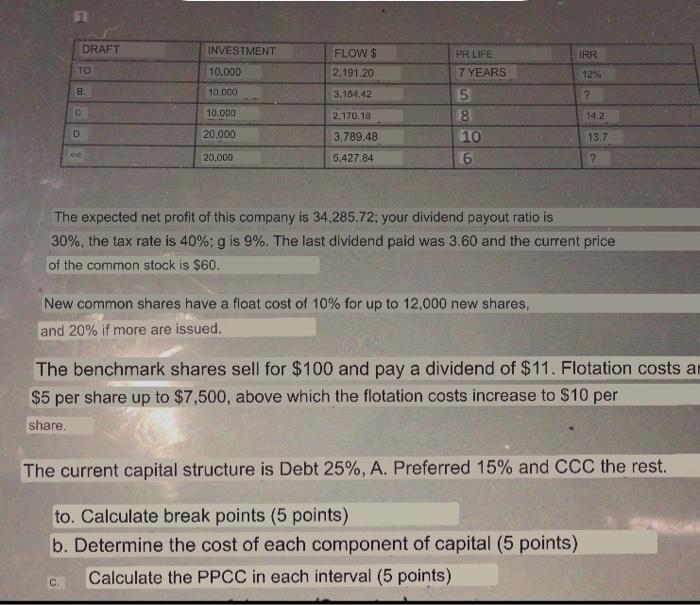

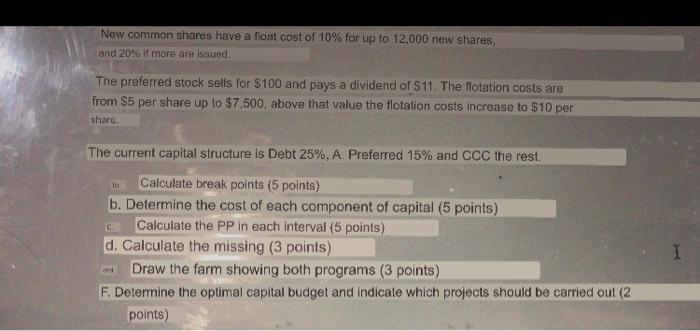

1 DRAFT INVESTMENT IRR FLOW $ 2.191.20 PR LIFE 7 YEARS TO 10,000 12% B. 10.000 3,154,42 2 C 10.000 14.2 2,170.18 3,789.48 5 8 10 6 D 20.000 13.7 20.000 5.427.84 2 The expected net profit of this company is 34.285.72; your dividend payout ratio is 30%, the tax rate is 40%;g is 9%. The last dividend paid was 3.60 and the current price of the common stock is $60. New common shares have a float cost of 10% for up to 12,000 new shares, and 20% if more are issued. The benchmark shares sell for $100 and pay a dividend of $11. Flotation costs an $5 per share up to $7,500, above which the flotation costs increase to $10 per share. The current capital structure is Debt 25%, A. Preferred 15% and CCC the rest. to. Calculate break points (5 points) b. Determine the cost of each component of capital (5 points) Calculate the PPCC in each interval (5 points) New common shares have a float cost of 10% for up to 12,000 new shares and 20% if moro are issued. The preferred stock sells for $100 and pays a dividend of $11. The flotation costs are from $5 per share up to $7,500, above that value the flotation costs increase to $10 per share The current capital structure is Debt 25%, A Preferred 15% and CCC the rest. lo 0 Calculate break points (5 points) b. Determine the cost of each component of capital (5 points) Calculate the PP in each interval (5 points) d. Calculate the missing (3 points) Draw the farm showing both programs (3 points) F. Determine the optimal capital budget and indicate which projects should be carried out (2 points) I 1 DRAFT INVESTMENT IRR FLOW $ 2.191.20 PR LIFE 7 YEARS TO 10,000 12% B. 10.000 3,154,42 2 C 10.000 14.2 2,170.18 3,789.48 5 8 10 6 D 20.000 13.7 20.000 5.427.84 2 The expected net profit of this company is 34.285.72; your dividend payout ratio is 30%, the tax rate is 40%;g is 9%. The last dividend paid was 3.60 and the current price of the common stock is $60. New common shares have a float cost of 10% for up to 12,000 new shares, and 20% if more are issued. The benchmark shares sell for $100 and pay a dividend of $11. Flotation costs an $5 per share up to $7,500, above which the flotation costs increase to $10 per share. The current capital structure is Debt 25%, A. Preferred 15% and CCC the rest. to. Calculate break points (5 points) b. Determine the cost of each component of capital (5 points) Calculate the PPCC in each interval (5 points) New common shares have a float cost of 10% for up to 12,000 new shares and 20% if moro are issued. The preferred stock sells for $100 and pays a dividend of $11. The flotation costs are from $5 per share up to $7,500, above that value the flotation costs increase to $10 per share The current capital structure is Debt 25%, A Preferred 15% and CCC the rest. lo 0 Calculate break points (5 points) b. Determine the cost of each component of capital (5 points) Calculate the PP in each interval (5 points) d. Calculate the missing (3 points) Draw the farm showing both programs (3 points) F. Determine the optimal capital budget and indicate which projects should be carried out (2 points)