Question

1. During the first week of January, an employee works 44 hours. For this company, workers earn 150% of their regular rate for hours in

1. During the first week of January, an employee works 44 hours. For this company, workers earn 150% of their regular rate for hours in excess of 40 per week. Her pay rate is $14 per hour, and her wages are subject to no deductions other than FICA Social Security, FICA Medicare, and federal income taxes. The tax rate for Social Security is 6.2% of the first $118,500 earned each calendar year and the FICA tax rate for Medicare is 1.45% of all earnings. The current FUTA tax rate is 0.6%, and the SUTA tax rate is 5.4%. Both unemployment taxes are applied to the first $7,000 of an employees pay. The employee has $93 in federal income taxes withheld. What is the amount of this employees net pay for the first week of January?

A 644.00 B 142.27 C 594.73 D 501.73 E 786.27

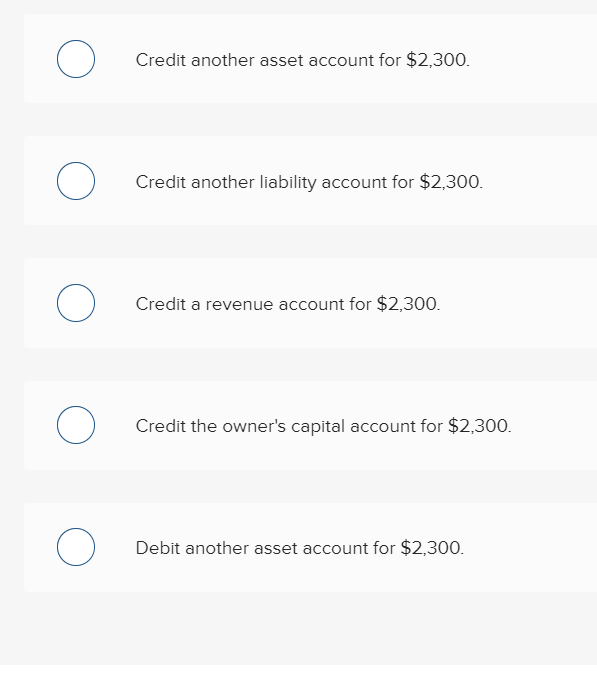

2. A bookkeeper has debited an asset account for $5,100 and credited a liability account for $2,800. Which of the following would be an incorrect way to complete the recording of this transaction:

3. A company purchased new furniture at a cost of $23,000 on September 30. The furniture is estimated to have a useful life of 5 years and a salvage value of $2,900. The company uses the straight-line method of depreciation. How much depreciation expense will be recorded for the furniture for the first year ended December 31?

A $335 B $1005 C $1150 D $1295 E $4195

Credit another asset account for $2,300. C) Credit another liability account for $2,300. Credit a revenue account for $2,300. Credit the owner's capital account for $2,300. Debit another asset account for $2,300Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started