Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Ebony is the sole shareholder of Solutions Ltd. She has had a good year and has profits before tax of 56,000 that could

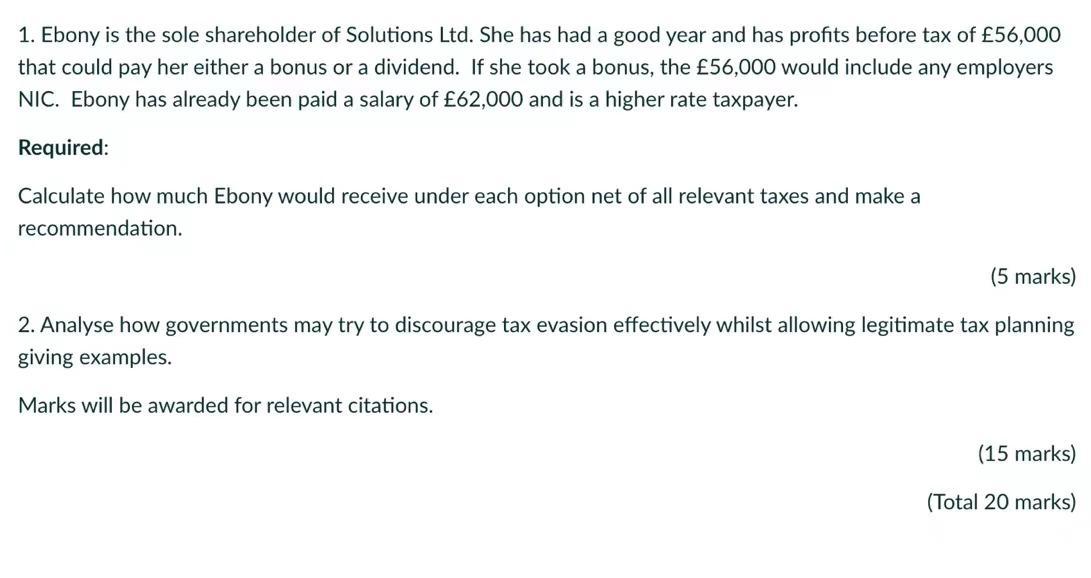

1. Ebony is the sole shareholder of Solutions Ltd. She has had a good year and has profits before tax of 56,000 that could pay her either a bonus or a dividend. If she took a bonus, the 56,000 would include any employers NIC. Ebony has already been paid a salary of 62,000 and is a higher rate taxpayer. Required: Calculate how much Ebony would receive under each option net of all relevant taxes and make a recommendation. (5 marks) 2. Analyse how governments may try to discourage tax evasion effectively whilst allowing legitimate tax planning giving examples. Marks will be awarded for relevant citations. (15 marks) (Total 20 marks)

Step by Step Solution

★★★★★

3.41 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Employer NIC of Ebony is taxable Since the amount is above the upper earning limit of 50270 per year her bonus of 56000 would be taxed at 138...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started