Answered step by step

Verified Expert Solution

Question

1 Approved Answer

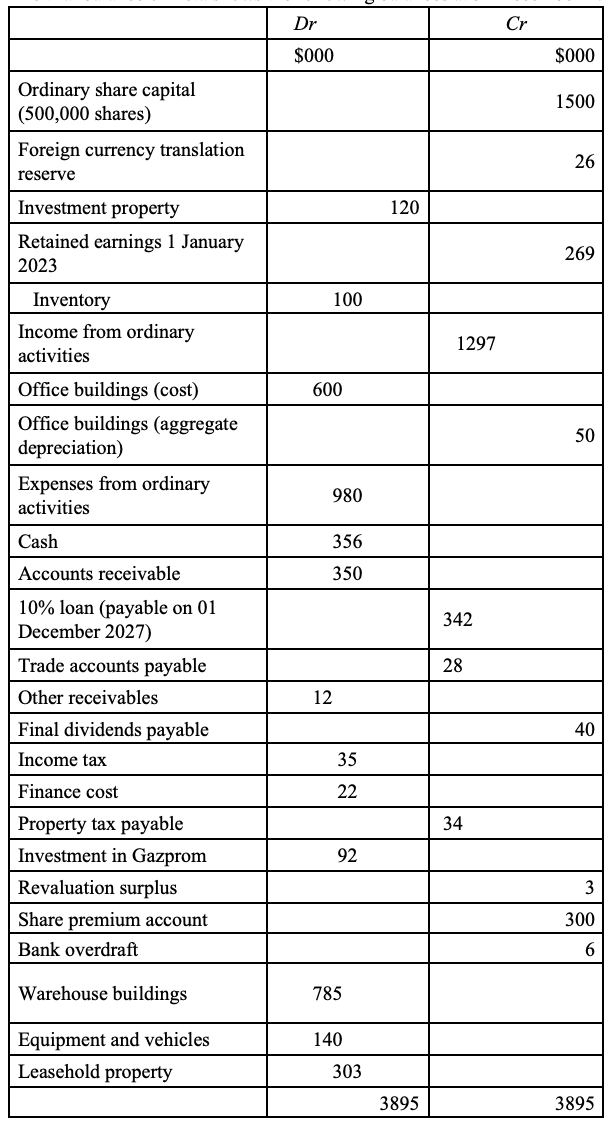

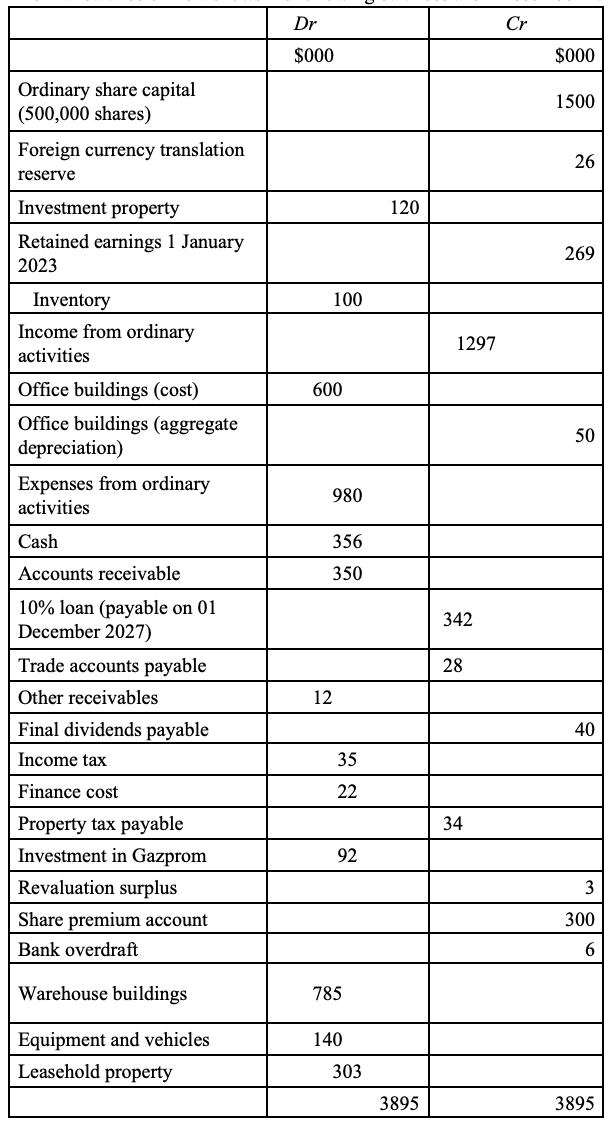

( 1 ) ?During the year to 3 1 ?December 2 0 2 3 , ?an item of equipment with a carrying amount of $

?During the year to ?December ?an item of equipment with a carrying amount of $ ?were sold at a loss of $ ?No entries have yet been made to record this. Depreciation charges for the year should be calculated at ?on cost for equipment and vehicles and at ?on book value for buildings. Full year depreciation is recorded in the year of purchase and none in the year of disposal. ?The income tax for the year is evaluated as $ ?Beta works as an agent for a number of smaller contractors, earning commission of ?Betas revenue includes $ ?received from clients under these agreements with $ ?in cost of sales representing the amount paid to the contractors. ?Receivables totalling $ ?are to be written off ?Allowance for receivables should be created as ?of net sales ?On ?November ?there was a fire in the warehouse, in which inventory valued at $ ?was destroyed. Under the terms of the insurance contract, the insurance company has stated that it will only pay out the first $ ?of the claim. No entries have yet been made to record this. ?Betas directors made the following decisions during the year ended ?December : It disposed of all of its outlets in country A ?A decision was also made to close down a regional office, which was communicated to the employees before the yearend. ?employees would be retrained and kept within Beta at a cost of $ ?the others took redundancy and will be paid $ ?The loan note issue during the year took place on ?April ?and all interest for the year should be accrued ?During the inventory count on ?December, some goods which had cost $ ?were found to be damaged. In February ?the damaged goods were sold for $ ?by an agent who received a ?commission out of the sale proceeds ?Bank charges of $ ?appeared on the bank statement on ?December ?but the company was unaware of this transaction

tableDrCr$$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started