Question

1. Each question refers to the same initial data. Treat each question separately. Ignore income taxes. Assume no beginning or ending inventories. Calculations and backup

1. Each question refers to the same initial data. Treat each question separately. Ignore income taxes. Assume no beginning or ending inventories. Calculations and backup should be completed and submitted in Excel. Use proper Contribution Income Statement formatting. Analysis can either be typed into cells in Excel (formatted to be easily legible) or typed into a text box in Excel.

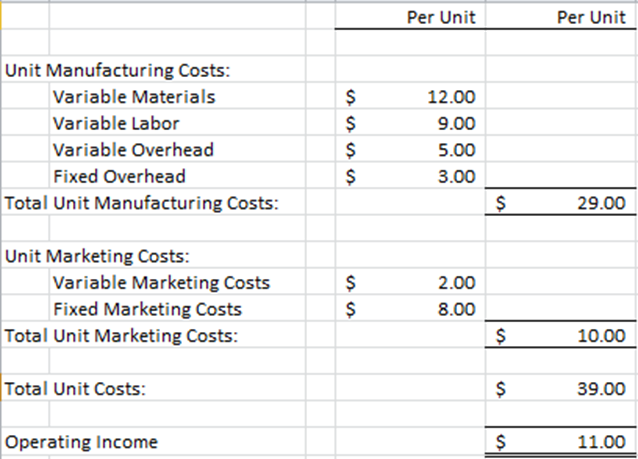

Data for all questions: Panalon produces cast iron dutch ovens (a deep pot with a lid that can be used on a stovetop or in the oven). Their pots are sold at many local department stores. The cost of manufacturing and marketing their pots, at their normal factory volume of 5,000 pots per month, is shown in the table below. These pots sell for $50 each. Panalon is making a small profit, but would prefer to increase profitability.

2: A kitchen-goods chain has offered to purchase 4,000 pots (one time in one month) if the sales price was lowered to $40 per pot. Panalon?s maximum capacity is 8,000 units. A) Based on the cost data provided, what would be the impact of the price decrease on sales, costs, and operating income if Panalon accepted this sale? Use a contribution margin income statement to show your results. B) Do you think Panalon should accept this sale? Support your decision with evidence and analysis.

3: Market research has shown that enameled pans are selling well. Panalon would be able to produce an enameled dutch oven by putting a special coating on their existing pots. This would increase fixed overhead costs by $40,000 per month (still based on normal production volume of 5,000 units). The variable materials costs (only variable material costs ? not all variable costs) for the enameled pots would also be double the cost of the variable materials for the regular pots (to account for the coating). Maximum production for both types of pots together would still be 8,000 units because the same production lines would be used. The enameled pots would sell for $75 each. A) What would be the break-even point if Panalon only sold enameled pots? (In units and sales dollars) B) Create a contribution income statement for a month in which Panalon sold 2,500 regular pots, and 3,500 enameled pots. C) Explain, in your own words, how the changes to fixed and variable costs for the enameled pots impact profitability.

Please use ONLY one Excel file to complete case study one, and use one spreadsheet for each problem. No credit will be granted for problems that are not completed using Excel.

In 2011, when the Gallup organization polled investors, 32% rated gold the best long-term investment. But in April of 2013 Gallup surveyed a random sample of U.S. adults. Respondents were asked to select the best long-term investment from a list of possibilities. Only 168 of the 650 respondents chose gold as the best long-term investment. By contrast, only 83 chose bonds.

- Compute the standard error for each sample proportion. Compute and describe a 99% confidence interval in the context of the question.

- Do you think opinions about the value of gold as a long-term investment have really changed from the old 32% favorability rate, or do you think this is just sample variability? Explain.

- Suppose we want to keep the margin of error at 4%, and we still want to construct a 99% confidence interval. What is the necessary sample size?

- Based on the sample size obtained in part c, suppose 306 respondents chose gold as the best long-term investment. Compute the standard error for choosing gold as the best long-term investment. Compute and describe a 99% confidence interval in the context of the question.

- Based on the results of part d, do you think opinions about the value of gold as a long-term investment have really changed from the old 32% favorability rate, or do you think this is just sample variability? Explain.

Unit Manufacturing Costs: Variable Materials Variable Labor Variable Overhead Fixed Overhead Total Unit Manufacturing Costs: Unit Marketing Costs: Variable Marketing Costs Fixed Marketing Costs Total Unit Marketing Costs: Total Unit Costs: Operating Income $ $ $ $ $ $ Per Unit 12.00 9.00 5.00 3.00 2.00 8.00 $ $ $ $ Per Unit 29.00 10.00 39.00 11.00

Step by Step Solution

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

answer Variable Cost These are the cost that increases with the increase in the unit of productions This means that if the unit of production has incr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started