period Net ante tot provided NA NA NA Inventory turnover COGS to not provided NA NA Days in inventory COGS hilo not provide NA NA NA Pret margin Net als info not provided NA NA NA Assoltanover Net als info not provided NA DONO NA Return on assets 1,49% 667021,206+20452272 Return on common stockholder's quity 116.80/4554962002 5.49%87079634-067272 Debt to total assets ratio 12252406000122640 0.0220020617100349210205 Times Interesteamed Interest Expens info not NA provided NA NA Operating cash flow & Free canh sow capital expenditure Info NA NA NA not provided Work Space Formulas Gumentation et les Acoours Recebe umover a average contabile Average collection period your receivable uoverrato Inventory turnover = COGS average inventory Dar invidays inventory tumoverrato Asetumover waverage total Return on assets not come average total Return on common sholders'uty net incomaleverage shareholder ty De tool ratio local debat Times best and retinom interestepense Free cash flow operating cash flow all capital 25 10 10 F. Next you a Galculations thu and fiscale work, solo partial croot answers to 2 notes for 00 found the info obtain partial Next, your rabowo for those rame and the show your Round your Also, makan where you to help you or appropriate Frally, there with the Mar 20