Question

1. Draw a simple diagram of Nanzhang Securities Traditional Cost System. Label your diagram as completely as possible based on the data. 2. Based on

1. Draw a simple diagram of Nanzhang Securities Traditional Cost System. Label your diagram as completely as possible based on the data.

2. Based on the traditional cost system, compute the profitability of the two sales divisions, HSO and GSO.

3A. HSO is not happy with the way that the traditional accounting system (SOPAS) allocates costs. Explain why HSO is not happy. Be specific and cite facts from the case.

3B. Do you agree with their perspective? Why or why not?

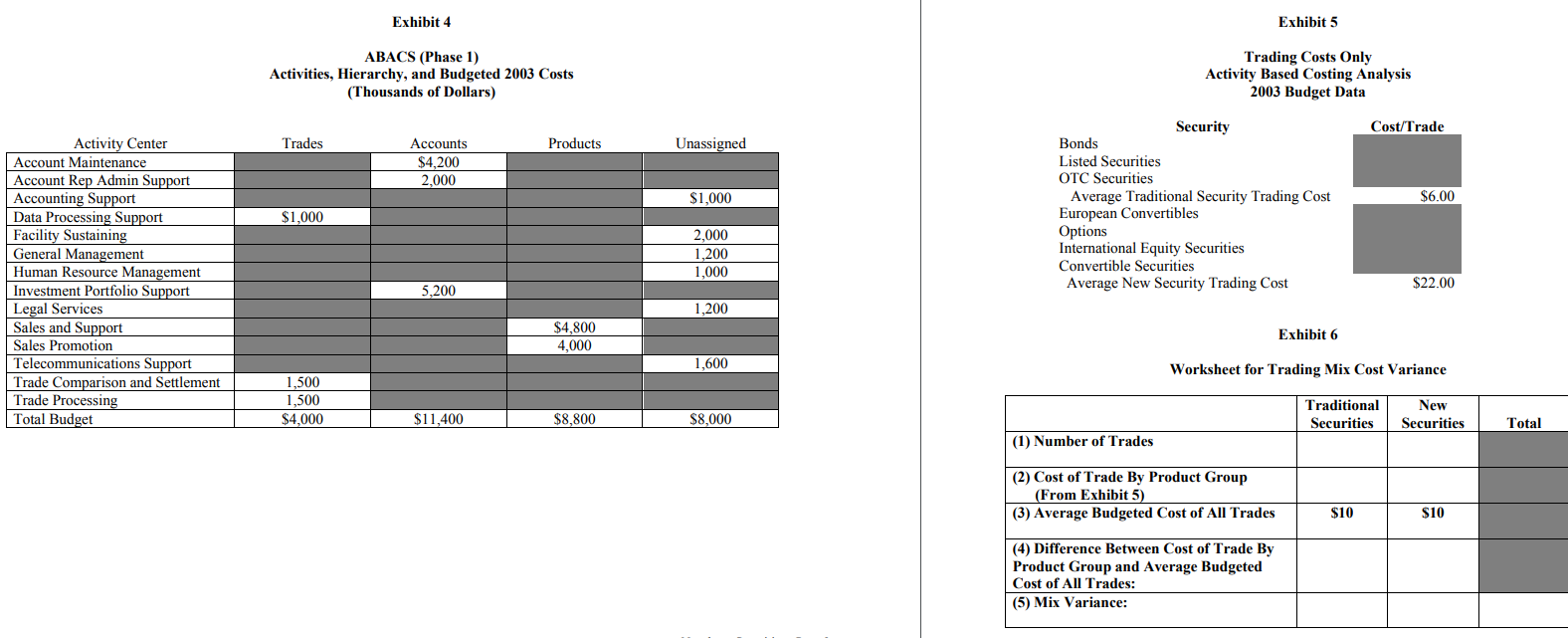

4A. Draw a SIMPLE diagram to reflect the system suggested by the new costing study. Perform the necessary calculations and label it as completely as possible based on the operating data. Your diagram should provide enough detail to help estimate the full cost of the two sales offices.

4B. Does this system address the concerns with the traditional system? Why? Please explain briefly (no numbers needed).

5. Calculate the costs and profitability of the HSO and GSO offices under the new cost system.

6. Based on your analysis, recommend two changes to Misty Donath in order to improve the profitability of the two sales offices.

7. Currently, account reps are evaluated on the number of trades and the number of accounts brought in. Cite two strengths and two weaknesses of these criteria for performance evaluation. Do you think that this evaluation system contributed to the lower-than-expected performance? Why or why not? Suggest one change to the performance evaluation system that would mitigate the weaknesses.

8. During 2003, Nanzhang Securities budgeted the HSO costs to be lower. The actual labor costs incurred (within the HSO Direct Sales Group Cost) were 2,286,000 and HSO completed 184,000 trades. At the beginning of the year, not expecting too much out of the HSO office, the company budgeted 176,000 trades to be completed during the year and expected labor costs in the HSO office to be 2,112,000. The firm expected to use 52,800 hours of labor but only actually used 50,800 hours. Analyze the difference between the expected and actual costs of labor during 2003. Explain what the discrepancy is caused by.

9. You are creating the budget for next years direct sales group costs. Assume, for this question, that these costs are variable. We expect the per-trade costs and the resources needed to complete each trade to stay constant next year. However, we do expect an increase in the trades at both offices: HSO is expected to complete 190,000 trades and GSO is expected to continue its rapid growth and complete 285,000 trades. Please calculate how much you expect the Direct Sales Group Costs to be for HSO and GSO

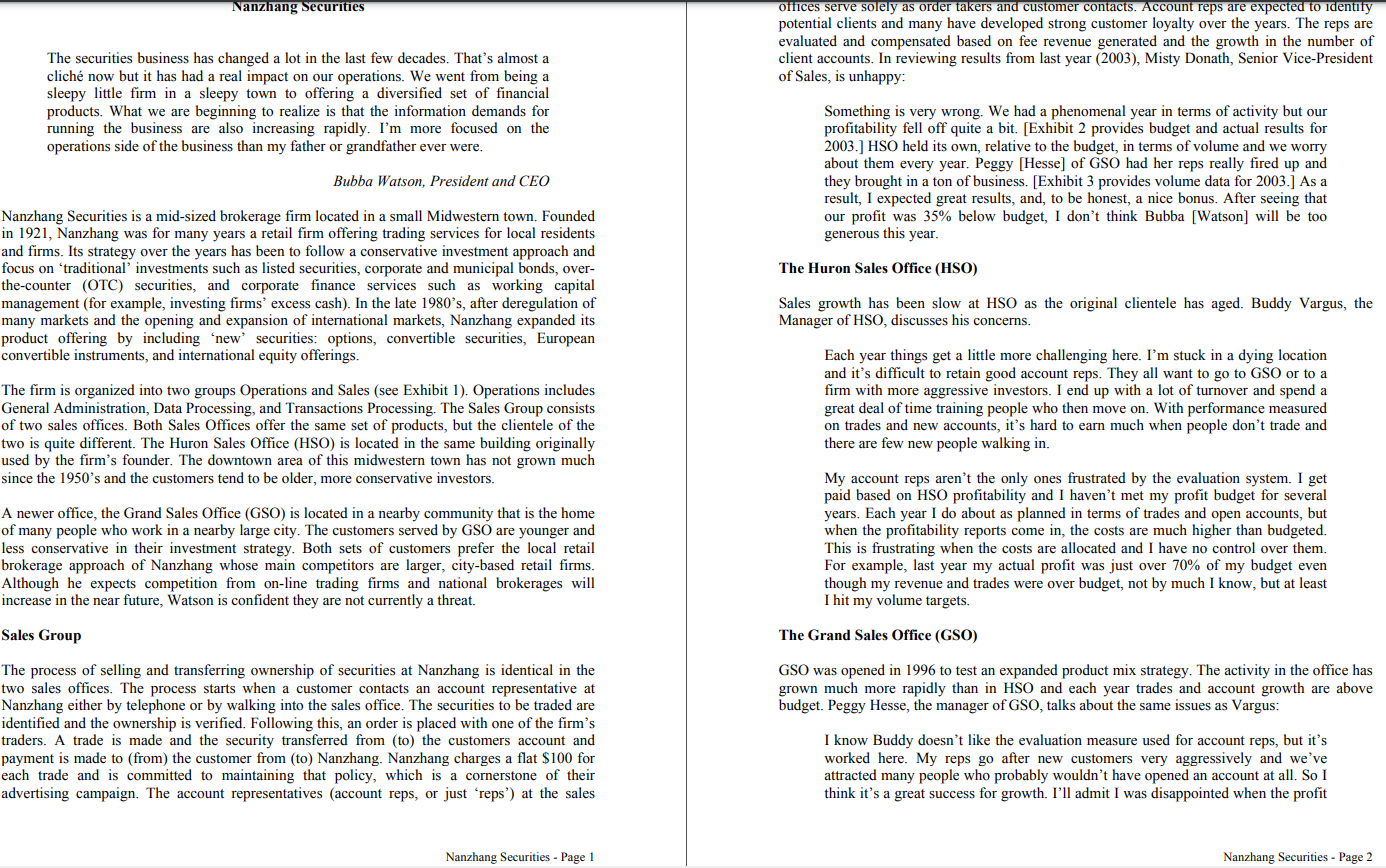

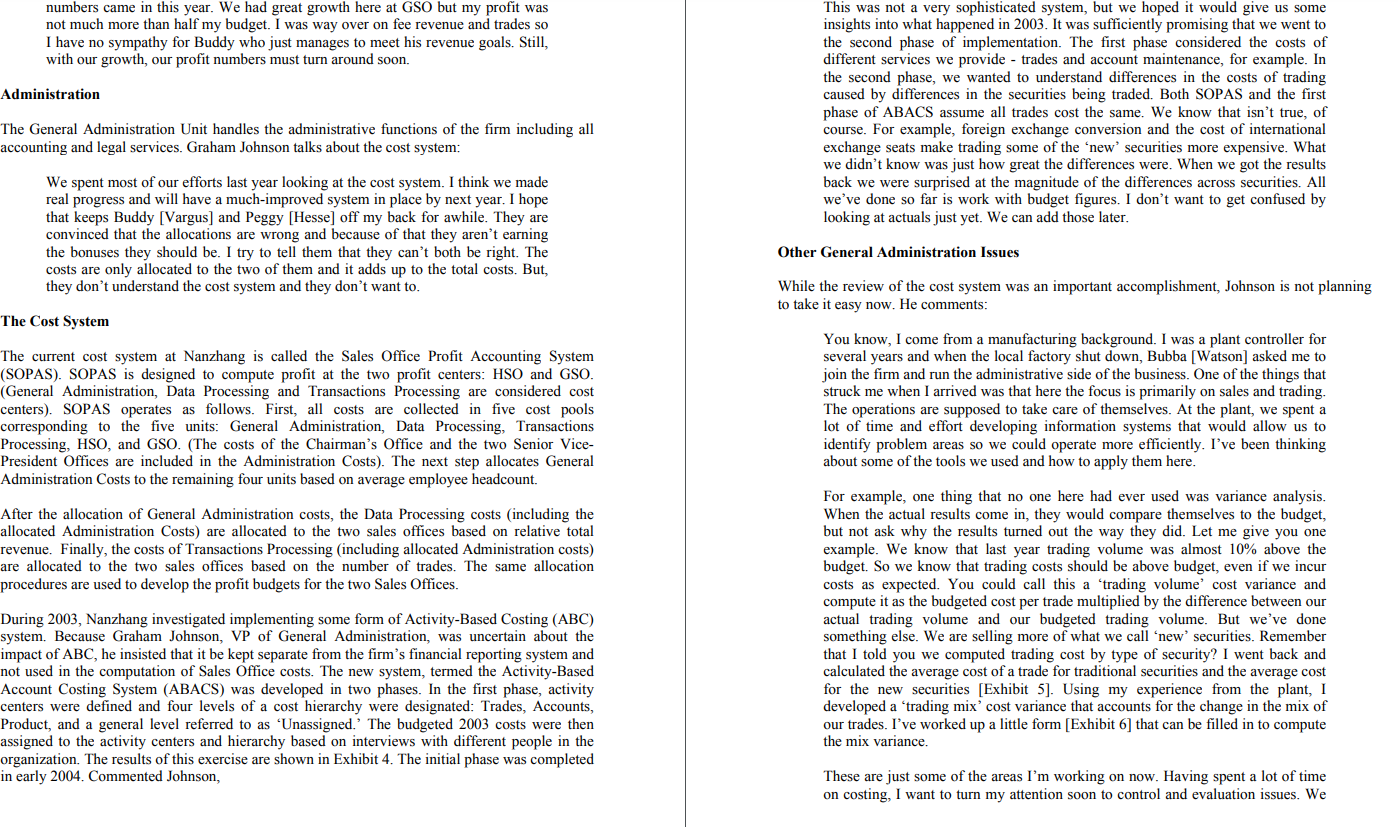

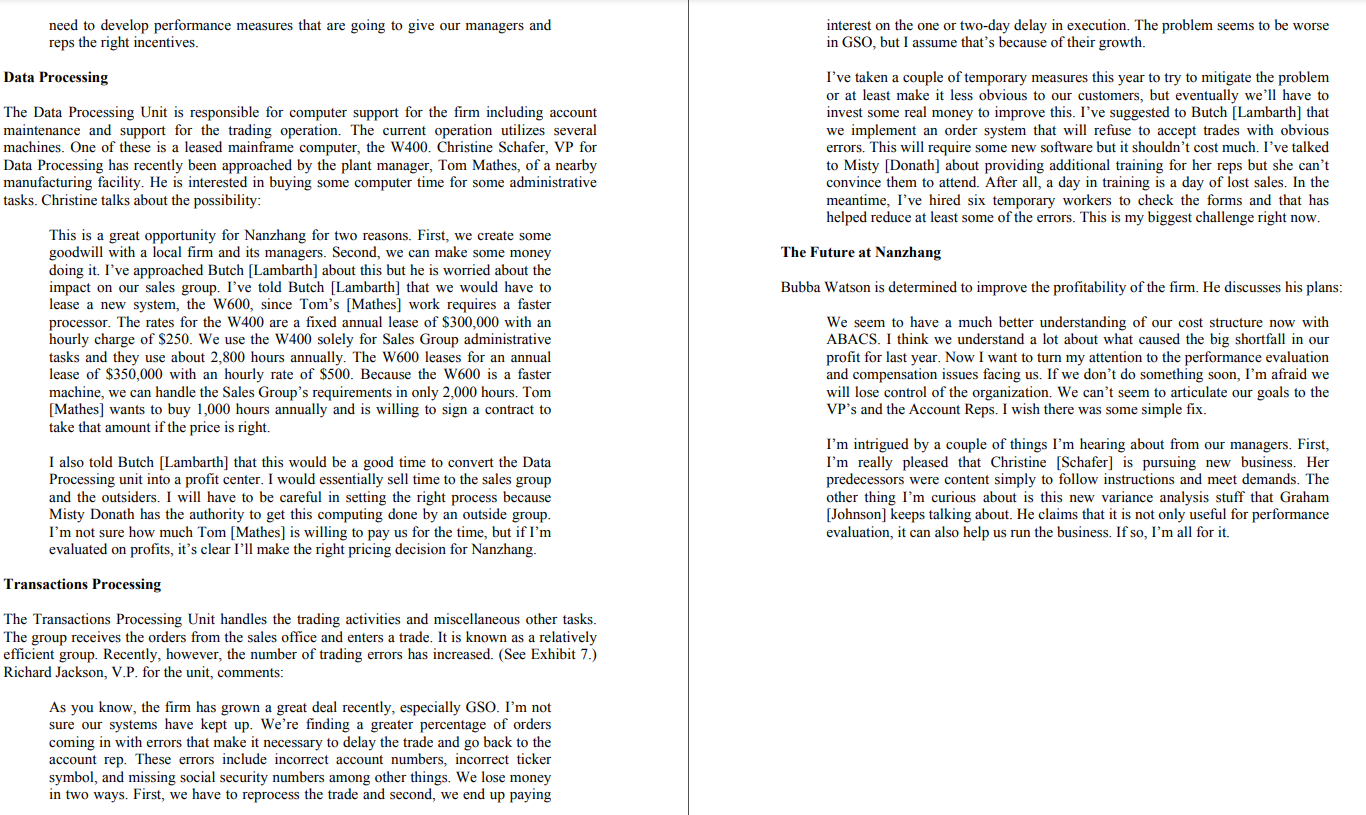

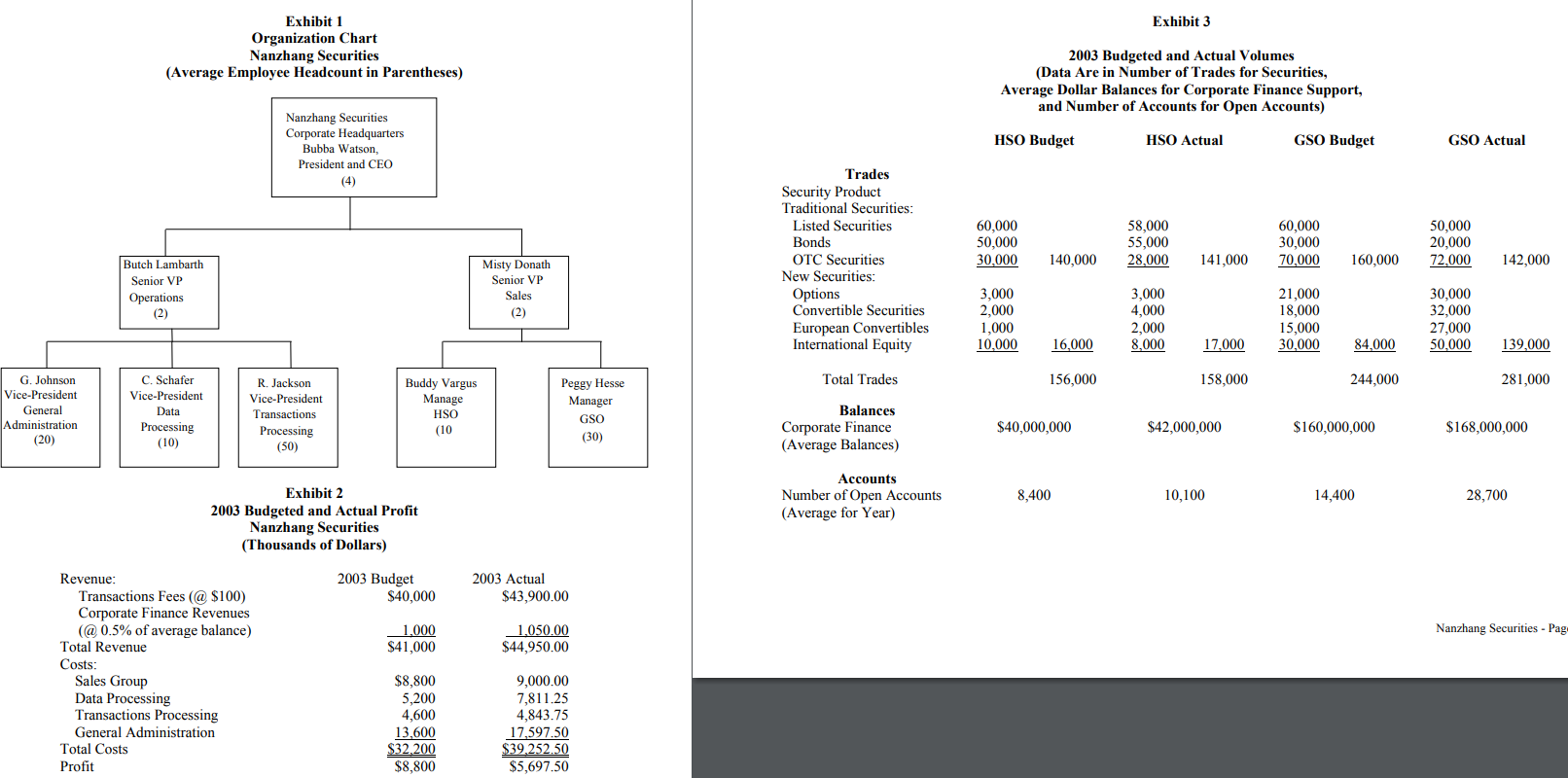

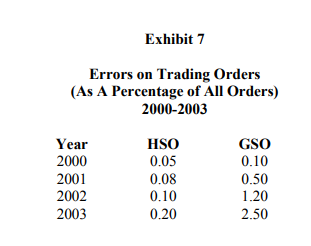

Nanzhang Securities Offices serve solely as order takers and customer contacts. Account reps are expected to identity potential clients and many have developed strong customer loyalty over the years. The reps are evaluated and compensated based on fee revenue generated and the growth in the number of client accounts. In reviewing results from last year (2003), Misty Donath, Senior Vice-President of Sales, is unhappy: The securities business has changed a lot in the last few decades. That's almost a clich now but it has had a real impact on our operations. We went from being a sleepy little firm in a sleepy town to offering a diversified set of financial products. What we are beginning to realize is that the information demands for running the business are also increasing rapidly. I'm more focused on the operations side of the business than my father or grandfather ever were. Bubba Watson, President and CEO Something is very wrong. We had a phenomenal year in terms of activity but our profitability fell off quite a bit. [Exhibit 2 provides budget and actual results for 2003.) HSO held its own, relative to the budget, in terms of volume and we worry about them every year. Peggy (Hesse) of GSO had her reps really fired up and they brought in a ton of business. [Exhibit 3 provides volume data for 2003.] As a result, I expected great results, and, to be honest, a nice bonus. After seeing that our profit was 35% below budget, I don't think Bubba [Watson) will be too generous this year. The Huron Sales Office (HSO) Nanzhang Securities is a mid-sized brokerage firm located in a small Midwestern town. Founded in 1921, Nanzhang was for many years a retail firm offering trading services for local residents and firms. Its strategy over the years has been to follow a conservative investment approach and focus on traditional investments such as listed securities, corporate and municipal bonds, over- the-counter (OTC) securities, and corporate finance services such as working capital management (for example, investing firms' excess cash). In the late 1980's, after deregulation of many markets and the opening and expansion of international markets, Nanzhang expanded its product offering by including 'new' securities: options, convertible securities, European convertible instruments, and international equity offerings. The firm is organized into two groups Operations and Sales (see Exhibit 1). Operations includes General Administration, Data Processing, and Transactions Processing. The Sales Group consists of two sales offices. Both Sales Offices offer the same set of products, but the clientele of the two is quite different. The Huron Sales Office (HSO) is located in the same building originally used by the firm's founder. The downtown area of this midwestern town has not grown much since the 1950's and the customers tend to be older, more conservative investors. Sales growth has been slow at HSO as the original clientele has aged. Buddy Vargus, the Manager of HSO, discusses his concerns. Each year things get a little more challenging here. I'm stuck in a dying location and it's difficult to retain good account reps. They all want to go to GSO or to a firm with more aggressive investors. I end up with a lot of turnover and spend a great deal of time training people who then move on. With performance measured on trades and new accounts, it's hard to earn much when people don't trade and there are few new people walking in. My account reps aren't the only ones frustrated by the evaluation system. I get paid based on HSO profitability and I haven't met my profit budget for several years. Each year I do about as planned in terms of trades and open accounts, but when the profitability reports come in, the costs are much higher than budgeted. This is frustrating when the costs are allocated and I have no control over them. For example, last year my actual profit was just over 70% of my budget even though my revenue and trades were over budget, not by much I know, but at least I hit my volume targets. A newer office, the Grand Sales Office (GSO) is located in a nearby community that is the home of many people who work in a nearby large city. The customers served by GSO are younger and less conservative their investment strategy. Both sets of customers prefer the local retail brokerage approach of Nanzhang whose main competitors are larger, city-based retail firms. Although he expects competition from on-line trading firms and national brokerages will increase in the near future, Watson is confident they are not currently a threat. Sales Group The Grand Sales Office (GSO) GSO was opened in 1996 to test an expanded product mix strategy. The activity in the office has grown much more rapidly than in HSO and each year trades and account growth are above budget. Peggy Hesse, the manager of GSO, talks about the same issues as Vargus: The process of selling and transferring ownership of securities at Nanzhang is identical in the two sales offices. The process starts when a customer contacts an account representative at Nanzhang either by telephone or by walking into the sales office. The securities to be traded are identified and the ownership is verified. Following this, an order is placed with one of the firm's traders. A trade is made and the security transferred from (to) the customers account and payment is made to (from) the customer from (to) Nanzhang. Nanzhang charges a flat $100 for each trade and is committed to maintaining that policy, which is a cornerstone of their advertising campaign. The account representatives (account reps, or just reps') at the sales I know Buddy doesn't like the evaluation measure used for account reps, but it's worked here. My reps go after new customers very aggressively and we've attracted many people who probably wouldn't have opened an account at all. So I think it's a great success for growth. I'll admit I was disappointed when the profit Nanzhang Securities - Page 1 Nanzhang Securities - Page 2 numbers came in this year. We had great growth here at GSO but my profit was not much more than half my budget. I was way over on fee revenue and trades so I have no sympathy for Buddy who just manages to meet his revenue goals. Still, with our growth, our profit numbers must turn around soon. Administration This was not a very sophisticated system, but we hoped it would give us some insights into what happened in 2003. It was sufficiently promising that we went to the second phase of implementation. The first phase considered the costs of different services we provide - trades and account maintenance, for example. In the second phase, we wanted to understand differences in the costs of trading caused by differences in the securities being traded. Both SOPAS and the first phase of ABACS assume all trades cost the same. We know that isn't true, of course. For example, foreign exchange conversion and the cost of international exchange seats make trading some of the 'newsecurities more expensive. What we didn't know was just how great the differences were. When we got the results back we were surprised at the magnitude of the differences across securities. All we've done so far is work with budget figures. I don't want to get confused by looking at actuals just yet. We can add those later. The General Administration Unit handles the administrative functions of the firm including all accounting and legal services. Graham Johnson talks about the cost system: We spent most of our efforts last year looking at the cost system. I think we made real progress and will have a much-improved system in place by next year. I hope that keeps Buddy [Vargus) and Peggy (Hesse) off my back for awhile. They are convinced that the allocations are wrong and because of that they aren't earning the bonuses they should be. I try to tell them that they can't both be right. The costs are only allocated to the two of them and it adds up to the total costs. But, they don't understand the cost system and they don't want to. Other General Administration Issues While the review of the cost system was an important accomplishment, Johnson is not planning to take it easy now. He comments: The Cost System The current cost system at Nanzhang is called the Sales Office Profit Accounting System (SOPAS). SOPAS is designed to compute profit at the two profit centers: HSO and GSO. (General Administration, Data Processing and Transactions Processing are considered cost centers). SOPAS operates as follows. First, all costs are collected in five cost pools corresponding to the five units: General Administration, Data Processing, Transactions Processing, HSO, and GSO. (The costs of the Chairman's Office and the two Senior Vice- President Offices are included in the Administration Costs). The next step allocates General Administration Costs to the remaining four units based on average employee headcount. You know, I come from a manufacturing background. I was a plant controller for several years and when the local factory shut down, Bubba [Watson) asked me to join the firm and run the administrative side of the business. One of the things that struck me when I arrived was that here the focus is primarily on sales and trading. The operations are supposed to take care of themselves. At the plant, we spent a lot of time and effort developing information systems that would allow us to identify problem areas so we could operate more efficiently. I've been thinking about some of the tools we used and how to apply them here. After the allocation of General Administration costs, the Data Processing costs (including the allocated Administration Costs) are allocated to the two sales offices based on relative total revenue. Finally, the costs of Transactions Processing (including allocated Administration costs) are allocated to the two sales offices based on the number of trades. The same allocation procedures are used to develop the profit budgets for the two Sales Offices. During 2003, Nanzhang investigated implementing some form of Activity-Based Costing (ABC) system. Because Graham Johnson, VP of General Administration, was uncertain about the impact of ABC, he insisted that it be kept separate from the firm's financial reporting system and not used in the computation of Sales Office costs. The new system, termed the Activity-Based Account Costing System (ABACS) was developed in two phases. In the first phase, activity centers were defined and four levels of a cost hierarchy were designated: Trades, Accounts, Product, and a general level referred to as 'Unassigned.' The budgeted 2003 costs were then assigned to the activity centers and hierarchy based on interviews with different people in the organization. The results of this exercise are shown in Exhibit 4. The initial phase was completed in early 2004. Commented Johnson, For example, one thing that no one here had ever used was variance analysis. When the actual results come in, they would compare themselves to the budget, but not ask why the results turned out the way they did. Let me give you one example. We know that last year trading volume was almost 10% above the budget. So we know that trading costs should be above budget, even if we incur costs as expected. You could call this a trading volume cost variance and compute it as the budgeted cost per trade multiplied by the difference between our actual trading volume and our budgeted trading volume. But we've done something else. We are selling more of what we call 'new' securities. Remember that I told you we computed trading cost by type of security? I went back and calculated the average cost of a trade for traditional securities and the average cost for the new securities [Exhibit 5]. Using my experience from the plant, I developed a "trading mix' cost variance that accounts for the change in the mix of our trades. I've worked up a little form [Exhibit 6] that can be filled in to compute the mix variance. These just some of the areas I'm working on now. Having spent a lot of time on costing, I want to turn my attention soon to control and evaluation issues. We need to develop performance measures that are going to give our managers and reps the right incentives. interest on the one or two-day delay in execution. The problem seems to be worse in GSO, but I assume that's because of their growth. Data Processing The Data Processing Unit is responsible for computer support for the firm including account maintenance and support for the trading operation. The current operation utilizes several machines. One of these is a leased mainframe computer, the W400. Christine Schafer, VP for Data Processing has recently been approached by the plant manager, Tom Mathes, of a nearby manufacturing facility. He is interested in buying some computer time for some administrative tasks. Christine talks about the possibility: I've taken a couple of temporary measures this year to try to mitigate the problem or at least make it less obvious to our customers, but eventually we'll have to invest some real money to improve this. I've suggested to Butch [Lambarth] that we implement an order system that will refuse to accept trades with obvious errors. This will require some new software but it shouldn't cost much. I've talked to Misty [Donath] about providing additional training for her reps but she can't convince them to attend. After all, a day in training is a day of lost sales. In the meantime, I've hired six temporary workers to check the forms and that has helped reduce at least some of the errors. This is my biggest challenge right now. The Future at Nanzhang This is a great opportunity for Nanzhang for two reasons. First, we create some goodwill with a local firm and its managers. Second, we can make some money doing it. I've approached Butch [Lambarth] about this but he is worried about the impact on our sales group. I've told Butch [Lambarth] that we would have to lease a new system, the W600, since Tom's [Mathes] work requires a faster processor. The rates for the W400 are a fixed annual lease of $300,000 with an hourly charge of $250. We use the W400 solely for Sales Group administrative tasks and they use about 2,800 hours annually. The W600 leases for an annual lease of $350,000 with an hourly rate of $500. Because the W600 is a faster machine, we can handle the Sales Group's requirements in only 2,000 hours. Tom [Mathes] wants to buy 1,000 hours annually and is willing to sign a contract to take that amount if the price is right. Bubba Watson is determined to improve the profitability of the firm. He discusses his plans: We seem to have a much better understanding of our cost structure now with ABACS. I think we understand a lot about what caused the big shortfall in our profit for last year. Now I want to turn my attention to the performance evaluation and compensation issues facing us. If we don't do something soon, I'm afraid we will lose control of the organization. We can't seem to articulate our goals to the VP's and the Account Reps. I wish there was some simple fix. I also told Butch [Lambarth] that this would be a good convert the Data Processing unit into a profit center. I would essentially sell time to the sales group and the outsiders. I will have to be careful in setting the right process because Misty Donath has the authority to get this computing done by an outside group. I'm not sure how much Tom [Mathes] is willing to pay us for the time, but if I'm evaluated on profits, it's clear I'll make the right pricing decision for Nanzhang. I'm intrigued by a couple of things I'm hearing about from our managers. First, I'm really leased Christine [Schafer] pursuing new business. Her predecessors were content simply to follow instructions and meet demands. The other thing I'm curious about is this new variance analysis stuff that Graham [Johnson] keeps talking about. He claims that it is not only useful for performance evaluation, it can also help us run the business. If so, I'm all for it. Transactions Processing The Transactions Processing Unit handles the trading activities and miscellaneous other tasks. The group receives the orders from the sales office and enters a trade. It is known as a relatively efficient group. Recently, however, the number of trading errors has increased. (See Exhibit 7.) Richard Jackson, V.P. for the unit, comments: As you know, the firm has grown a great deal recently, especially GSO. I'm not sure our systems have kept up. We're finding a greater percentage of orders coming in with errors that make it necessary to delay the trade and go back to the account rep. These errors include incorrect account numbers, incorrect ticker symbol, and missing social security numbers among other things. We lose money in two ways. First, we have to reprocess the trade and second, we end up paying Exhibit 3 Exhibit 1 Organization Chart Nanzhang Securities (Average Employee Headcount in Parentheses) 2003 Budgeted and Actual Volumes (Data Are in Number of Trades for Securities, Average Dollar Balances for Corporate Finance Support, and Number of Accounts for Open Accounts) Nanzhang Securities Corporate Headquarters Bubba Watson, President and CEO (4) HSO Budget HSO Actual GSO Budget GSO Actual 60,000 50,000 30,000 Trades Security Product Traditional Securities: Listed Securities Bonds OTC Securities New Securities: Options Convertible Securities European Convertibles International Equity 58,000 55,000 28,000 60,000 30,000 70,000 50,000 20,000 72,000 140,000 141,000 160,000 Butch Lambarth Senior VP Operations (2) 142,000 Misty Donath Senior VP Sales (2) 3,000 2,000 1,000 10,000 3,000 4,000 2,000 8.000 21,000 18,000 15,000 30,000 30,000 32,000 27,000 50,000 16,000 17.000 84,000 139,000 Buddy Vargus Total Trades 156,000 158,000 244,000 281,000 Manage G. Johnson Vice-President General Administration (20) C. Schafer Vice-President Data Processing (10) R. Jackson Vice-President Transactions Processing (50) HSO (10 Peggy Hesse Manager GSO (30) Balances Corporate Finance (Average Balances) $40,000,000 $42,000,000 $160,000,000 $168,000,000 Accounts Number of Open Accounts (Average for Year) 8,400 10,100 14,400 Exhibit 2 2003 Budgeted and Actual Profit Nanzhang Securities (Thousands of Dollars) 28,700 2003 Budget $40,000 2003 Actual $43,900.00 Nanzhang Securities - Pag- 1.000 $41,000 1,050.00 $44,950.00 Revenue: Transactions Fees (@ $100) Corporate Finance Revenues (@0.5% of average balance) Total Revenue Costs: Sales Group Data Processing Transactions Processing General Administration Total Costs Profit $8,800 5,200 4,600 13,600 $32.200 $8,800 9,000.00 7,811.25 4,843.75 17,597.50 $39.252.50 $5,697.50 Exhibit 4 Exhibit 5 ABACS (Phase 1) Activities, Hierarchy, and Budgeted 2003 Costs (Thousands of Dollars) Trading Costs Only Activity Based Costing Analysis 2003 Budget Data Cost/Trade Trades Products Unassigned Accounts $4,200 2,000 $1,000 $6.00 Security Bonds Listed Securities OTC Securities Average Traditional Security Trading Cost European Convertibles Options International Equity Securities Convertible Securities Average New Security Trading Cost $1,000 Activity Center Account Maintenance Account Rep Admin Support Accounting Support Data Processing Support Facility Sustaining General Management Human Resource Management Investment Portfolio Support Legal Services Sales and Support Sales Promotion Telecommunications Support Trade Comparison and Settlement Trade Processing Total Budget 2,000 1,200 1,000 $22.00 5,200 1,200 $4,800 4,000 Exhibit 6 1,600 Worksheet for Trading Mix Cost Variance 1,500 1,500 $4,000 $11,400 $8,800 $8,000 Traditional Securities New Securities Total (1) Number of Trades (2) Cost of Trade By Product Group (From Exhibit 5) (3) Average Budgeted Cost of All Trades $10 $10 (4) Difference Between Cost of Trade By Product Group and Average Budgeted Cost of All Trades: (5) Mix Variance: Exhibit 7 Errors on Trading Orders (As A Percentage of All Orders) 2000-2003 Year 2000 2001 2002 2003 HSO 0.05 0.08 0.10 0.20 GSO 0.10 0.50 1.20 2.50 Nanzhang Securities Offices serve solely as order takers and customer contacts. Account reps are expected to identity potential clients and many have developed strong customer loyalty over the years. The reps are evaluated and compensated based on fee revenue generated and the growth in the number of client accounts. In reviewing results from last year (2003), Misty Donath, Senior Vice-President of Sales, is unhappy: The securities business has changed a lot in the last few decades. That's almost a clich now but it has had a real impact on our operations. We went from being a sleepy little firm in a sleepy town to offering a diversified set of financial products. What we are beginning to realize is that the information demands for running the business are also increasing rapidly. I'm more focused on the operations side of the business than my father or grandfather ever were. Bubba Watson, President and CEO Something is very wrong. We had a phenomenal year in terms of activity but our profitability fell off quite a bit. [Exhibit 2 provides budget and actual results for 2003.) HSO held its own, relative to the budget, in terms of volume and we worry about them every year. Peggy (Hesse) of GSO had her reps really fired up and they brought in a ton of business. [Exhibit 3 provides volume data for 2003.] As a result, I expected great results, and, to be honest, a nice bonus. After seeing that our profit was 35% below budget, I don't think Bubba [Watson) will be too generous this year. The Huron Sales Office (HSO) Nanzhang Securities is a mid-sized brokerage firm located in a small Midwestern town. Founded in 1921, Nanzhang was for many years a retail firm offering trading services for local residents and firms. Its strategy over the years has been to follow a conservative investment approach and focus on traditional investments such as listed securities, corporate and municipal bonds, over- the-counter (OTC) securities, and corporate finance services such as working capital management (for example, investing firms' excess cash). In the late 1980's, after deregulation of many markets and the opening and expansion of international markets, Nanzhang expanded its product offering by including 'new' securities: options, convertible securities, European convertible instruments, and international equity offerings. The firm is organized into two groups Operations and Sales (see Exhibit 1). Operations includes General Administration, Data Processing, and Transactions Processing. The Sales Group consists of two sales offices. Both Sales Offices offer the same set of products, but the clientele of the two is quite different. The Huron Sales Office (HSO) is located in the same building originally used by the firm's founder. The downtown area of this midwestern town has not grown much since the 1950's and the customers tend to be older, more conservative investors. Sales growth has been slow at HSO as the original clientele has aged. Buddy Vargus, the Manager of HSO, discusses his concerns. Each year things get a little more challenging here. I'm stuck in a dying location and it's difficult to retain good account reps. They all want to go to GSO or to a firm with more aggressive investors. I end up with a lot of turnover and spend a great deal of time training people who then move on. With performance measured on trades and new accounts, it's hard to earn much when people don't trade and there are few new people walking in. My account reps aren't the only ones frustrated by the evaluation system. I get paid based on HSO profitability and I haven't met my profit budget for several years. Each year I do about as planned in terms of trades and open accounts, but when the profitability reports come in, the costs are much higher than budgeted. This is frustrating when the costs are allocated and I have no control over them. For example, last year my actual profit was just over 70% of my budget even though my revenue and trades were over budget, not by much I know, but at least I hit my volume targets. A newer office, the Grand Sales Office (GSO) is located in a nearby community that is the home of many people who work in a nearby large city. The customers served by GSO are younger and less conservative their investment strategy. Both sets of customers prefer the local retail brokerage approach of Nanzhang whose main competitors are larger, city-based retail firms. Although he expects competition from on-line trading firms and national brokerages will increase in the near future, Watson is confident they are not currently a threat. Sales Group The Grand Sales Office (GSO) GSO was opened in 1996 to test an expanded product mix strategy. The activity in the office has grown much more rapidly than in HSO and each year trades and account growth are above budget. Peggy Hesse, the manager of GSO, talks about the same issues as Vargus: The process of selling and transferring ownership of securities at Nanzhang is identical in the two sales offices. The process starts when a customer contacts an account representative at Nanzhang either by telephone or by walking into the sales office. The securities to be traded are identified and the ownership is verified. Following this, an order is placed with one of the firm's traders. A trade is made and the security transferred from (to) the customers account and payment is made to (from) the customer from (to) Nanzhang. Nanzhang charges a flat $100 for each trade and is committed to maintaining that policy, which is a cornerstone of their advertising campaign. The account representatives (account reps, or just reps') at the sales I know Buddy doesn't like the evaluation measure used for account reps, but it's worked here. My reps go after new customers very aggressively and we've attracted many people who probably wouldn't have opened an account at all. So I think it's a great success for growth. I'll admit I was disappointed when the profit Nanzhang Securities - Page 1 Nanzhang Securities - Page 2 numbers came in this year. We had great growth here at GSO but my profit was not much more than half my budget. I was way over on fee revenue and trades so I have no sympathy for Buddy who just manages to meet his revenue goals. Still, with our growth, our profit numbers must turn around soon. Administration This was not a very sophisticated system, but we hoped it would give us some insights into what happened in 2003. It was sufficiently promising that we went to the second phase of implementation. The first phase considered the costs of different services we provide - trades and account maintenance, for example. In the second phase, we wanted to understand differences in the costs of trading caused by differences in the securities being traded. Both SOPAS and the first phase of ABACS assume all trades cost the same. We know that isn't true, of course. For example, foreign exchange conversion and the cost of international exchange seats make trading some of the 'newsecurities more expensive. What we didn't know was just how great the differences were. When we got the results back we were surprised at the magnitude of the differences across securities. All we've done so far is work with budget figures. I don't want to get confused by looking at actuals just yet. We can add those later. The General Administration Unit handles the administrative functions of the firm including all accounting and legal services. Graham Johnson talks about the cost system: We spent most of our efforts last year looking at the cost system. I think we made real progress and will have a much-improved system in place by next year. I hope that keeps Buddy [Vargus) and Peggy (Hesse) off my back for awhile. They are convinced that the allocations are wrong and because of that they aren't earning the bonuses they should be. I try to tell them that they can't both be right. The costs are only allocated to the two of them and it adds up to the total costs. But, they don't understand the cost system and they don't want to. Other General Administration Issues While the review of the cost system was an important accomplishment, Johnson is not planning to take it easy now. He comments: The Cost System The current cost system at Nanzhang is called the Sales Office Profit Accounting System (SOPAS). SOPAS is designed to compute profit at the two profit centers: HSO and GSO. (General Administration, Data Processing and Transactions Processing are considered cost centers). SOPAS operates as follows. First, all costs are collected in five cost pools corresponding to the five units: General Administration, Data Processing, Transactions Processing, HSO, and GSO. (The costs of the Chairman's Office and the two Senior Vice- President Offices are included in the Administration Costs). The next step allocates General Administration Costs to the remaining four units based on average employee headcount. You know, I come from a manufacturing background. I was a plant controller for several years and when the local factory shut down, Bubba [Watson) asked me to join the firm and run the administrative side of the business. One of the things that struck me when I arrived was that here the focus is primarily on sales and trading. The operations are supposed to take care of themselves. At the plant, we spent a lot of time and effort developing information systems that would allow us to identify problem areas so we could operate more efficiently. I've been thinking about some of the tools we used and how to apply them here. After the allocation of General Administration costs, the Data Processing costs (including the allocated Administration Costs) are allocated to the two sales offices based on relative total revenue. Finally, the costs of Transactions Processing (including allocated Administration costs) are allocated to the two sales offices based on the number of trades. The same allocation procedures are used to develop the profit budgets for the two Sales Offices. During 2003, Nanzhang investigated implementing some form of Activity-Based Costing (ABC) system. Because Graham Johnson, VP of General Administration, was uncertain about the impact of ABC, he insisted that it be kept separate from the firm's financial reporting system and not used in the computation of Sales Office costs. The new system, termed the Activity-Based Account Costing System (ABACS) was developed in two phases. In the first phase, activity centers were defined and four levels of a cost hierarchy were designated: Trades, Accounts, Product, and a general level referred to as 'Unassigned.' The budgeted 2003 costs were then assigned to the activity centers and hierarchy based on interviews with different people in the organization. The results of this exercise are shown in Exhibit 4. The initial phase was completed in early 2004. Commented Johnson, For example, one thing that no one here had ever used was variance analysis. When the actual results come in, they would compare themselves to the budget, but not ask why the results turned out the way they did. Let me give you one example. We know that last year trading volume was almost 10% above the budget. So we know that trading costs should be above budget, even if we incur costs as expected. You could call this a trading volume cost variance and compute it as the budgeted cost per trade multiplied by the difference between our actual trading volume and our budgeted trading volume. But we've done something else. We are selling more of what we call 'new' securities. Remember that I told you we computed trading cost by type of security? I went back and calculated the average cost of a trade for traditional securities and the average cost for the new securities [Exhibit 5]. Using my experience from the plant, I developed a "trading mix' cost variance that accounts for the change in the mix of our trades. I've worked up a little form [Exhibit 6] that can be filled in to compute the mix variance. These just some of the areas I'm working on now. Having spent a lot of time on costing, I want to turn my attention soon to control and evaluation issues. We need to develop performance measures that are going to give our managers and reps the right incentives. interest on the one or two-day delay in execution. The problem seems to be worse in GSO, but I assume that's because of their growth. Data Processing The Data Processing Unit is responsible for computer support for the firm including account maintenance and support for the trading operation. The current operation utilizes several machines. One of these is a leased mainframe computer, the W400. Christine Schafer, VP for Data Processing has recently been approached by the plant manager, Tom Mathes, of a nearby manufacturing facility. He is interested in buying some computer time for some administrative tasks. Christine talks about the possibility: I've taken a couple of temporary measures this year to try to mitigate the problem or at least make it less obvious to our customers, but eventually we'll have to invest some real money to improve this. I've suggested to Butch [Lambarth] that we implement an order system that will refuse to accept trades with obvious errors. This will require some new software but it shouldn't cost much. I've talked to Misty [Donath] about providing additional training for her reps but she can't convince them to attend. After all, a day in training is a day of lost sales. In the meantime, I've hired six temporary workers to check the forms and that has helped reduce at least some of the errors. This is my biggest challenge right now. The Future at Nanzhang This is a great opportunity for Nanzhang for two reasons. First, we create some goodwill with a local firm and its managers. Second, we can make some money doing it. I've approached Butch [Lambarth] about this but he is worried about the impact on our sales group. I've told Butch [Lambarth] that we would have to lease a new system, the W600, since Tom's [Mathes] work requires a faster processor. The rates for the W400 are a fixed annual lease of $300,000 with an hourly charge of $250. We use the W400 solely for Sales Group administrative tasks and they use about 2,800 hours annually. The W600 leases for an annual lease of $350,000 with an hourly rate of $500. Because the W600 is a faster machine, we can handle the Sales Group's requirements in only 2,000 hours. Tom [Mathes] wants to buy 1,000 hours annually and is willing to sign a contract to take that amount if the price is right. Bubba Watson is determined to improve the profitability of the firm. He discusses his plans: We seem to have a much better understanding of our cost structure now with ABACS. I think we understand a lot about what caused the big shortfall in our profit for last year. Now I want to turn my attention to the performance evaluation and compensation issues facing us. If we don't do something soon, I'm afraid we will lose control of the organization. We can't seem to articulate our goals to the VP's and the Account Reps. I wish there was some simple fix. I also told Butch [Lambarth] that this would be a good convert the Data Processing unit into a profit center. I would essentially sell time to the sales group and the outsiders. I will have to be careful in setting the right process because Misty Donath has the authority to get this computing done by an outside group. I'm not sure how much Tom [Mathes] is willing to pay us for the time, but if I'm evaluated on profits, it's clear I'll make the right pricing decision for Nanzhang. I'm intrigued by a couple of things I'm hearing about from our managers. First, I'm really leased Christine [Schafer] pursuing new business. Her predecessors were content simply to follow instructions and meet demands. The other thing I'm curious about is this new variance analysis stuff that Graham [Johnson] keeps talking about. He claims that it is not only useful for performance evaluation, it can also help us run the business. If so, I'm all for it. Transactions Processing The Transactions Processing Unit handles the trading activities and miscellaneous other tasks. The group receives the orders from the sales office and enters a trade. It is known as a relatively efficient group. Recently, however, the number of trading errors has increased. (See Exhibit 7.) Richard Jackson, V.P. for the unit, comments: As you know, the firm has grown a great deal recently, especially GSO. I'm not sure our systems have kept up. We're finding a greater percentage of orders coming in with errors that make it necessary to delay the trade and go back to the account rep. These errors include incorrect account numbers, incorrect ticker symbol, and missing social security numbers among other things. We lose money in two ways. First, we have to reprocess the trade and second, we end up paying Exhibit 3 Exhibit 1 Organization Chart Nanzhang Securities (Average Employee Headcount in Parentheses) 2003 Budgeted and Actual Volumes (Data Are in Number of Trades for Securities, Average Dollar Balances for Corporate Finance Support, and Number of Accounts for Open Accounts) Nanzhang Securities Corporate Headquarters Bubba Watson, President and CEO (4) HSO Budget HSO Actual GSO Budget GSO Actual 60,000 50,000 30,000 Trades Security Product Traditional Securities: Listed Securities Bonds OTC Securities New Securities: Options Convertible Securities European Convertibles International Equity 58,000 55,000 28,000 60,000 30,000 70,000 50,000 20,000 72,000 140,000 141,000 160,000 Butch Lambarth Senior VP Operations (2) 142,000 Misty Donath Senior VP Sales (2) 3,000 2,000 1,000 10,000 3,000 4,000 2,000 8.000 21,000 18,000 15,000 30,000 30,000 32,000 27,000 50,000 16,000 17.000 84,000 139,000 Buddy Vargus Total Trades 156,000 158,000 244,000 281,000 Manage G. Johnson Vice-President General Administration (20) C. Schafer Vice-President Data Processing (10) R. Jackson Vice-President Transactions Processing (50) HSO (10 Peggy Hesse Manager GSO (30) Balances Corporate Finance (Average Balances) $40,000,000 $42,000,000 $160,000,000 $168,000,000 Accounts Number of Open Accounts (Average for Year) 8,400 10,100 14,400 Exhibit 2 2003 Budgeted and Actual Profit Nanzhang Securities (Thousands of Dollars) 28,700 2003 Budget $40,000 2003 Actual $43,900.00 Nanzhang Securities - Pag- 1.000 $41,000 1,050.00 $44,950.00 Revenue: Transactions Fees (@ $100) Corporate Finance Revenues (@0.5% of average balance) Total Revenue Costs: Sales Group Data Processing Transactions Processing General Administration Total Costs Profit $8,800 5,200 4,600 13,600 $32.200 $8,800 9,000.00 7,811.25 4,843.75 17,597.50 $39.252.50 $5,697.50 Exhibit 4 Exhibit 5 ABACS (Phase 1) Activities, Hierarchy, and Budgeted 2003 Costs (Thousands of Dollars) Trading Costs Only Activity Based Costing Analysis 2003 Budget Data Cost/Trade Trades Products Unassigned Accounts $4,200 2,000 $1,000 $6.00 Security Bonds Listed Securities OTC Securities Average Traditional Security Trading Cost European Convertibles Options International Equity Securities Convertible Securities Average New Security Trading Cost $1,000 Activity Center Account Maintenance Account Rep Admin Support Accounting Support Data Processing Support Facility Sustaining General Management Human Resource Management Investment Portfolio Support Legal Services Sales and Support Sales Promotion Telecommunications Support Trade Comparison and Settlement Trade Processing Total Budget 2,000 1,200 1,000 $22.00 5,200 1,200 $4,800 4,000 Exhibit 6 1,600 Worksheet for Trading Mix Cost Variance 1,500 1,500 $4,000 $11,400 $8,800 $8,000 Traditional Securities New Securities Total (1) Number of Trades (2) Cost of Trade By Product Group (From Exhibit 5) (3) Average Budgeted Cost of All Trades $10 $10 (4) Difference Between Cost of Trade By Product Group and Average Budgeted Cost of All Trades: (5) Mix Variance: Exhibit 7 Errors on Trading Orders (As A Percentage of All Orders) 2000-2003 Year 2000 2001 2002 2003 HSO 0.05 0.08 0.10 0.20 GSO 0.10 0.50 1.20 2.50Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started